BTC Sells-off as Metaverse Tokens Show Strength: Markets Wrap

Metaverse tokens rally in the face of a broader market sell-off.

Blockworks exclusive art by Axel Rangel

key takeaways

- The macro backdrop continues to favor BTC despite the recent sell-off.

- MANA and SAND are pushing past all-time highs in the face of market pullback.

BTC continues its downward price action despite a favorable macro backdrop.

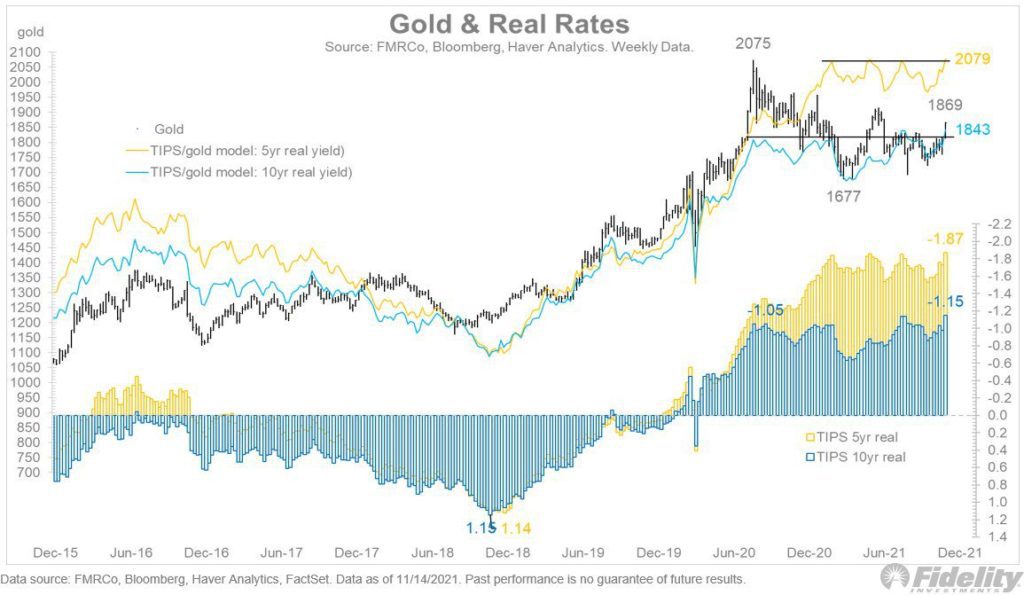

Negative real rates on Treasuries have historically been good environments for inflation hedges such as gold.

Commodities appear to have ended their decade-long bear market.

