Byron Gilliam

In the 90s, rapt audiences worldwide watched a coffee pot — will that fascination ever turn to crypto?

Maybe tokenholders don’t need the rights that corporate shareholders have come to expect

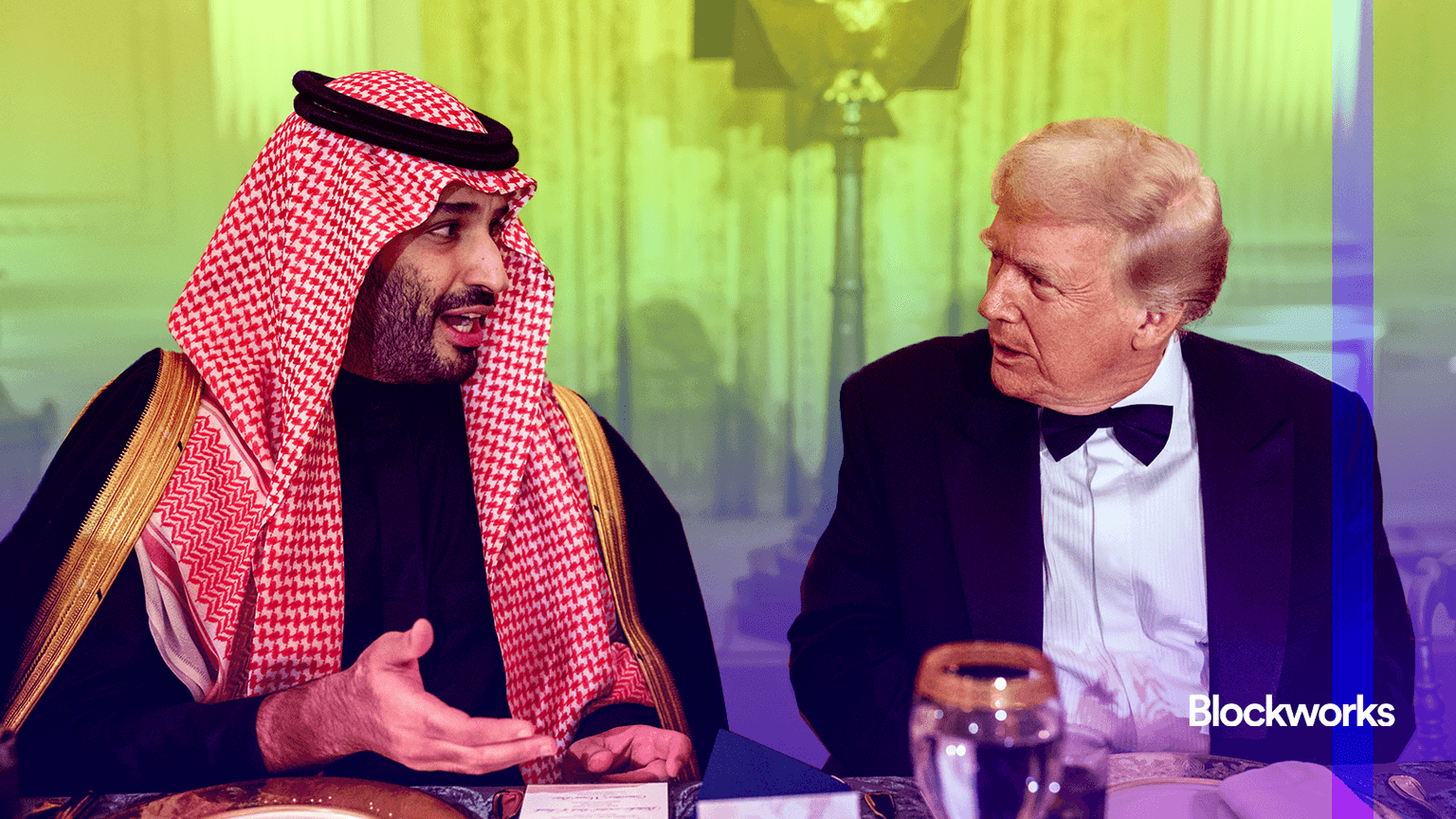

Will mega-unicorns collectively earn the trillions of dollars of revenue required to justify their valuations?

What Thomas Edison actually invented — and what it tells us about the future of crypto

Throughout its billions of searches, Google’s goal has always been to train and hone its algorithms

Bad math makes headlines: real progress, a history of candlelight, and “the worst poverty analysis…ever seen”

Anthropic researchers report that their AI agents successfully exploited 56% of vulnerable smart contracts

For new growth, crypto may need to shed tired norms like over-raising and the hoarding of investment resources

Futuristic DeFi is stuck inside the computer. An old idea might be its escape hatch