Bretton Woods

Greg Foss thinks bitcoin could reach $2 million, watch our interview to hear him explain how.

In the interview, DiMartino Booth shared her thoughts on the Fed’s Reverse Repurchasing facilities, which provide fast liquidity, meaning on an overnight basis, to money market funds.

“The latest wave we’ve seen has been the coming of the large financial institutions that really have been prompted by their clients to enter the space,” Kostadinov said.

The 30-year long bond is at about 2% and it’s a matter of time for it to continue declining as it faces major precedent from other interest rates across the rest of the world, he said.

The rise of China and the changing of the global order has penetrated the public debate. What does the new order look like and how does that influence the monetary system? Find out in this interview with Kofinas.

How do cryptocurrencies fit into the overall asset classes? McGarraugh answers this question and more during a recent interview from Blockworks’ Bretton Woods conference.

“We’re caught in this mirage of thinking that prices always have to go up or that our money has to be worth less each year for our system to work because we created a system like that,” he said.

Crypto businesses are increasingly leaning into traditional banking products, Materazzi said, and he is excited to see how traditional banking starts to merge with digital assets.

Fidelity’s Jurrien Timmer sat down with Blockworks in Bretton Woods to talk about market bubbles, asset allocation and gold versus bitcoin.

People should also understand that bitcoin is one of the first truly global macro investments to exist, Tapiero said.

The monetary system created by ruling elites, cherished by oligarchs and scorned by the rest of us can’t be fixed. Attempting to do so would only recreate some altered version of the status quo. Instead, we can create something new entirely.

America has succumbed to Triffin’s Dilemma by running massive trade deficits with producing countries like China and India, where many once-American middle-class jobs now also reside.