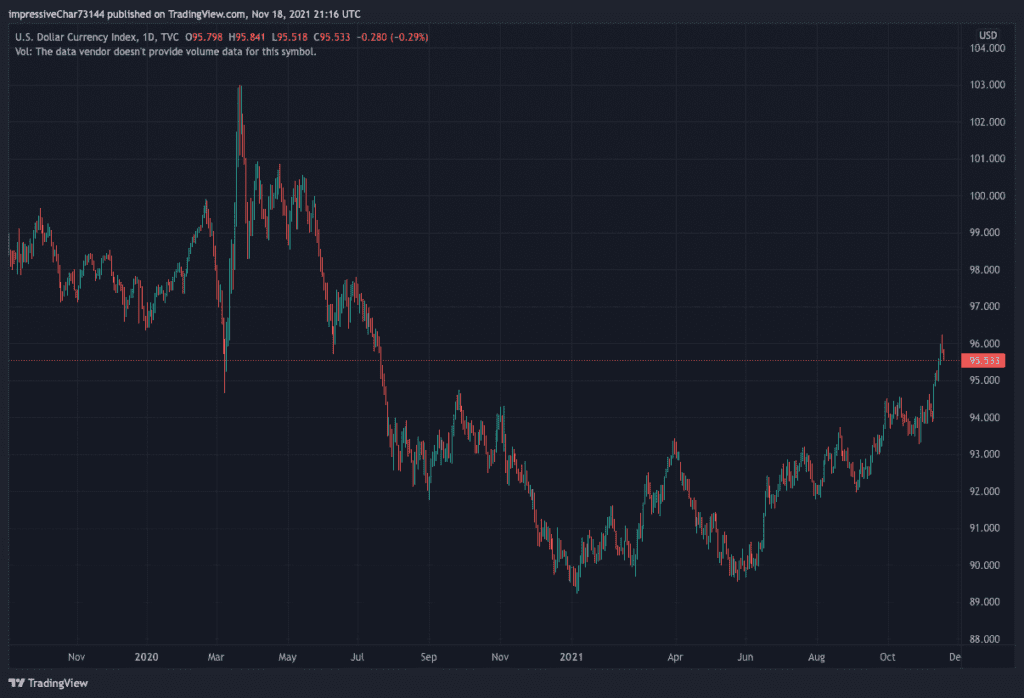

The USD is strengthening versus other currencies, adding downward pressure to USD denominated assets.

The recent pullback in digital assets has flushed out a lot of leverage, setting up a healthier market structure for the longer term.

MANA and SAND are showing strength, trading at all-time highs despite the broader market sell-off.

With the price of ETH dropping, NFTs are seeing a decent boost to their floor prices.

Latest in Macro:

- S&P 500: 4,704, +.34%

- NASDAQ: 15,993, +.45%

- Gold: $1,858, -.21%

- WTI Crude Oil: $78.878, +.65%

- 10-Year Treasury: 1.587%, -.017%

Latest in Crypto:

- BTC: $57,444, -4.06%

- ETH: $4,033, -4.58%

- ETH/BTC: .0702, -1.24%

- BTC.D: 43.79%, -.46%

Macro backdrop

In February of 2020 when markets crashed due to COVID-19, a policy response unlike any other seen before was initiated by governments and central banks around the world. The resulting fiscal response and monetary expansion flooded markets with liquidity to try and combat the retraction in global growth.

The resurrection of global growth in conjunction with supply chain bottlenecks has pushed inflation higher, as displayed in the recent 6.2% CPI print. Higher inflation on the heels low yielding bonds sets the stage for negative real rates, which should be viewed as a positive for gold and BTC as they normally have a negative correlation.

“The divergence between nominal and real yields for 10-year Treasuries is creating a potential opportunity for gold, silver, and bitcoin,” wrote Jurrien Timmer, director of global macro at Fidelity, on Twitter today.

Commodity prices had been In a decades-long bear market prior to the 2020 market crash, but have since rallied and appear to have broken out of a multi-year downward trend. This, of course, adds inflationary pressure with spillover effects that are hard to quantify.

The recent strength of the USD is likely adding pressure to digital asset prices. The DXY, which measures the USD against a basket of other currencies, has been in an uptrend since the middle of June and is trading at levels not seen since the July of 2020. It seems counterintuitive that the DXY would rally in the face of rampant inflation, but other currencies around the world are also struggling with inflationary pressures. Nonetheless, a rising USD puts downward pressure on assets denominated in the same currency.

