What Crypto Winter? It’s Summer All the Time for DeFi and Ether

A new CoinDesk Research report shows that the DeFi market is not slowing down despite a bearish overall crypto market

BLOCKWORKS EXCLUSIVE ART BY AXEL RANGEL

key takeaways

- Continued interest in DeFi means the value of ether has risen steadily even as bitcoin enters a bear market

- But ether, as a store of value for DeFi, might have come competition on the horizon

Decentralized Finance (DeFi) is proving to be the great differentiator between bitcoin and ether, as a new report from CoinDesk Research shows that bitcoin had one of its worst quarters ever, while ether had double-digit gains.

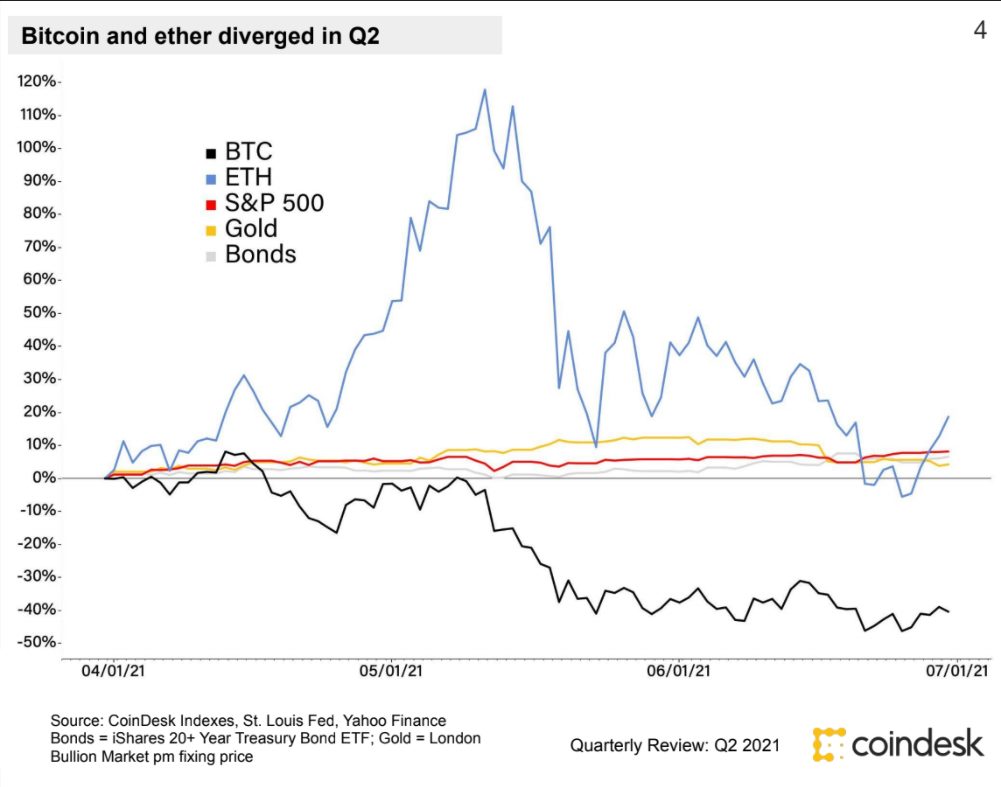

In the second quarter of 2021, CoinDesk Research found that bitcoin had its third-worst quarter ever, in terms of price performance, with the CoinDesk Bitcoin Price Index (XBX) dropping 40.39%. Only the fourth quarter of 2018, where it dropped by 44%, and the first quarter of 2018, where it posted a 50% decline, were worse. In total contrast, the CoinDesk Ether Price Index (ETX) finished the quarter up 18.69%.

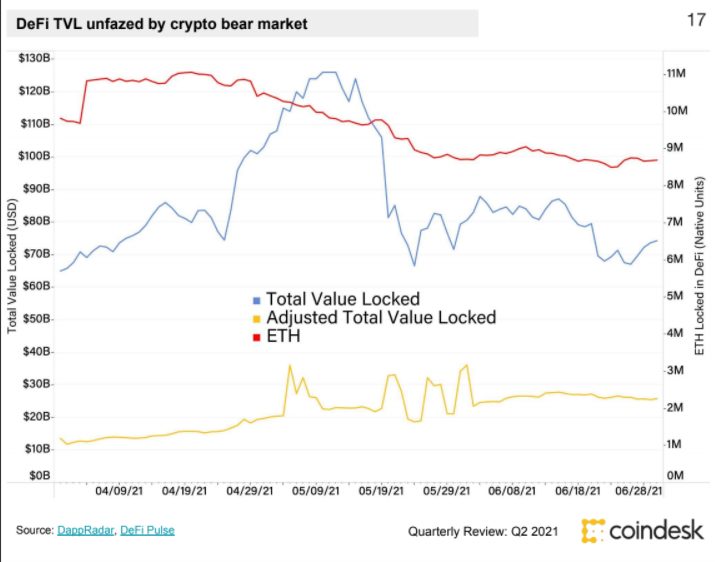

As for DeFi, like ether’s gains, it posted growth with the total locked-in value increasing by 13% during the quarter.

“It’s only the fourth time since ETX inception in the fourth quarter of 2016 that ether and bitcoin have recorded mixed quarters, but quarterly returns for the two price indexes have diverged by more than 50 percentage points nine times since the first quarter of 2017,” the report said.

The report said that there’s still a correlation between bitcoin and ether, but it’s slipping, coming in at 0.75.

It’s not about DeFi’s outperformance of bitcoin, but rather “eth’s outperformance of DeFi,” explained CoinDesk Research analyst Christine Kim in an interview with Blockworks.

“In a crypto winter, more investors and traders are fueled to search for yield in a very yield-scarce environment. People are going to look for ways to put their assets to work to secure some kind of a return on their investment,” Kim told Blockworks. “And that’s where the DeFi ecosystem really helped to step in with various protocols and applications, which are lending markets as well as decentralized exchanges.”

Kim said that this quarter’s notable divergence strengthens the weakened correlation between these two crypto assets.

“Very different value propositions, investment narratives,” she said.

But that’s not to say that ether, as a currency, doesn’t have competition. While much has been reported about alternatives to Ethereum, the blockchain, Kim sees many emerging ERC-20 (the type of token used on Ethereum) tokens competing as stores of value.

“One of the things that will be interesting to watch in the upcoming quarter is the makeup of crypto assets locked in DeFi,” Kim said. “We’re starting to see a lot of different types of tokens in use.”

One of those alternatives is tokenized bitcoin, ERC-20 tokens on the Ethereum blockchain that represent bitcoin stored in trust.

“In a bear market, there’s going to be potentially more holders of Bitcoin looking to secure gains by using their bitcoin and transferring it to the Ethereum-based DeFi market,” Kim said. “That’s a huge avenue for liquidity, and a huge liquidity surge that could be potentially forthcoming to DeFi.”

And this liquidity surge, Kim argues, will bring further legitimacy to DeFi and Ethereum all while fueled by bitcoin’s use as a store of value — even when it’s wrapped in Ethereum.