$4.2 Billion Withdrawn from AAVE’s Money Market Protocol

Total Value Locked is down 18% after wallets linked to Tron founder Justin Sun withdrew billions of dollars worth of ETH, WBTC and stablecoins.

Source: Shutterstock

key takeaways

- Aave community members have been concerned about the safety of the protocol following the Cream Finance exploit earlier this week

- Lending rates on USDT spiked as high as 78% APY following the withdrawal

Concerns over the recent Cream Finance exploit that drained $130 million dollars from the protocol have spilled over to the number one blue-chip in DeFi, Aave. On Friday, a significant percentage of the assets deposited into Aave’s V2 money market protocol were withdrawn.

Ethereum transaction logs indicate the wallets responsible are associated with Justin Sun, the founder of the Tron network, who removed billions of dollars worth of ETH, WBTC, USDC, USDT and TUSD. Collectively these funds represented about 18% of the protocol’s Total Value Locked (TVL), which now stands at $15.2 billion according to DefiLlama. As a result, Aave has fallen to number three in the TVL rankings behind Curve Finance and MakerDAO.

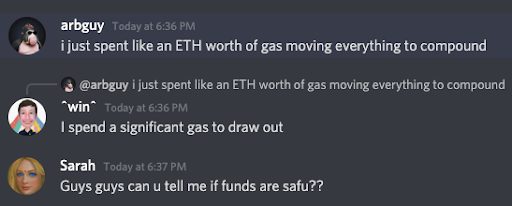

Justin Sun did not immediately return Blockworks’ request for comment, but discussion of the sudden withdrawal has been rampant on the Aave Discord chat group, where members of the community voiced concerns over the safety of the protocol in the wake of the Cream Finance exploit.

According to Aave’s official Twitter feed, the concern stems from the use of xSUSHI (representing staked Sushi governance tokens) as collateral in Aave, which may be subject to a similar price manipulation exploit that befell Cream Finance. According to Gauntlet Network, a major holder of DeFi governance tokens including AAVE, the potential vulnerability cannot be profitably exploited, which should come as some relief to concerned depositors.

In an effort to address the community concerns, Gauntlet put forward an Aave governance proposal, “to disable borrowing of $xSUSHI, $DPI, and the LP tokens on the AMM market to mitigate the potential of any future risks.”

The proposal passed a governance vote with virtually unanimous support and as of Monday morning is “queued” for execution.

If, as Gauntlet’s research indicates, the risk of an exploit is small, the question remains: Why did Justin Sun remove his copious assets?

In the wake of the withdrawal, stablecoins — particularly USDT — were in short supply, and both utilization rates and, consequently, the yields being charged borrowers skyrocketed. For several hours, the cost to borrow USDT on Aave’s V2 Ethereum market was between 60-80% annualized.

Over the weekend, borrowing rates normalized, and as of 5:30 am ET on Monday, rates had fallen to between 4-10% on stablecoins, with the exception of Gemini’s GUSD, which remained in short supply.

Aave’s TVL is down nearly 30% over the past seven days to $13.54 billion, according to DefiLlama, below that of Convex Finance for the first time in its history.

This story was updated on November 1, 2021, at 5:40 am ET.