About Ethereum (Ether)

Ethereum is an open-source, decentralized smart contract blockchain platform. It has its own native coin, ether, that trades with the ticker symbol ETH. Ether is also used as a gas asset within the Ethereum blockchain to pay for smart contract execution.

Ethereum was first proposed by Vitalik Buterin, a Russian-Canadian computer programmer, in a whitepaper back in 2013. At that time, the platform was unique because it was built to help expand the utility of cryptocurrencies by allowing for the programming of applications on a general-purpose blockchain via the use of its ERC-20 standard. This way, developers can build self-executing decentralized applications (DApps) by using smart contracts.

Although Buterin is the face of the project, Ethereum has seven other co-founders. Gavin Wood, a British programmer, is the second most critical co-founder since he proposed the use of Solidity as Ethereum’s native programming language and was the first CTO of Ethereum’s Foundation. Other co-founders include Anthony Di Iorio, who underwrote the Ethereum project in its initial stages, Charles Hoskinson who established the Ethereum Foundation plus its legal framework, Mihai Alisie who assisted in creating the Ethereum Foundation, Joseph Lubin who funded the project in its early days and Amir Chetrit who helped develop Ethereum before stepping away.

The Ethereum blockchain was launched in 2015 by the Ethereum Foundation under the codename ‘Frontier’. Since then, the platform has undergone several network updates under different codenames. Unlike Bitcoin, which has a limited supply, Ethereum has an infinite supply. As of this writing, there are 122.7 million ETH in circulation.

Price History

In 2014, the Ethereum project raised over 31,500 BTC worth $18.3 million through an Initial Coin Offering (ICO). At the time of the fundraising, ether’s price was $0.311, and more than 60 million ether were sold.

Before transitioning to PoS through an upgrade known as the Merge, the issuance rate of Ether was impacted by a feature referred to as the difficulty bomb. This is a mechanism that increased the mining difficulty, raising the time it took miners to discover new blocks. This, in turn, decreased the overall issuance of ether, especially between 2017 and 2020 as the mechanism was activated, reset, and delayed a couple of times ahead of the Merge.

Looking back at the ether price chart from launch to March 2017, its price oscillated around $0.70 and $21. In 2017, the crypto bull market saw ether’s price rise beyond $100 for the first time. In June of the same year, the ether price shot up to $414. Five months later, the crypto market’s bullish streak strengthened due to increased buying pressure, pushing the price of every digital currency to new highs. Because almost every new project launched on Ethereum by doing an ICO, ether was in high demand. By January 2018, ether’s price shot to $1,418 before experiencing a huge fall. It would take another three years for its price to rise again to a new all-time high (ATH) of $4,379 between February and May 2021. On November 16, 2021, ETH hit yet another new ATH of 4,891.70.

However, due to the 2022 crypto bear market, ether’s price has experienced a downturn in tandem with declining prices in the entire crypto market. For the remainder of the year, ether price predictions are estimated to be between $1,145 and $1,684.

How does Ethereum work?

While the Bitcoin blockchain can be compared to a bank’s ledger, the Ethereum blockchain is similar to a (world) computer. Why? Because while it does document and secure transactions, it trades security for flexibility, and developers can utilize it to build a wide range of applications, so-called decentralized applications or dapps.

So, how does Ethereum work? Ethereum uses the proof-of-stake (PoS) consensus mechanism, where validators secure the network and verify transactions. Validators must stake 32 ETH — or less when staking through pools such as Lido and Rocket Pool — to ensure they act in the network’s best interest. Dishonest behavior is penalized through something called slashing, meaning that the culprit loses a portion of their staked ETH. In exchange for their contribution to the network, validators earn rewards in ETH.

FAQs

Does Ether have a future?

Based on the fact that ether is the second-largest cryptocurrency by market cap and it powers the Ethereum blockchain, one is tempted to assume that ether appears to have a future. Furthermore, Ethereum’s coin powers the NFT and DeFi spaces since most NFTs and DApps are built on the Ethereum blockchain, thereby needing ether as a gas asset to carry out their functionalities. For instance, Ethereum has the highest number of DeFi protocols, according to data from DeFi Llama. So will Ethereum be a great contender for smart contract applications going forward? It is hard to say with certainty what will happen in the future.

Is Ether coin a good investment?

Yes and no. Cryptocurrencies are known to be highly volatile, which makes them risky investments. However, experts predict that the price of ETH will increase, and thus it may be a good investment opportunity. Still, should you choose to invest in ether, you need to do your own research and never invest more than you can afford to lose.

Is Ethereum a coin or a token?

Ethereum is a coin because it has its own native blockchain on which it operates and functions. Various tokens are launched on Ethereum itself.

Can Ethereum reach $10,000?

Many experts predict that Ethereum will not only reach $10,000 but will surpass it in the future as demand will continuously pick up. Ether could also become deflationary in the future, further pushing its price to new highs.

Popular Criticisms

Just like any other technology, Ethereum isn’t immune to criticism. One popular critique focuses on Ethereum’s scalability issues. This is the inability of the blockchain to process as many transactions per second (TPS) as Visa or Mastercard. Ethereum’s all-time TPS lies between 1 and 16 compared to Visa’s 24,000 TPS and Mastercard’s 5,000 TPS. While Ethereum’s base layer blockchain is still limited in terms of scalability, second-layer solutions on top of Ethereum are already being developed to alleviate the issue.

