Scammers Use of Meta Platforms Draws US Political Ire

US Senators asked CEO Mark Zuckerberg to detail its current policies and practices to remove crypto scammers by Oct. 24

Senator Elizabeth Warren | Source: Shutterstock

key takeaways

- Elizabeth Warren, Bernie Sanders call Meta “breeding ground” for crypto fraud

- Social media users can accidentally end up downloading harmful bots via malicious links

Facebook parent Meta isn’t doing enough to get rid of crypto-related scammers on its platforms, according to several US Democrats.

They questioned CEO Mark Zuckerberg last week over its efforts to fight related scams on platforms including Facebook, Instagram and WhatsApp.

Sens. Robert Menendez, Elizabeth Warren and Bernie Sanders, among others, wrote in a letter on Sept. 8 that they were concerned the Facebook parent is a “breeding ground” for crypto fraud that results in significant harm to consumers.

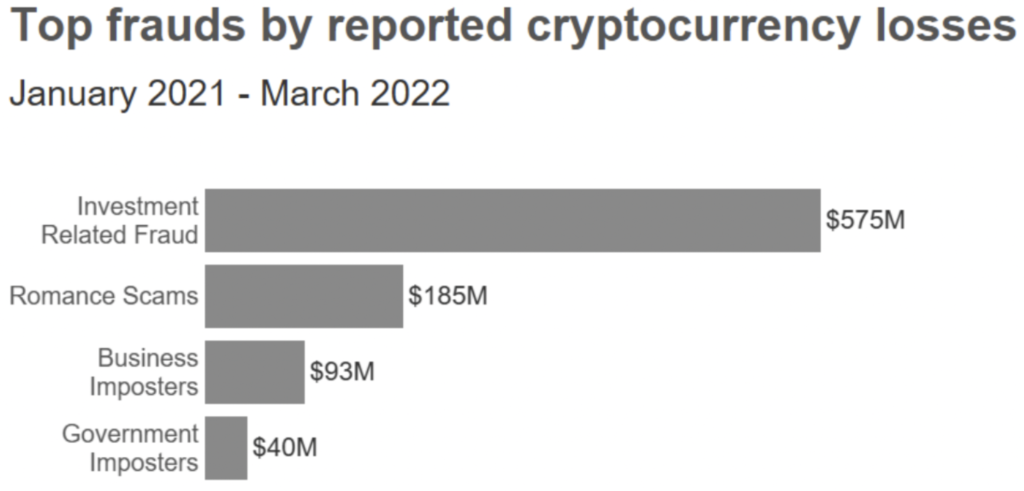

Data from the Federal Trade Commission shows over 46,000 people collectively lost more than $1 billion in crypto-related scams between 2021 and the first quarter of 2022. That figure includes scams where the crypto connection consists of its use as a payment method.

Non-crypto-related scams accounted for about $4.16 billion, or 76% of losses, the FTC said.

The report states that, among customers who were scammed, roughly half were perpetrated via social media, leading to consumer losses worth $417 million: 32% reported being conned on Instagram, 26% on Facebook, 9% on WhatsApp and 7% on Telegram.

The senators have now asked Meta to respond to questions including detailed current policies and practices to remove crypto scammers and steps to assist victims. A deadline for responses has been set for Oct. 24.

Social networking service (SNS) hacks or scams can occur via fake administrator accounts or administrator accounts that are infected with malicious bots, explained Jasper Lee, audit head at smart contract auditing firm Sooho.io.

Harmful bots can be installed if users click on a specific link attached via a direct message. This way, attackers then install malicious bots with administrative authority on the account and lure investors to a fraudulent minting site.

“There are an increasing number of fake sites disguised as official NFT minting sites and impersonating SNS accounts, even with the same photos and descriptions of official accounts used for real announcements,” Lee told Blockworks.

Meta didn’t respond to Blockworks’ request for comment by press time. According to its website, the company’s current crypto ads policy states that most products require to be licensed or registered with a recognized regulator.

What Meta could do to tackle scammers

In April 2022, Meta launched a campaign on Facebook and Instagram featuring educational videos to help people spot and avoid scams online. It included prevalent methods, including romance, investment, cash flipping, money mule, and friend-in-need scams.

It also partnered with a banking and online industry network called Stop Scams UK in 2022 to proactively help stop scams.

But Aarti Dhapte, senior research analyst at Market Research Future, said Meta must indulge in an increasing number of campaigns in every country.

“These campaigns should be customized per the prevalent crypto scams/frauds in that country/area,” she told Blockworks.

Meta should also use its recently launched Next-Gen AI supercomputers to prevent fraudsters from registering under fake, offline identities, she added.

Sued by Australian watchdog for fake endorsements

Earlier this year, Meta was sued by Australia’s competition watchdog for allegedly promoting fake ads that endorsed crypto investments. The lawsuit claimed Meta “aided and abetted or was knowingly concerned in false or misleading conduct and representations by the advertisers.”

One individual lost more than A$650,000 ($443,992) through such a scam, the complaint said.

The watchdog said Facebook’s ads would likely mislead customers into believing they were associated with prominent personalities, when in fact they weren’t. The people featured had never approved them.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.