Impossible for Russia To Evade Sanctions With Crypto, FinCEN Rep Says

As the conflict in Ukraine continues to escalate, lawmakers are taking a closer look at digital assets and how they could be used to commit crimes

Source: Shutterstock

key takeaways

- The Senate Banking Committee heard from financial crime experts and crypto industry members to discuss the extent to which the technology is used in financial crimes

- Witnesses agreed that it would be difficult for Russian entities to completely avoid sanctions with digital assets

As the conflict in Ukraine continues to escalate, lawmakers are taking a closer look at digital assets and how they may or may not be used to commit crimes.

Russian sanctions evasion, which some have speculated could be facilitated with digital assets, was a key topic of discussion during Thursday’s Senate Banking Committee hearing, titled “understanding the role of digital assets in illicit finance.”

When asked if Russian President Putin or other sanctioned entities could use cryptocurrencies to work around the rules, the witnesses agreed that the likelihood of this was slim.

“I will quote my successor as counselor to the deputy secretary of the Treasury, who recently said ‘you can’t flip a switch overnight and run a G20 economy on cryptocurrency, there just isn’t the liquidity,’” Michael Mosier, former acting director and current deputy director and digital innovation officer of the Financial Crimes Enforcement Network (FinCEN), said during the hearing.

Michael Chobanian, founder of KUNA Exchange and president of Blockchain Association of Ukraine, agreed.

“I’m the person who is behind all the numbers, I know how this happens, and it’s impossible, physically impossible, to transfer large amounts of money from fiat into crypto,” he said.

Sen. Elizabeth Warren, D-Mass., also revealed a new bill Thursday, the Digital Assets Sanctions Compliance Enhancement Act, aimed at blocking cryptocurrency companies from transacting with sanctioned entities.

“The crypto industry claims that Russians can’t use crypto to hide their wealth,” Warren said during the hearing. “This is a bill that would authorize the president to sanction foreign cryptocurrency firms that are doing business with sanctioned Russian entities and authorize the secretary of Treasury to act.”

