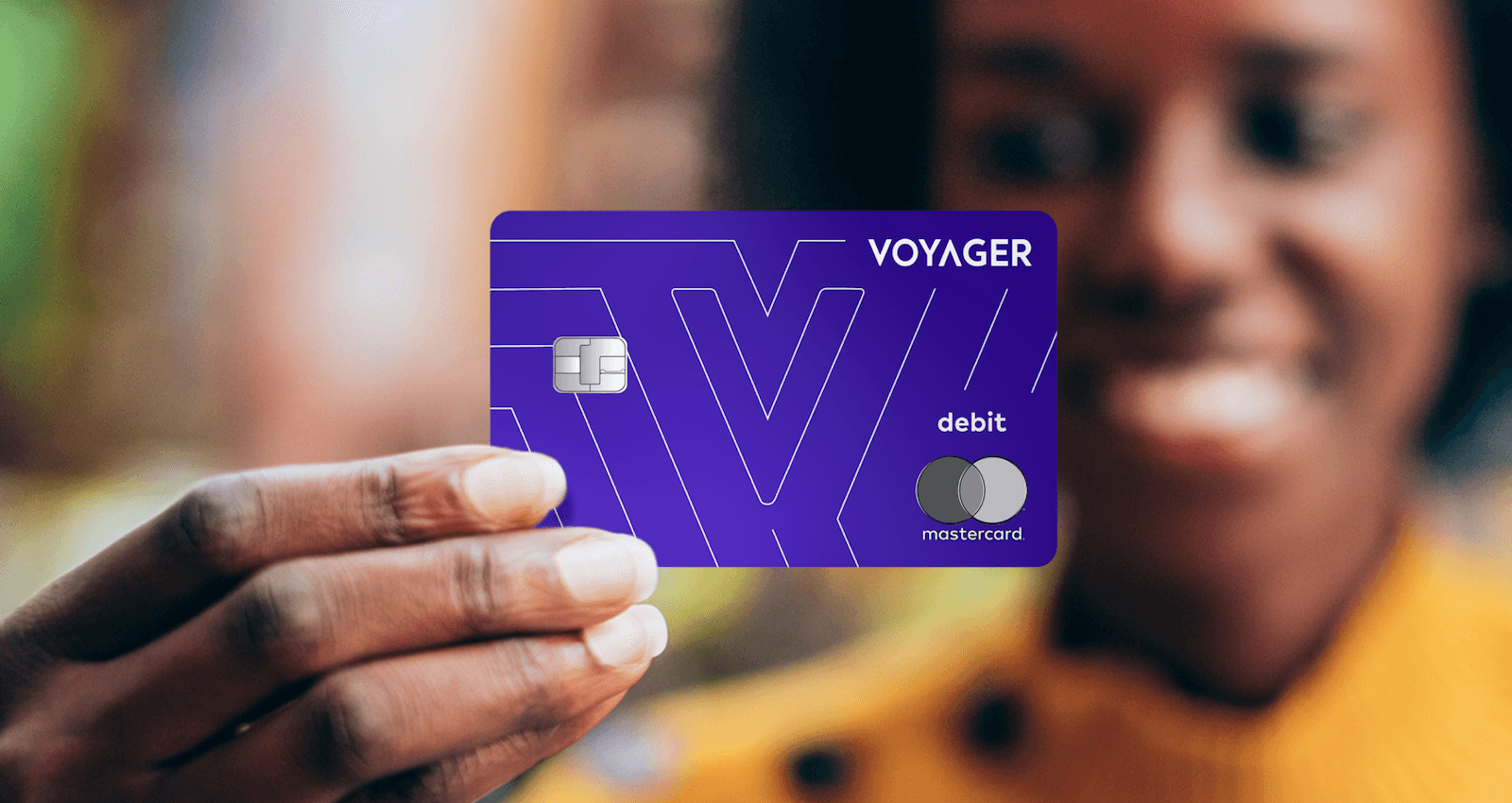

Voyager Digital to Debut Crypto Debit Card

Offering provides rewards of up to 9% on all USD Coin holdings of $100 or more.

Source: Voyager

key takeaways

- Crypto platform Voyager surpassed 1 million funded accounts last week and now has 2.7 million registered users

- A customer with the card can spend USDC everywhere debit Mastercard is accepted

Cryptocurrency platform Voyager Digital is set to offer a crypto debit card that pays up to 9% annual rewards to its customers, the firm announced Tuesday.

Called the Voyager Debit Mastercard, the offering provides annual rewards of up to 9% on all USD Coin (USDC) holdings of $100 or more. The rewards are paid monthly, meaning that USDC holders will receive additional USDC in their Voyager accounts based on their average monthly balance.

Voyager customers, who can now pre-register for the debit card, will start receiving their cards in early 2022.

“By basing our debit card on [USDC], a stablecoin priced one-to-one to the US dollar, we are offering customers a predictable and rewarding way to hold and easily convert crypto for payments, while offering Voyager Loyalty Program members additional rewards,” Voyager CEO Steve Ehrlich said in a statement.

With the new Voyager card, a customer can swipe and spend USDC everywhere debit Mastercard is accepted, a firm spokesperson told Blockworks. The debit card has no annual fees and customers can swap their cash into USDC at no cost, a spokesperson told Blockworks.

“Even though crypto is poised to dominate the future of finance, people still think about the world in terms of dollars,” the Voyager representative said. “USD Coin lets you spend crypto with the familiarity of cash.”

The launch coincided with Voyager reporting its third-quarter results. The company’s revenue for the quarter totaled about $66 billion, which was up from $2 million a year ago. An additional $16 billion of revenue came from Coinify, a crypto payment platform that Voyager acquired during Q3.

An operating loss of $28.3 million for Q3 was incurred primarily as a result of Voyager investing in its loyalty and rewards program to continue user growth.

Voyager announced last week that it surpassed 1 million funded accounts, a 2,225% increase from 10 months ago. The company’s number of registered users now totals 2.7 million, up from 1 million in April.

In an effort to continue building its crypto platform, Voyager also partnered with the Dallas Mavericks last month to bolster brand awareness and drive cryptocurrency education.

In addition to labeling crypto debit cards as a focus for the company during a recent earnings call, Voyager CEO Steve Ehrlich had said international expansion and entering the NFT space are also priorities for the firm.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.