BTC

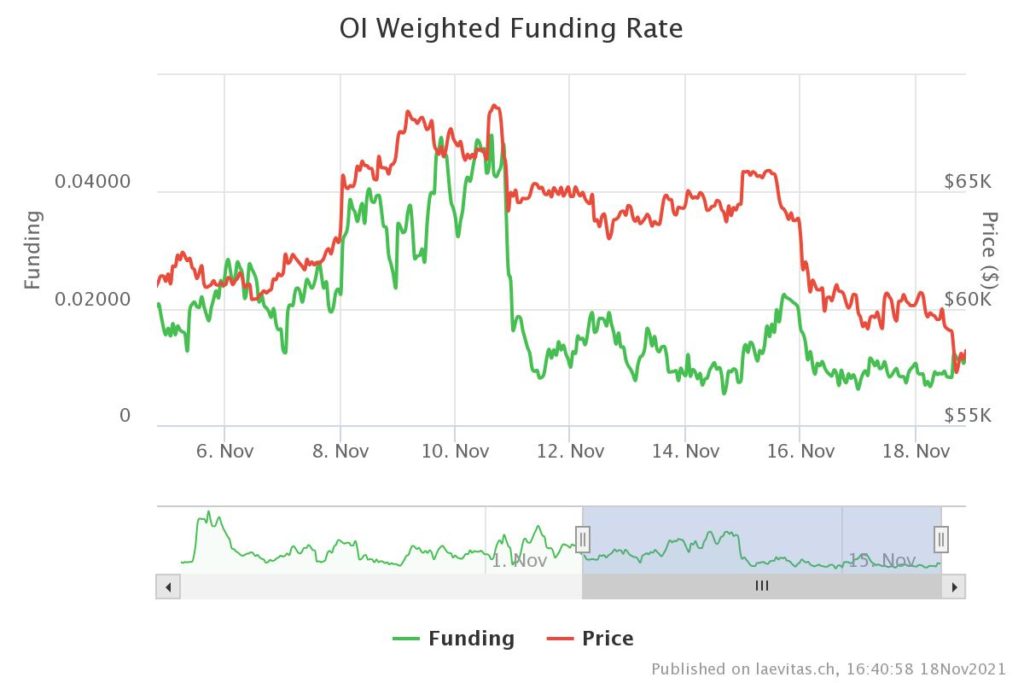

Despite the driving narrative behind BTC remaining intact, its price has suffered this week on the backs of short-term speculators. The recent pullback has flushed out a lot of leverage, which could be setting the stage for a rally once the dust settles on a healthier market structure.

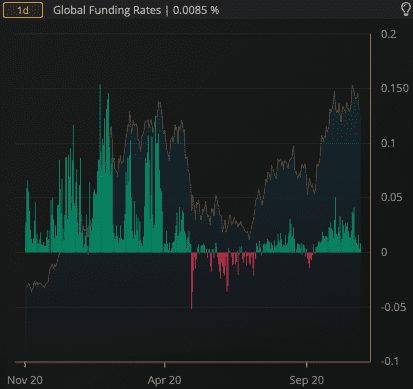

Perpetual funding rates have reset since climbing to high levels when BTC rallied to all-time highs earlier this month.

