Grayscale Investments Hires Ex-US Solicitor General

Firm adds muscle to its legal counsel before SEC rules on its bitcoin ETF application

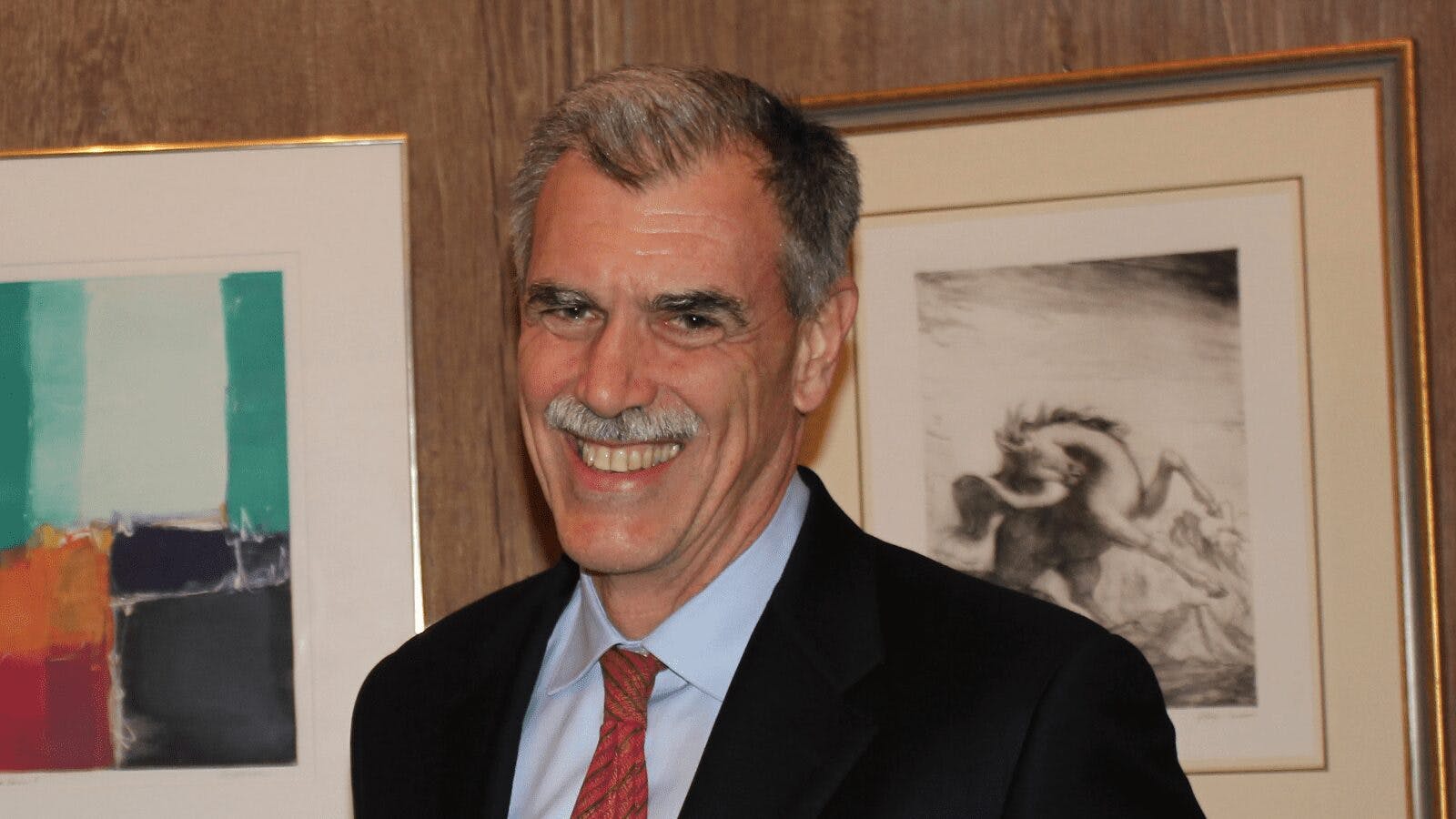

Donald B. Verrilli, Jr., former Solicitor General of the United States | Source: Embassy of Italy in the US/"21" (CC license)

key takeaways

- Donald B. Verrilli Jr. was US solicitor general from 2011 to 2016 and was previously deputy counsel to President Barack Obama

- The SEC is set to rule on Grayscale’s application to convert its bitcoin trust to an ETF next month

Grayscale Investments is bolstering its legal team as the SEC weighs whether to allow the crypto-focused asset manager to convert its bitcoin trust to an ETF.

The company hired Donald B. Verrilli, Jr. as a senior legal strategist to work alongside Grayscale’s in-house counsel and its attorneys at Davis Polk & Wardwell, Grayscale wrote Tuesday in a series of tweets.

“We want to ensure that we have the strongest possible team of legal minds ready to support our BTC ETF application,” Grayscale tweeted. “He is one of the nation’s most experienced attorneys with a deep understanding of legal theory, administrative procedure, and the practical matters of working with the judiciary branch.”

Verrilli was the 46th solicitor general of the United States, from 2011 to 2016. He previously served as deputy counsel to President Barack Obama and as an associate deputy attorney general in the US Department of Justice.

Before working for the government, he was a partner at law firm Jenner & Block where he co-chaired the firm’s Supreme Court practice.

The SEC, which has not yet approved an ETF that would invest directly in bitcoin, is set to rule on Grayscale’s application for such a product next month.

The asset manager has asked the agency for approval to morph its Grayscale Bitcoin Trust (GBTC), which has roughly $20 billion in assets, to an ETF.

Verrilli has argued more than 50 cases before the US Supreme Court, including several that dealt directly with Administrative Procedure Act (APA) violations, according to Grayscale.

Attorneys for Davis Polk & Wardwell previously argued to the SEC that the securities watchdog’s decision to approve a futures-based bitcoin ETF and not a spot ETF is “arbitrary and capricious” — and therefore in violation of the APA.

Grayscale Chief Legal Officer Craig Salm said in April that the bitcoin ETF landscape is “unfair and discriminatory against GBTC shareholders and all of the other US investors looking for an accessible and efficient way to gain their bitcoin exposure.”

Earlier that month, Grayscale CEO Michael Sonnenshein doubled down on previous comments that the company would consider suing the agency if it denies its proposed conversion.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.