PayPal Has a New Business Division Dedicated to Crypto

PayPal reported its fourth quarter earnings Wednesday and though it didn’t disclose specific performance metrics about its bitcoin services feature, PayPal Crypto, CEO Dan Schulman spoke vaguely on the call about its initial success and the company’s commitment to the digital […]

key takeaways

- CEO Dan Schulman said that the company is “significantly investing in its new crypto, blockchain and digital currency business unit”

- PayPal plans to launch international crypto offerings in the next several months

PayPal reported its fourth quarter earnings Wednesday and though it didn’t disclose specific performance metrics about its bitcoin services feature, PayPal Crypto, CEO Dan Schulman spoke vaguely on the call about its initial success and the company’s commitment to the digital assets market.

“Even with high initial expectations, the volume of crypto trading on our platform, greatly exceeded our projections,” he said. “These initial steps are just the beginning of an extensive roadmap around crypto, blockchain and digital currencies.”

He also said the company is “significantly investing in our new crypto, blockchain and digital currencies business unit in order to help shape this more inclusive feature.”

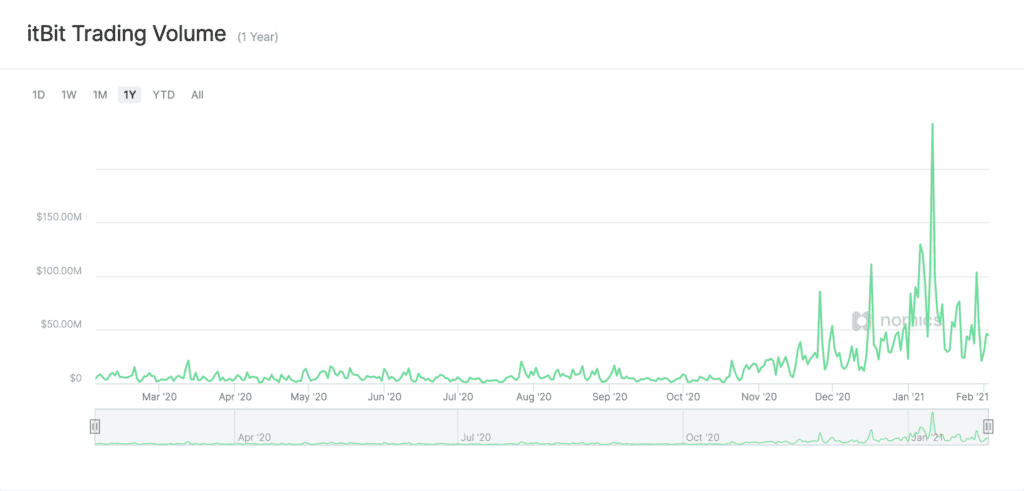

Lisa Ellis, an analyst and general partner at MoffettNathanson, said PayPal may already have between 500,000 and a million consumers using its wallet to trade digital assets, which she called “an extraordinary ramp in six weeks” – based on the amount of volume processed on itBit, Paxos’ digital asset exchange, and typical consumer volume.

She also noted that PayPal Crypto launched in the early stages of the current bitcoin bull run and that increases in exchange volume aren’t necessarily correlated to new digital asset investors using the new PayPal product.

PayPal reported 36 percent growth in total payment volume to $277 billion for the fourth quarter.

PayPal collects some of the spread between buy and sell prices it gets from its trading partner, Paxos Trust Company. And though it waived transaction fees through Dec. 31, a tiered fee structure came into effect this year, starting at 50 cents for transactions under $25. From $25 to $100, it charges 2.3 percent; 2 percent for transactions between $100 and $200; 1.8 percent for transactions between $200 and $1,000; and 1.5 percent for anything above $1,000.

“It looks like they’re already annualized somewhere between $10 billion and $20 billion in volume,” Ellis said. “If they are at that level of volume in 2021 it would imply at least $300 million to $600 million in revenues, and we put into our forecasts at least 2 percent of revenue in 2021 coming from crypto, though that number could be low by 3x.”

PayPal also supports trading of ether, litecoin and bitcoin cash and plans to let customers use digital assets as a funding source for purchases this year. It has 361 million consumer accounts and 29 million merchants in its global network.

PayPal has said it will consider customers using Crypto as part of its active accounts but won’t break them out, it won’t include Crypto transactions as part of its payment transactions metric, and won’t recognize total payment volume for the Crypto business, according to an October investor deck. It will recognize revenue on a net basis within transaction revenue.

The San Jose, Calif.-based company launched bitcoin buying and selling to U.S. users in October and plans to bring the same service to Venmo this year. It also plans to begin allowing customers to use their digital assets balance as a funding source when they interact with PayPal merchants. Schulman said the company plans to launch Crypto internationally “in the next several months.”

“We are already working with the regulators and central banks to reimagine and shape the next generation of the financial system, as consumers no longer like to handle cash,” Schulman said. “We all know the current financial system is antiquated and we can envision a future where transactions are completed in seconds, not days. The future transaction should be less expensive to complete, and a future that enables all people to be part of the digital economy, not just the affluent.”