Stocks Mixed and Oil Slides as Powell Doubles Down on Dovish Remarks: Markets Wrap

Weary investors speculate sustainability of economic growth while Fed chair insists that high inflation is temporary.

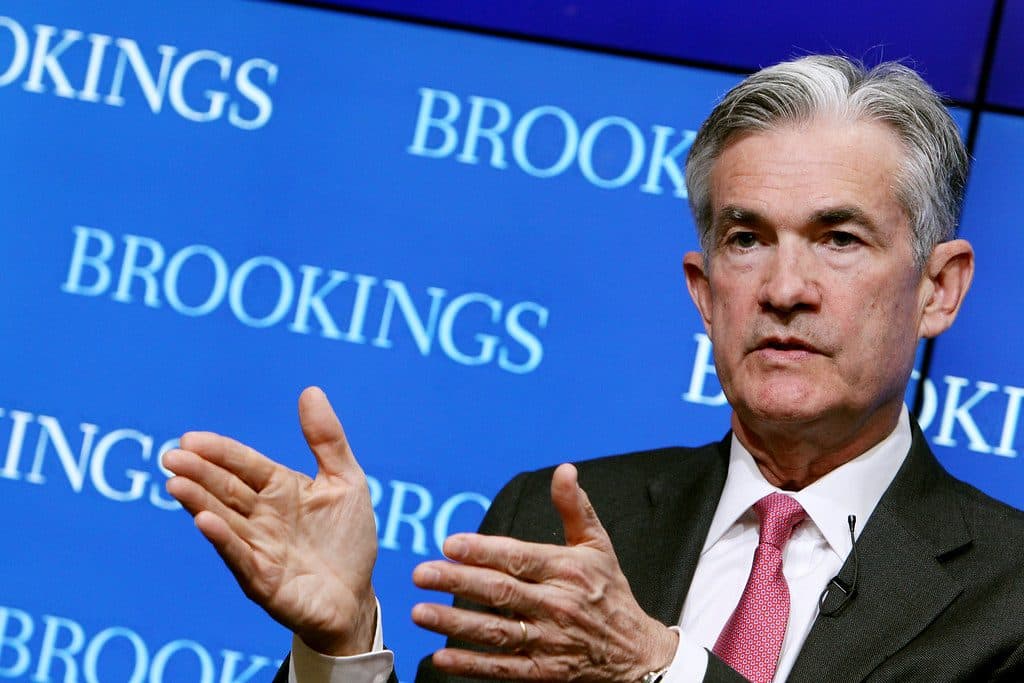

Jerome Powell, Source: Sharon Farmer/sfphot. (CC BY-ND 2.0)

key takeaways

- LMAX Group has closed a round with J.C. Flowers & Co, valuing the company at $1 billion

- The U.S. State Department said they would offer cryptocurrency as a payout options for cyber attacks