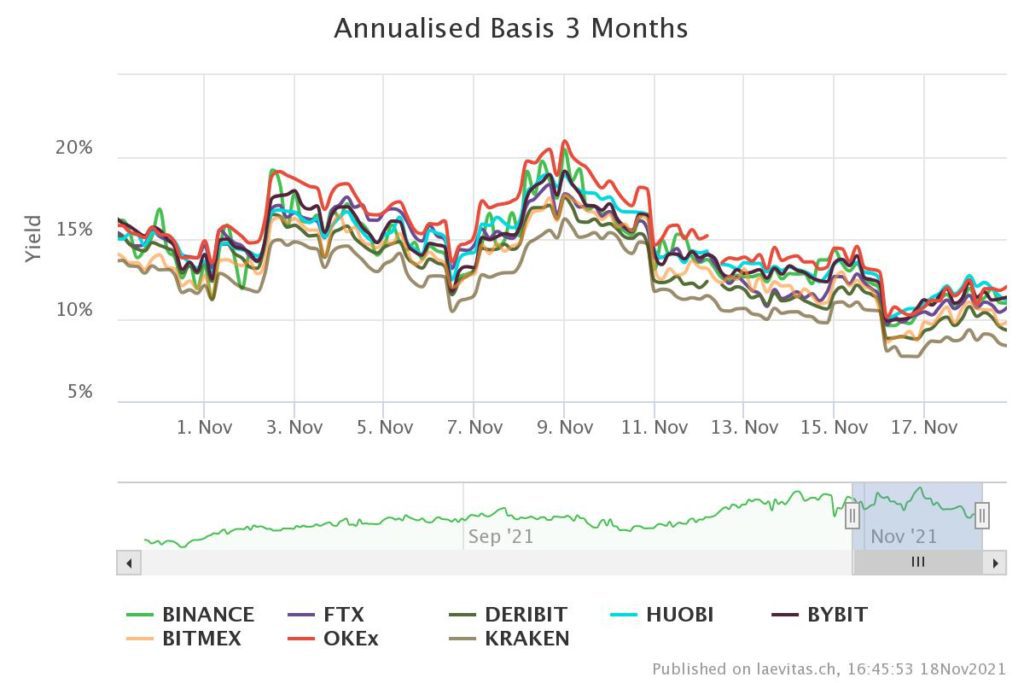

The annualized three-month basis, the difference percentage between spot price and futures price annualized, has also dropped to healthy levels.

While it’s tempting to blame everything bearish on short-term leveraged traders, funding rates never did reach levels anywhere close to the large rally seen from the end of 2020 through the first four months of the year.

Sell-off catalysts

It is very challenging to try to come up with an explanation for BTC’s downward price action. Noelle Acheson, head of market insights at Genesis, sums up some potential reasons for the sell-off in three points:

- The finalization of settlement claims against defunct crypto exchange Mt. Gox

- An ongoing civil suit in Miami that hinges on the identity of Bitcoin’s pseudonymous creator Satoshi Nakamoto, and rights to the 1.1 BTC Nakamoto mined in the early days

- Sell pressure that is impacting the market is from miners, who a few days ago became net sellers for the first time since early October.

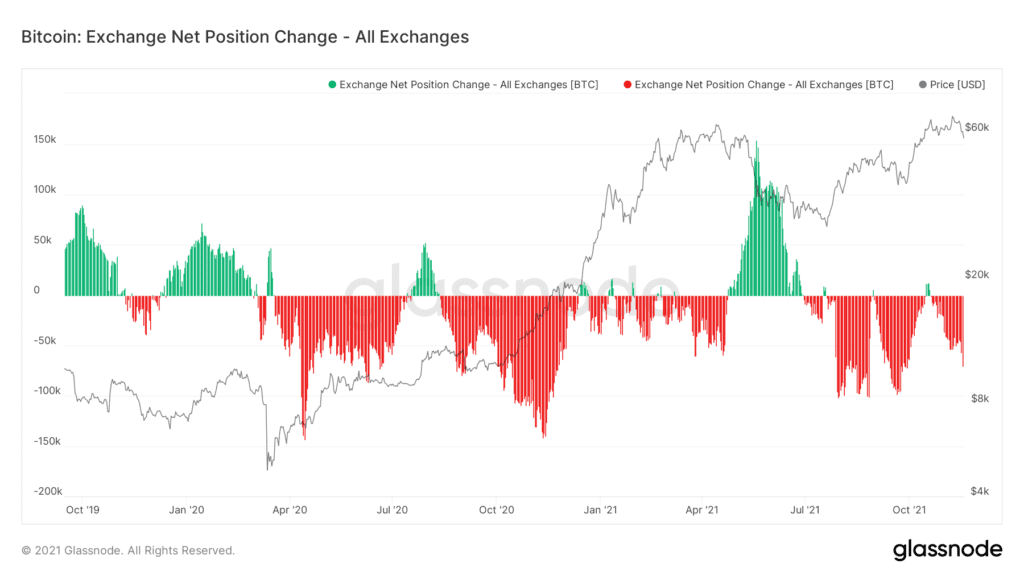

Overall, BTC supply continues to leave exchanges as long-term holders accumulate and send their holdings to cold storage, inflation is running hotter than it has in over 30 years, and real yields on the world’s reserve asset are negative. Digital assets are risky and volatile, which is unlikely to change in the near-to-medium term.

