Bitcoin a Stable Investment? Volatility Dips Below Nasdaq, S&P 500

As bitcoin becomes less sensitive to economic data, volatility in relation to equities markets has been on the decline

Blockworks exclusive art by axel rangel

key takeaways

- Cryptocurrencies on the whole have generally become less reactive to releases of sensitive economic data

- The indexes tracking price fluctuations in the S&P 500 and the Nasdaq are both on the rise this year

A silver lining to bitcoin’s recent sideways trading is the cryptocurrency now finds itself in uncharted territory: Bitcoin volatility is relatively low compared to equities markets.

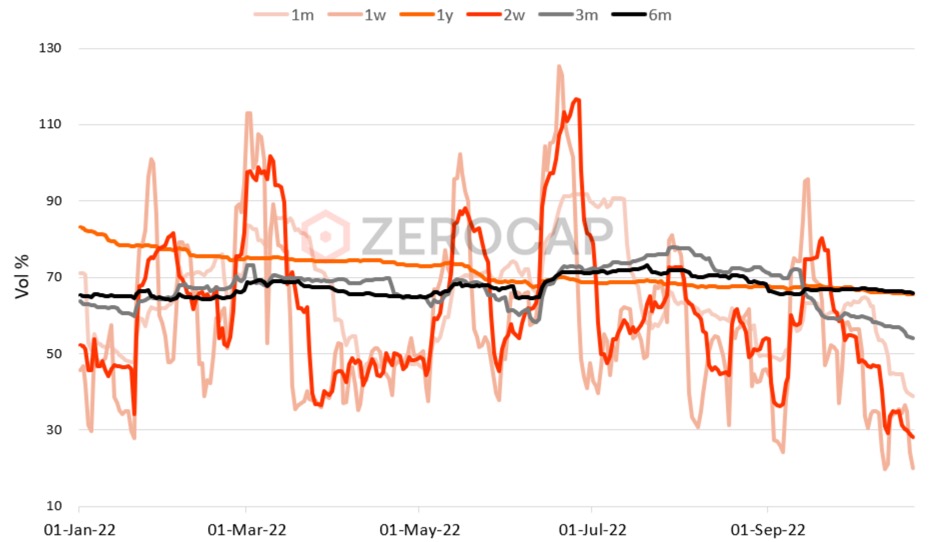

For the first time since 2020, bitcoin’s volatility has dropped below that of both the Nasdaq and the S&P 500 equity indexes, according to data from Kaiko. Today, bitcoin’s volatility is down more than 40% from its most volatile point so far this year in February.

On Tuesday, Cboe’s Volatility Index (ticker VIX), a measure of the S&P 500’s price fluctuation, hovered just below 30, which is the generally accepted mark for heightened uncertainty, risk and fear in markets. The VIX is up nearly 13 basis points year to date.

The Nasdaq-100 Volatility Index (ticker VOLQ) is also on the rise so far this year. It has seen more than a 90% increase year to date.

“For the first half of 2022, cryptocurrencies were highly reactive to macro market events, such as the release of inflation data, interest rate increases, and equity market volatility,” said Clara Medalie, Kaiko’s head of research. “Bitcoin’s correlation with Nasdaq and the S&P 500 shot to all-time highs in the spring as global financial markets entered a period of high volatility.”

Cryptocurrencies on the whole have generally become less reactive to releases of sensitive economic data, Medalie added, which could explain the overall drop in volatility relative to equity markets.

Bitcoin’s correlation coefficient to the S&P 500 has been hovering between 0.5 and 0.6 for the past three months, which is relatively high compared to historical data, but traders are hopeful the digital asset will start to distance itself from equities.

“It’s likely that ‘digital gold’ [bitcoin] can decouple and trade independently like gold,” Dan Morehead, CEO and co-chief investment officer at Pantera Capital wrote in a note Tuesday. “In the first rising interest rate environment in 42 years, there will be a desire to invest in things that don’t have to continue to go down as the Fed unwinds its twin mistakes.”

The Federal Reserve’s rate decision next month may bring renewed volatility to cryptos, but traders are generally optimistic about bitcoin for the time being.

“We see value in bitcoin at these levels; either it becomes a hedge against geopolitical and macro uncertainty, or it reconnects as a high-beta asset,” said Jon de Wet, co-founder and chief investment officer at digital asset firm Zerocap.

Bitcoin has tended to be inversely correlated to moves in the US Dollar Currency Index (DXY), which has been in a strong uptrend since March. While that long-term trend remains intact, the dollar’s momentum has recently slowed as it recedes to test an area of support between 110 and 111, coincident with its 50-day moving average.

If the dollar reverses to the downside, risk assets may benefit.

“One thing is for sure, volatility tends to mean revert — and long-dated volatility strategies are worth a look,” he said.

In other words, the prolonged period of volatility contraction that crypto markets have experienced in recent months is likely to give way, at some point, to volatility expansion. And like an ever-coiling spring, the longer the volatility remains muted, the more powerful the move — up or down — is likely to be.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.