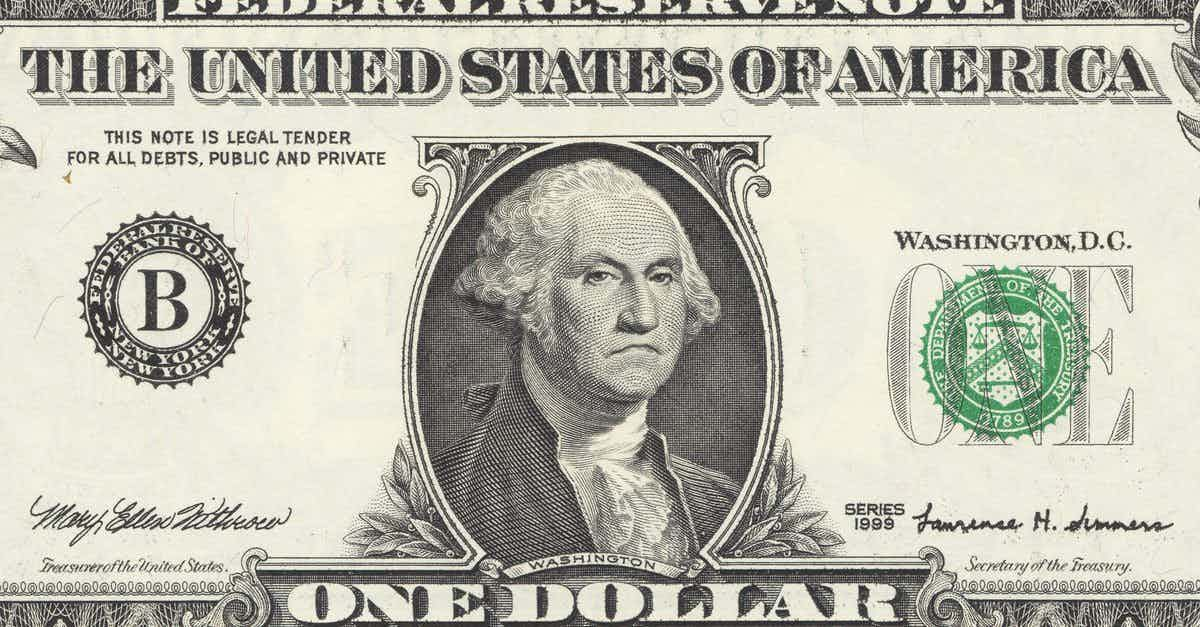

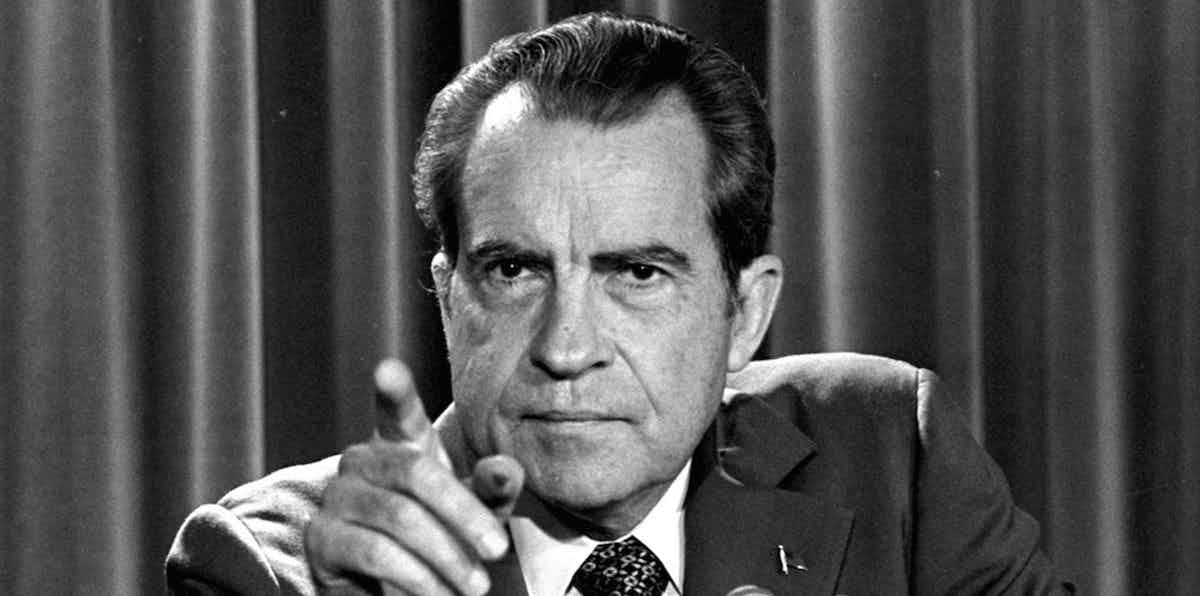

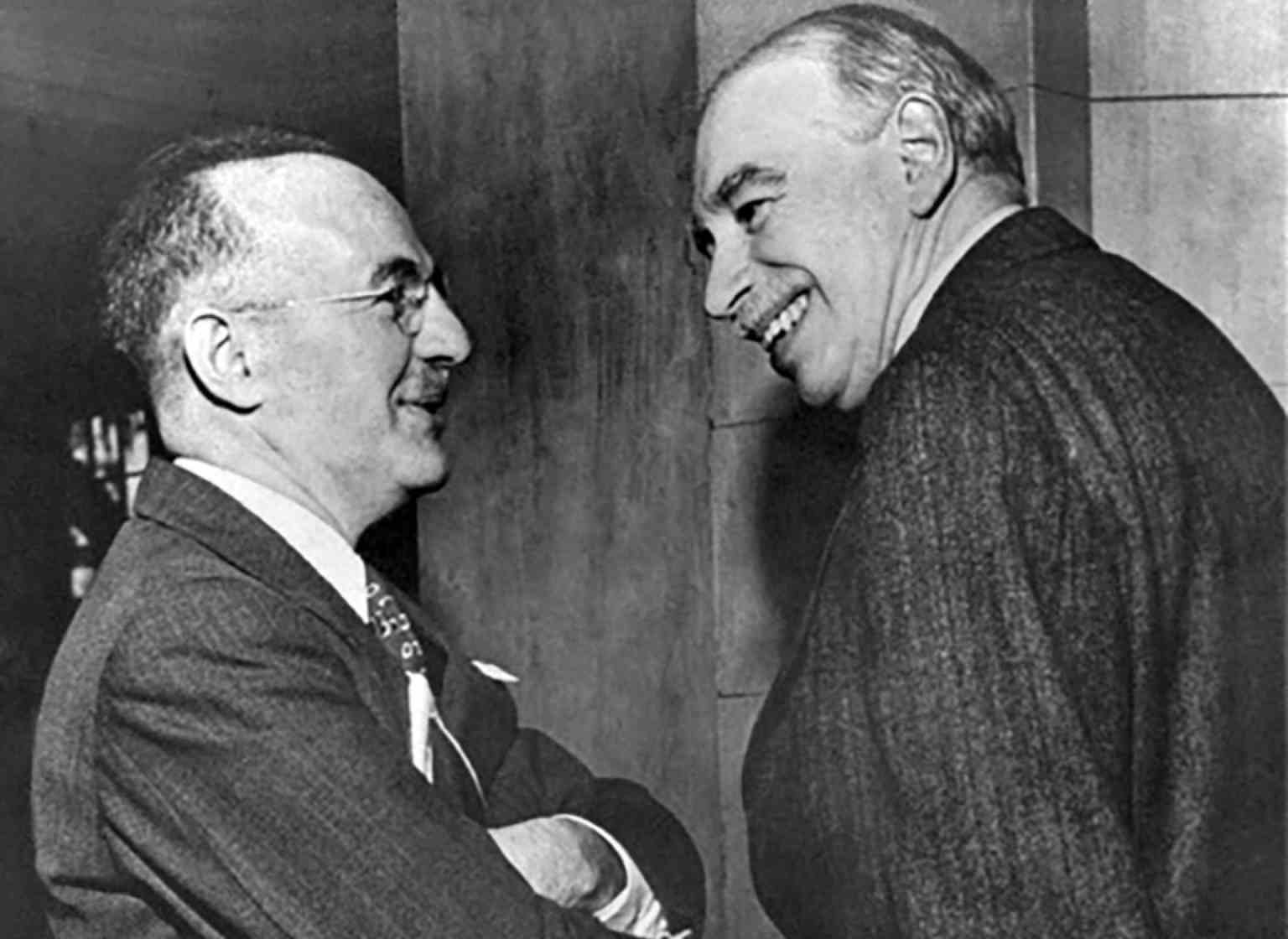

On August 15, 1971, President Richard Nixon de-pegged the US dollar from the price of gold, causing the Bretton Woods System to collapse.

In Part 2 of our Road to Bretton Woods series, we take a look at the history of gold and the part it played in developing the Bretton Woods System.

Set in place by 44 nations at the end of World War II, the Bretton Woods economics system was unprecedented at the time and warranted new centralized mechanisms of governance to ensure its continued functioning.