Ethereum users have in the past protested against the high gas fees required to use the network, which can rise to hundreds of dollars. Also, the switch to PoS has led to validator centralization concerns. Based on this pre-Merge data, over 60% of staking was concentrated among a few staking platforms. Moreover, hours after the Merge occurred, Coinbase and Lido added more than 40% of the blocks to the network. Ethereum’s security could be compromised when a few entities control the majority of the staking market share.

Another concern is about Ether being considered a security by law. While there have been conflicting views coming from relevant entities, it is yet to be determined with clarity, if ether truly is a security in a financial context or not.

Comparisons to other Projects

While the Ethereum network is popular in the DeFi and NFT spaces, Ethereum killers are building momentum and slowly but steadily growing their share in these spaces. Blockchains such as Arbitrum, Fantom, Tron, Avalanche, and BNB Chain are some of Ethereum’s top contenders. These blockchains are attracting user interest because they offer lower transaction fees and higher transaction throughputs than Ethereum.

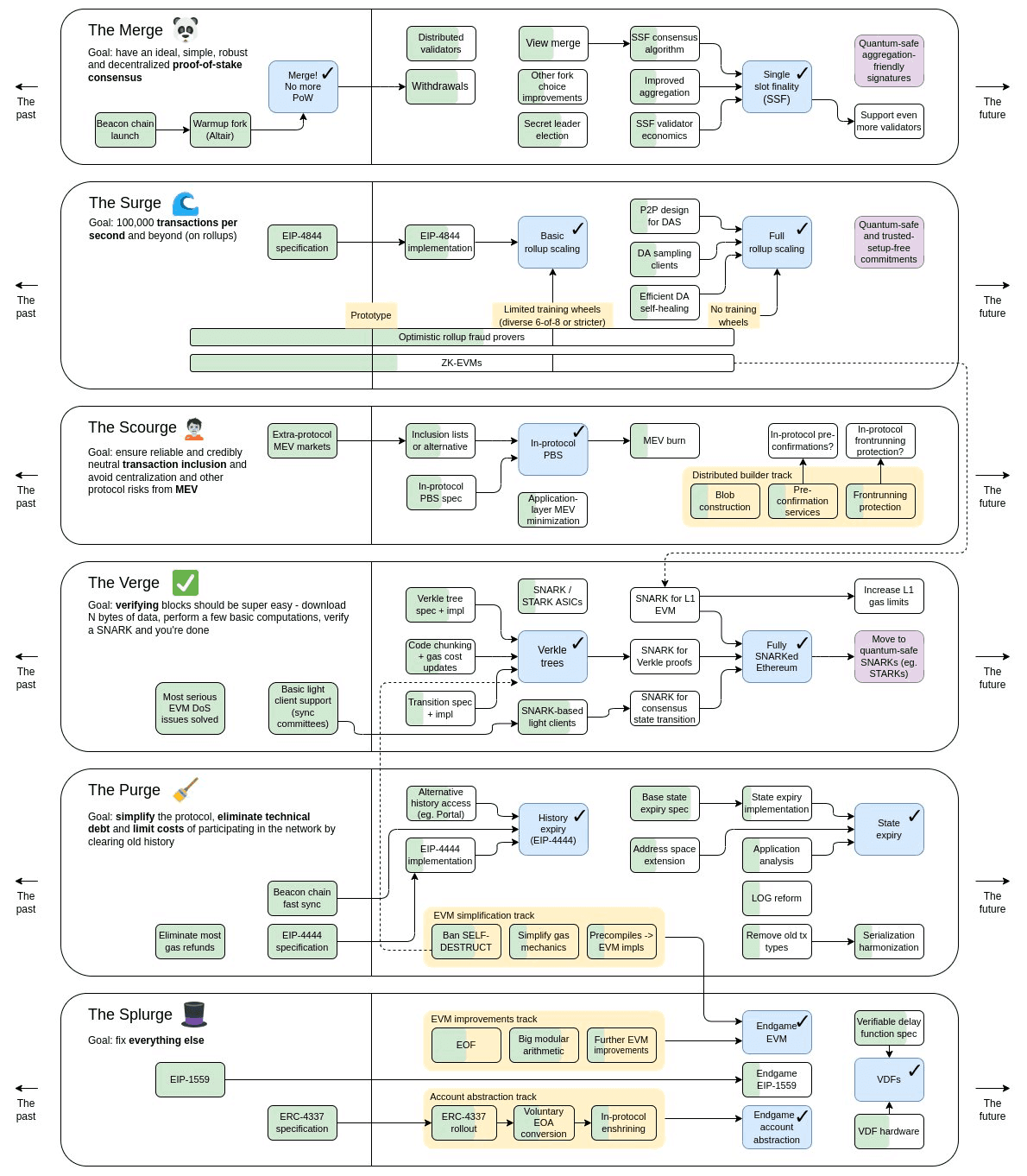

Development Timelines

Ethereum has so far implemented two major upgrades: the Beacon Chain and the Merge. On December 1, 2020, the Beacon Chain upgrade took place, bringing staking to Ethereum. This was followed by the Merge on September 15, 2022, completely shifting Ethereum to a PoS blockchain and ending the era of Proof-of-work (PoW).

Between 2023 and 2024, the Ethereum network will undergo Sharding with a focus on something called danksharding. This upgrade will expand the network’s capacity to store data while working cohesively with layer 2 chains to reduce network fees and scale transaction throughputs.