Metaverse tokens rally

Metaverse tokens have continued to rally in the face of the digital asset correction. The Sandbox (SAND) is up more than 30% today and trading near all-time highs at $4.57. Decentraland (MANA) is also trading at all-time highs of $3.96, up over 22% today.

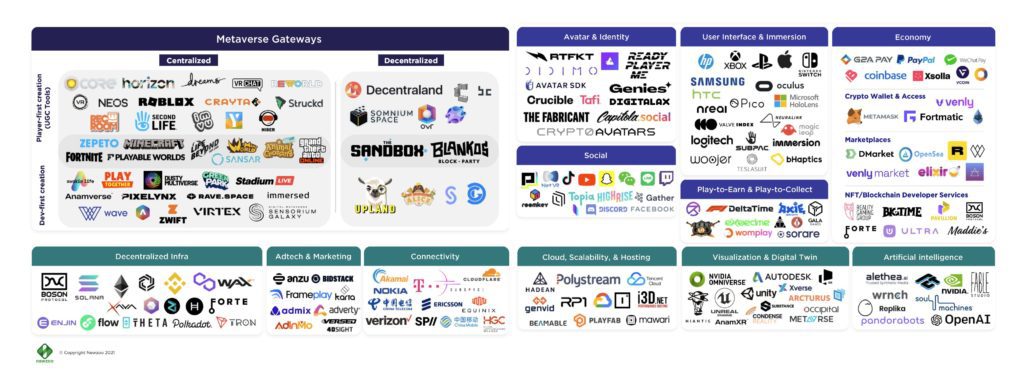

A helpful metaverse graphic can be seen below, courtesy of @LeonidasNFT on Twitter.

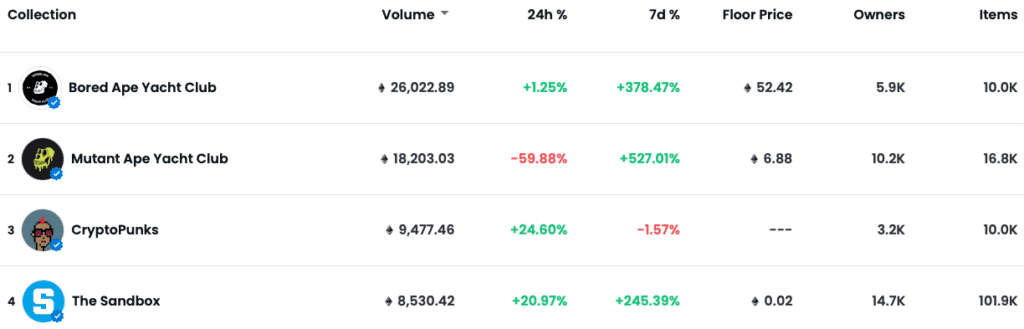

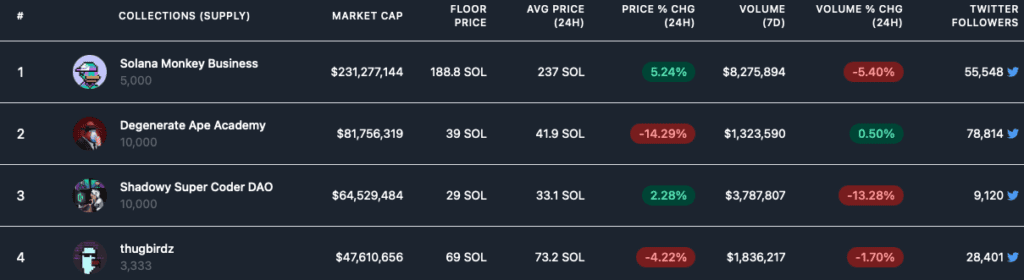

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.