Why Gold was Our Global Currency

In Part 2 of our Road to Bretton Woods series, we take a look at the history of gold and the part it played in developing the Bretton Woods System.

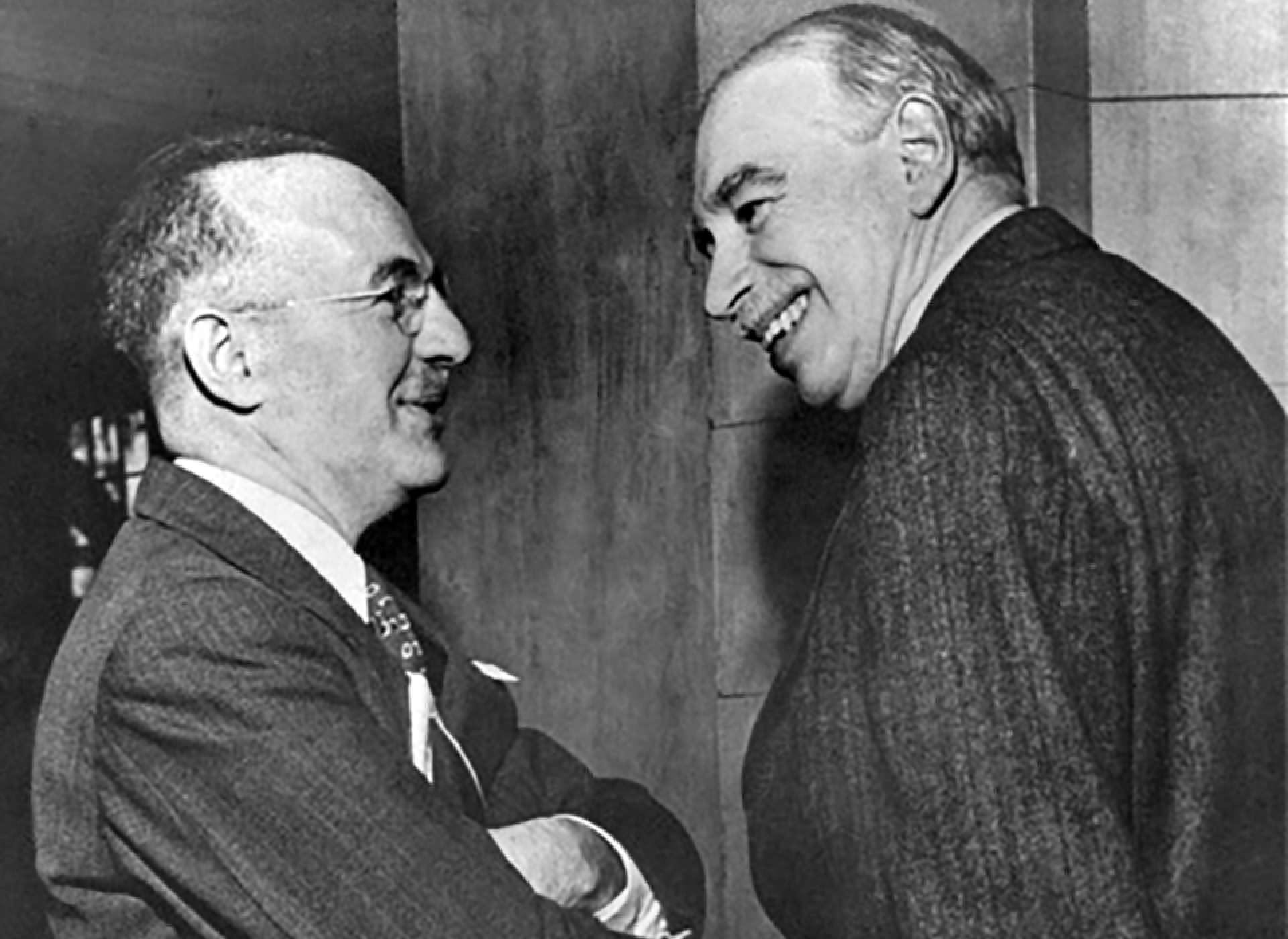

Harry Dexter White and John Maynard Keynes at Bretton Woods, July 1944

- Out of all the elements available, gold makes the most practical sense and is also among the scarcest.

- The original Bretton Woods System devised by John Maynard Keynes and others in 1944 declared that the US dollar would be the world’s reserve currency and maintain its peg to gold.

Throughout the ages, gold has served as the quintessential monetary medium. It is scarce, durable, fungible and has universal utility.

In his groundbreaking book The Bitcoin Standard, Saiffadean Amous takes readers through time and across cultures to discover the many materials that humans have used as forms of money. Sea shells, glass beads, and even gigantic rai stones have all served as the basis of monetary systems before.

But gold turned out to be the best form of money out of all tangible goods that had previously been tried.

Basic chemistry

Gold has been cherished throughout the ages for its rarity, beauty, and usefulness. But the same could be said about some other elements. Why not copper, silver, or platinum, for example?

Much of the answer comes down to basic chemistry.

After eliminating elements that are either gases, radioactive or reactive, we are left with only seven – the precious metals. These include: rhodium, rhenium, iridium, platinum, palladium, silver and gold.

Out of all the elements available, gold makes the most practical sense and is also among the scarcest. Other metals of potential value like iron, copper, and silver are reactive, as they rust or tarnish over time when exposed to the air. They’re also less scarce than gold.

The perfect form of money

Prior to 2009, gold may have been the most perfect form of money available. The precious metal fulfilled all the necessary roles of money better than most anything humans had previously used.

To serve as a form of money, something must be 1) a store of value, 2) a medium of exchange, and 3) a unit of account. Money must provide a way for people to store wealth, exchange that wealth with one another, and provide a mechanism by which goods and services can be priced in units of that wealth.

In addition to these three fundamental features, there are six other factors that contribute to somethings’ usefulness as money, including portability, durability, fungibility (also known as uniformity), acceptability, limited supply and divisibility.

Gold fulfills all the requirements for something to be money. The only real drawbacks were portability and divisibility. When gold served as a universal unit of account, small coins may have solved the divisibility problem, as goods and services could be priced in tiny increments of gold. And portability wasn’t much of a problem for any but the wealthiest of gold holders.

Over time, however, merchants discovered a clever way to “improve” the system of barter and trade built on gold. They could hold people’s gold for them and issue paper receipts in exchange. The receipts would be as good as gold. This way, the merchants could also issue additional paper even when they didn’t have the gold to back it, and no one would know the difference unless they all came to redeem their gold at once.

In this way, the fractional reserve banking system of today was born. Bretton Woods was the first attempt at implementing such a system on a global scale.

Why the US dollar?

The original Bretton Woods System devised by John Maynard Keynes and others in 1944 declared that the US dollar would be the world’s reserve currency and maintain its peg to gold.

At that time, the US represented roughly one third of global GDP and about half of all global manufacturing. The country also had ample gold reserves. It only seemed natural for such an economic powerhouse to be the home of the reserve currency under the new Bretton Woods System.

After its inception in 1944, the system appeared to function rather well. The global economy overall enjoyed over a quarter century of relative stability. America certainly prospered.

But then in 1971, the US de-pegged the dollar from gold, annihilating the very foundation of the Bretton Woods system.

Find out more about the fall of the Bretton Woods System next week.

Now is the time for a new Bretton Woods.

This article is part 2 in a 5-part series about Bretton Woods. Blockworks will be hosting a new Bretton Woods summit in the same location, 50 years later. Find out more about the conference and apply to attend today.