Crypto Total Market Capitalization Under $1T after 10% Fall

Bitcoin and ether are off 10% and 15% respectively as the total market returns levels not seen since January 2021

blockworks exclusive art by axel rangel

key takeaways

- Celsius liquidity crunch has spooked crypto investors, but the broader equity markets are also lower

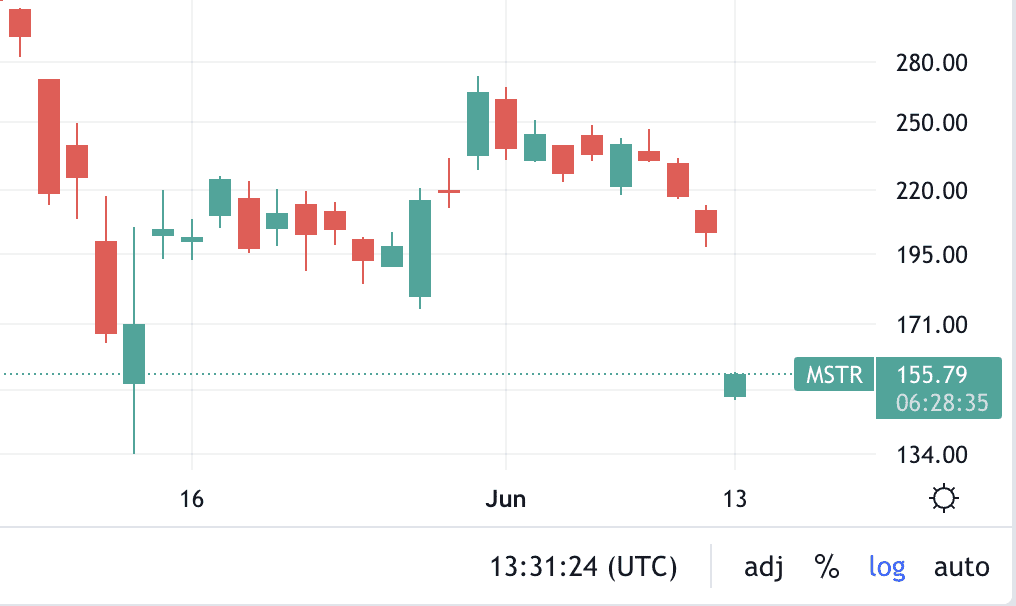

- MicroStrategy is down 27% at market open, as Michael Saylor’s leveraged BTC bet is underwater

Panic is sweeping crypto markets in early Monday trading following unsettling news of paused withdrawals at Celsius and Binance. The total market capitalization of all cryptoassets has dropped to around $960 billion, its lowest point in 18 months.

The weekend saw dramatic selloffs — exacerbated by compressed volatility over the past few weeks — across the entire digital asset sector, with almost every top 50 cryptocurrency in the red.

Bluechips bitcoin (BTC) and ether (ETH) respectively fell 25% and 38% in the past seven days. BTC currently changes hands for $23,700 — prices not seen since December 2020, when it had begun accelerating toward $50,000 for the first time.

ETH, on the other hand, is now valued under $1,200. Skittish markets sent Lido’s staked ETH derivative (stETH) far below par. Units of stETH trade for 0.9342 ETH as of 8 am ET, its lowest point ever.

While lending platform Celsius faces rumors of insolvency, governance tokens for lending platform Aave (AAVE) and the BoredApe ecosystem (APE) were the hardest hit among top 50 tokens, respectively falling 49% and 47% throughout the week.

Cryptocurrencies powering alternate layer-1s Elrond, Avalanche and NEAR similarly fell between 47% and 45%. The top 50 (sans stablecoins and wrapped assets) sank 34% on average.

Native tokens for crypto exchanges once again outperformed the market during the past week’s carnage. Bitfinex’s LEO is the only top 50 token in the green, having risen 8%.

FTX and Huobi’s offerings (FTT and HT) were the second and third best performing among the top 50 over the past seven days, having respectively fallen 10% and 28%.

With altcoins significantly heavier than BTC, the top cryptocurrency’s dominance rose almost 2%. BTC is now 47.9% of the entire crypto market, while ETH dominance dropped more than 15% to just above 15% — its lowest point since April 2021.

Top stablecoins Tether (USDT) and Circle’s USD Coin (USDC) now make up more of the crypto market, as traders seek shelter from volatility in dollar-pegged tokens, now 7.7% and 5.7% respectively.

Tether is fielding significant USDT inflows, either a sign of demand for fiat redemptions, or repayment of loans. The company sought to downplay its exposure to Celsius in a blog post Monday, asserting that any issues Celsius may be facing has “no impact on our reserves.”

Severe devaluations across the crypto sector have also severely crippled crypto stocks. Michael Saylor’s MicroStrategy — which holds some $3.1 billion in Bitcoin — is down an eye-watering 27% during Monday pre-market trade, set to test its May 12 lows.

MicroStrategy is now underwater on its BTC purchases by about 20%, according to BitcoinTreasuries.

Crypto exchange Coinbase looks set to open the day 18% below its previous close, while mining outfit Marathon Digital is eyeing a 16% drop.

Binance CEO Changpeng “CZ” Zhao added fuel to the fire after the exchange initiated a “temporary pause of BTC withdrawals.”

Initially billed as a 30-minute suspension, CZ followed up on his tweet, noting “this is going to take a bit longer to fix than my initial estimate,” and suggesting users withdraw a wrapped version of bitcoin on the BNB Chain.

Both the rationale and the suggestion are unusual. Bitcoin transactions — unlike Ethereum and some other chains — do not typically need to be executed one after another. Withdrawals to BEP-20 would not be the native asset, so few Bitcoiners would see that as a viable alternative to native bitcoin withdrawals.

This is a developing story.

This story was updated on Jun. 13 at 9:08 am and 9:32 am ET.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.