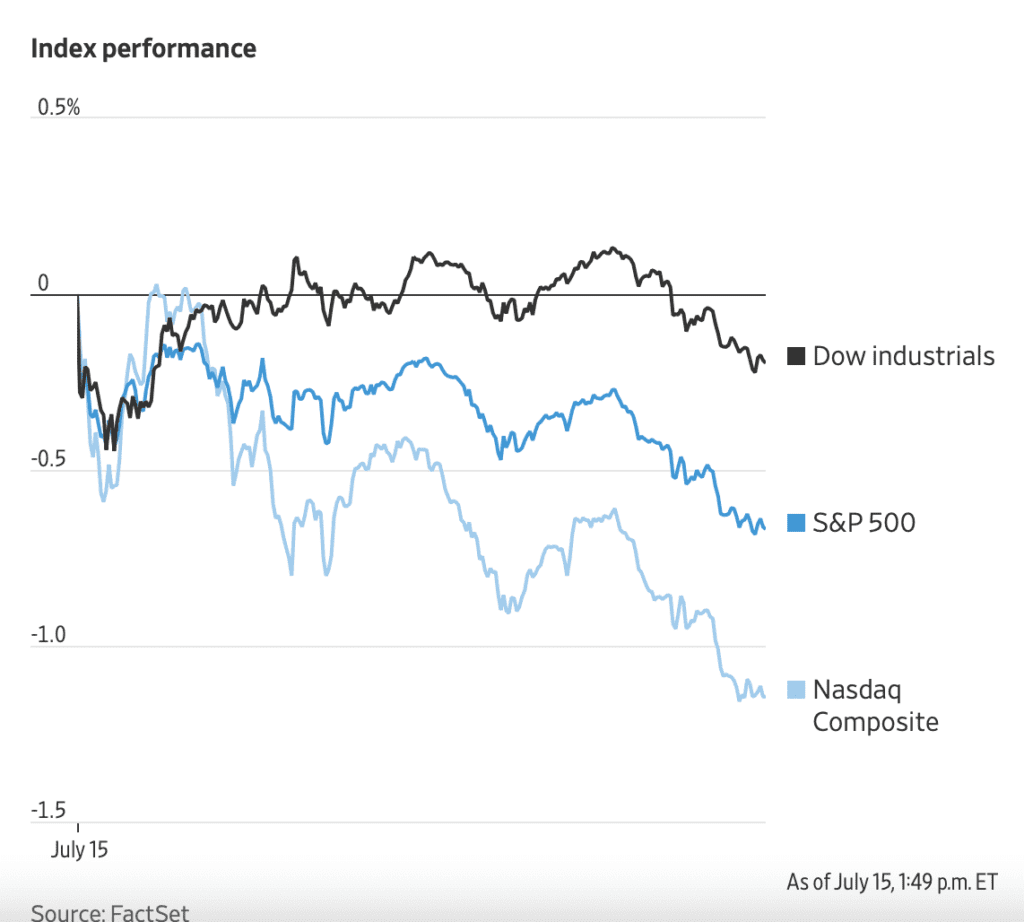

Stocks were mixed as Federal Reserve Chairman Jerome Powell took a dovish stance while testifying to Congress and jobless claims data hit pandemic-era lows. The S&P 500 fell 0.6% intraday following mixed earnings from big banks. The Nasdaq Composite shed 1%, while the Dow Jones Industrial Average rallied, jumping up 200 points on Thursday afternoon.

Powell reiterated that inflationary pressures stem from the economy reopening and should cool off in the near future. Weary investors question the sustainability of growth and consumers fret over rising prices as Powell continues to insist that inflation is fleeting. Most experts agree that inflation won’t be lasting, but where it will settle and how quickly are major questions.

Initial jobless claims were reported at 360,000, according to the Labor Department on Thursday. This was the lowest number it’s been since March of 2020.

Equities

- The Dow was up to 34,964, gaining 0.09%

- S&P 500 was little changed, down -0.36% to 4,359

- Nasdaq fell -0.76% to 14,533

Insight

“Markets were priced for perfection, and now that we have the uncertainty over Fed pullback on policy, it is resulting in this pause,” Derek Halpenny, head of research for global markets in the European region at MUFG Bank said to the Wall Street Journal. “The positive risk sentiment has definitely faded.”

Oil fell again, one of many losses for the commodity, following a week of volatile trading sessions.

In a change of tune, OPEC data indicated that demand would rise to pre-pandemic highs next year. Thursday’s monthly report revealed that demand would also hike 3.4% and average roughly 100 million barrels per day in H2.

After infighting between Saudia Arabia and United Arab Emirates sparked an unexpected delay at the OPEC+ meeting, the joint alliance’s tentative deal to increase outputs was put on the back burner. However, some progress has since been made to ratify a plan, which could give the UAE a more generous supply of oil in the coming months.

Prior to the conflict, oil had its best half since 2009, benchmarking a six-year high the for the commodity the week before investors wondered if production would rise or not.

Other commodities like lumber seems to be cooling down too after skyrocketing 90% in May but since have fallen 30%, one chart indicated. This comes at a time when the Producer Price Index (PPI) data increased 7.3% on a year-over-year basis, suggesting inflation could stay high and further supply chain restraints. Lumber slumped further on Thursday, trading 5.3% lower intraday.

Commodities

- Brent crude is down to $73.33 a barrel, falling -1.91%

- Gold is up 1.02% to $1,828.50

Insight

“The forecast basically gives OPEC+ cover to approve the United Arab Emirates baseline quota by 450,000 bpd at the next unannounced OPEC+ meeting, and then approve the already planned 400,000 bpd addition on a monthly basis until OPEC+ production is normalized,” Robert Yawger, Energy Futures Director at Mizuho said in a note. “OPEC+ was still sitting on spare production of around 5.9 million bpd, which would have taken around 15 months to eliminate at the rate of 400,000 a month. The UAE production quota tantrum complicates matters a bit, and there are Bloomberg reports that Iraq is also seeking a higher baseline, but a 400,000 monthly increase would basically get OPEC+ back to normal production levels around October or November 2022.”

In crypto news, the U.S. State Department’s Rewards for Justice program said they would include cryptocurrency in their payout options in the case of ransom-ware attacks or cyber crimes, the department announced Thursday.

Bitcoin and ether were both down a day after Powell said that having a Fed-issued digital currency would be more viable than several cryptocurrencies.

Crypto

- Bitcoin is trading around $31,591.33, down -3.59% in 24 hours at 4:00 pm ET

- Ether is trading around $1,919.29, shedding -3.54% in 24 hours at 4:00 pm ET

- ETH:BTC is at 0.607, up 0.05% at 4:00 pm ET

- VIX jumped 4.23% to 17.02 at 4:00 pm ET

Fixed Income

- U.S. 10-year treasury yields 1.299% as of 4:00 pm ET

Currencies

- The US dollar strengthened 0.21%, according to the Bloomberg Dollar Spot Index

In other news…

LMAX Group has closed a round with J.C. Flowers & Co, valuing the company at $1 billion. J.C. Flowers & Co, one of the world’s leading financial investors, is set to take a 30% stake in LMAX Group for $300 million in a secondary share sale by LMAX Group employees, Blockworks reported on Thursday.

Insight

“The vision we share is that LMAX Group becomes the preeminent player in global capital markets and the market leader of FX and cryptocurrency trading,” LMAX Group CEO David Mercer said to Blockworks in an interview. “With our technology, we can leverage any asset class in the world. We took it and applied it to crypto right alongside foreign exchange.”

We’re watching out for …

- Bank of Japan’s interest rate decision will be on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.