Markets

Markets are volatile with everyone rushing to get their hands on the latest, greatest cryptocurrency. Get ahead of the pack with Blockworks premium insights.

Thursday’s GDP report shows economic growth is slowing faster than expected, spurring concerns from economists over stagflation

The iShares Bitcoin Trust saw zero flows Wednesday, according to Farside Investors, after seeing $15.5 billion enter the fund in its first 71 days

Bitcoin’s price was mostly unchanged following the event that occurs roughly every four years

BlackRock’s iShares Bitcoin Trust continues to see daily positive net flows, though its inflow total for a single day hit a new low Wednesday

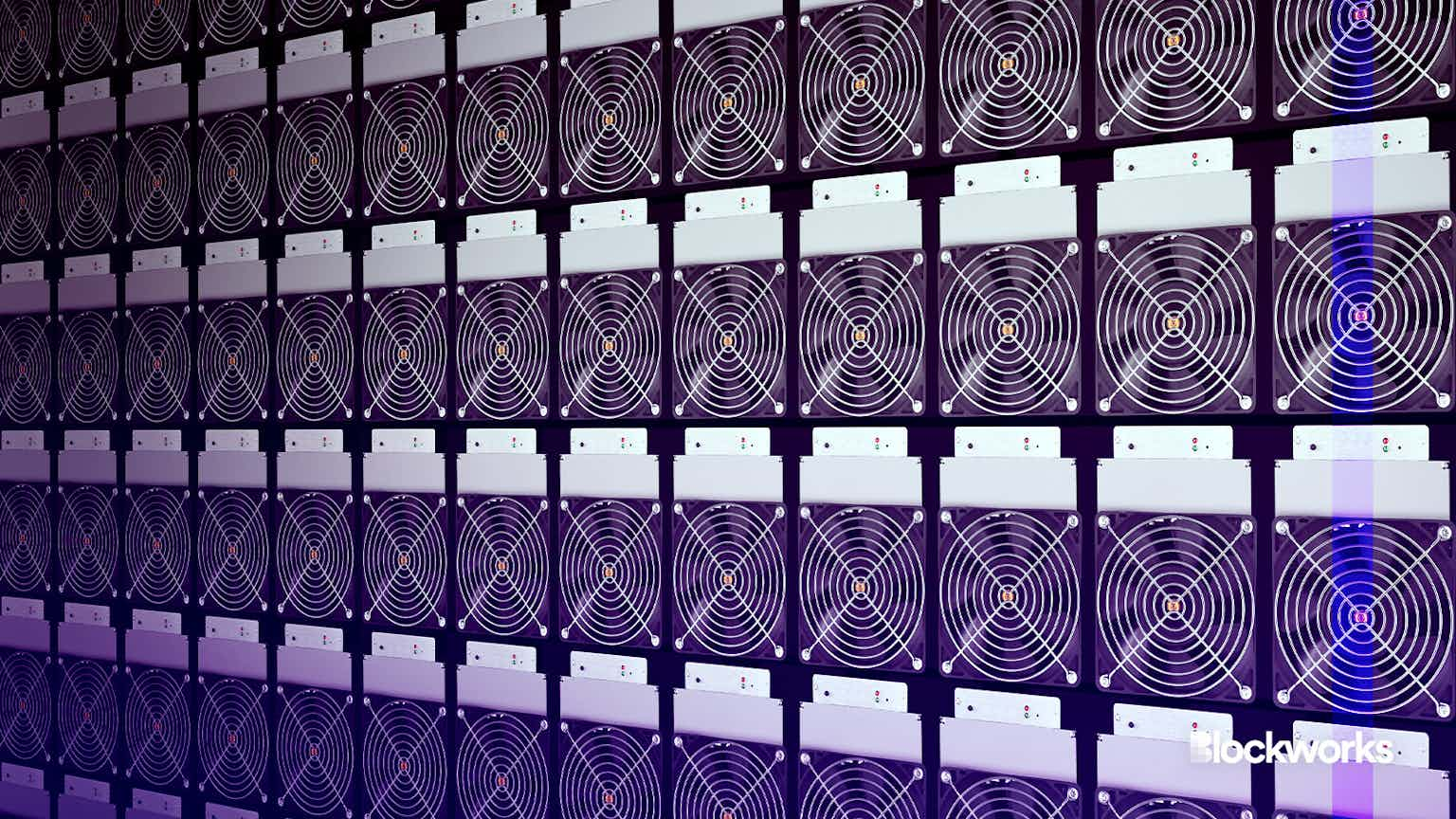

Miner stocks have historically underperformed bitcoin before the halving and outperformed the asset after the event, analysts note

Bitcoin slipped further Tuesday as researchers warn that the next halving event is likely already priced in

GBTC’s net outflows of $17.5 million on Wednesday mark the fund’s lowest in a single day since it converted to an ETF on Jan. 11

The US economy added 303,000 jobs in March, almost 100,000 more than economists had predicted

Bitcoin retook $68,000 Thursday, rallying close to 4% in 24-hours while ether gained 2% to sit around $3,400

Bitcoin and ether took a sharp turn Tuesday morning while US stocks continued to kick off the second quarter of 2024 in the red

Bitcoin retook $70,000 Monday for the first time in about 10 days while Coinbase, MicroStrategy stocks surge

The BTC funds by BlackRock and Fidelity have both brought in net inflows during each of their first 50 days trading.

BTC net outflows in the last four days total $1.8 billion, while inflows by BlackRock’s and other funds have been unable to offset them

Stocks and cryptocurrencies have been on the decline since Thursday, although analysts say this week’s bad economic reads should have caused a bigger selloff

Assets under management within BlackRock’s iShares Bitcoin Trust (IBIT) stands at about $15 billion following fund’s record day

Bitcoin, after posting another record-high of just under $73,000 Monday, lost 0.7% Tuesday

Bitcoin started another record-setting week Monday, hitting a price of $72,846.65 according to Coinbase

Get the daily newsletter that helps thousands of investors understand the markets.