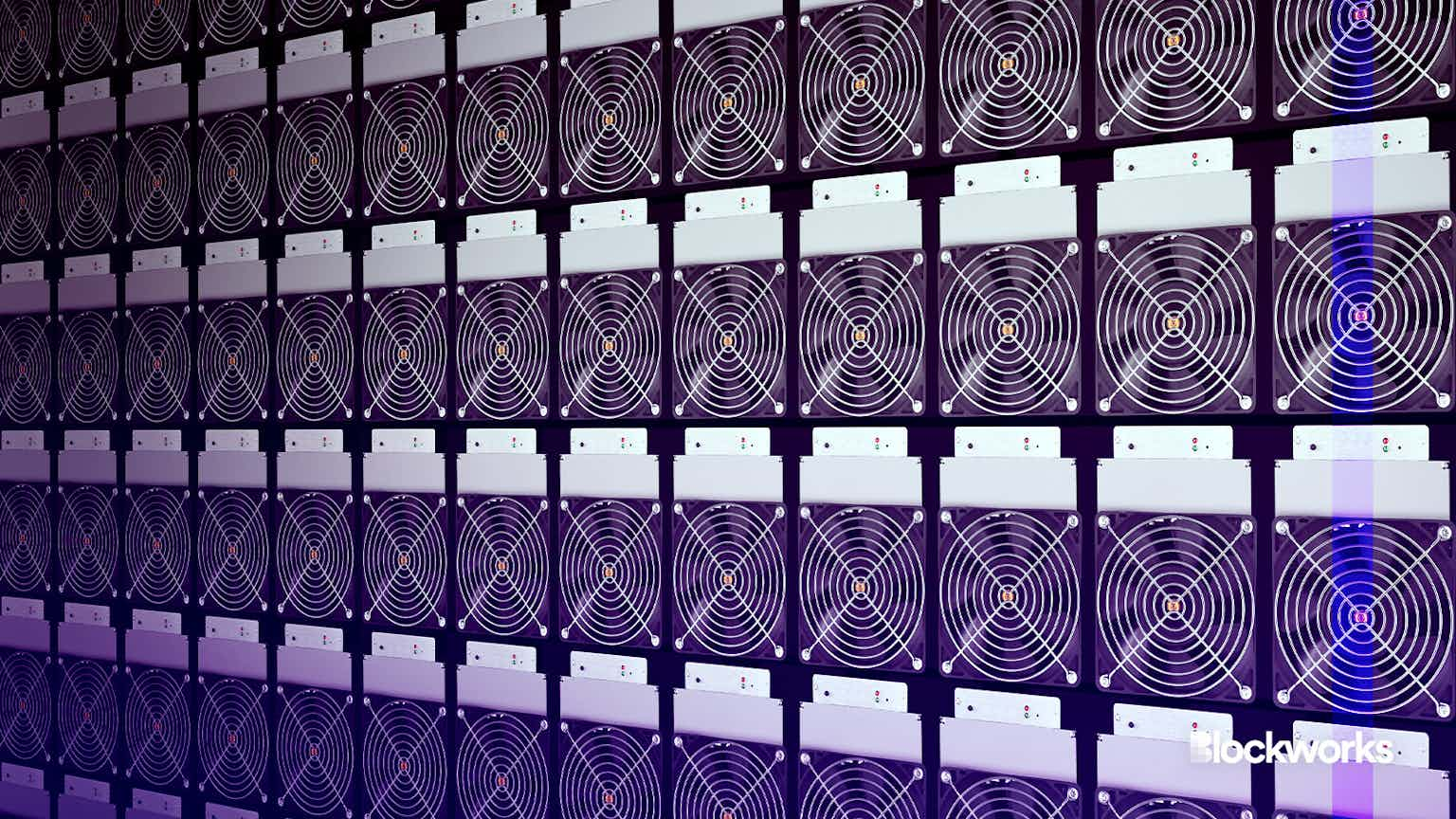

Senators also raised concerns about cryptocurrency mining, which has been increasing in Russia since China’s renewed ban in 2021.

“Because the main costs associated with mining cryptocurrency is energy, I worry that the Russian government will also look to mining as a way to evade sanctions,” Sen. Bob Menendez, D-N.J., said. He added that Russia accounts for 13.6% of bitcoin mining globally, citing data from the Cambridge bitcoin electricity consumption index.

“Iran has successfully mined cryptocurrency to its advantage,” Shane Stansbury said, a Robinson Everett distinguished fellow in the Center For Law, Ethics and National Security and senior lecturing fellow at Duke University School of Law. “There’s also a lot of reporting about North Korea, that it has turned to cryptocurrency to fund its regime…it’s a huge problem.”

Chobanian disagreed, arguing that Russian miners are “ordinary people” who mine to earn money and engage with the technology.

“But again, when you talk about sanctions on the government level, what kind of sums are we talking about?” Chobanian said. “It’s impossible to substitute bitcoin or any other cryptocurrency for US dollars on the government level. You cannot transfer a couple billion dollars without anyone noticing on the physical level.”

When it comes to tracking financial crimes and tracing economic activity, cryptocurrencies provide a major advantage, Jonathan Levin, co-founder and chief strategy officer of Chainalysis, added.

“It’s often conceived that the cryptocurrency is not as transparent as it actually is,” he said. “The fact that all of the industry and all of law enforcement and the regulatory authorities can all have access to that same information about what services and what entities are behind these transactions, that allows us to take unprecedented steps in being able to collaborate on weeding out illicit activity.”

The hearing comes as the federal government looks to increase its oversight of the cryptocurrency industry. The Biden administration’s recent executive order outlining the next steps for research and regulation around digital assets was largely praised by members of the industry, who have long stressed the importance of clear legal guidelines.

“The mischaracterization that crypto is the wild west of illicit finance…I’d hate to see that be used in a way to open the door to drop a morass of regulation on an industry that poses so much potential for America and for our competitive advantage,” Sen. Bill Hagerty, R-Tenn., said.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.