The End of a Financial System

On August 15, 1971, President Richard Nixon de-pegged the US dollar from the price of gold, causing the Bretton Woods System to collapse.

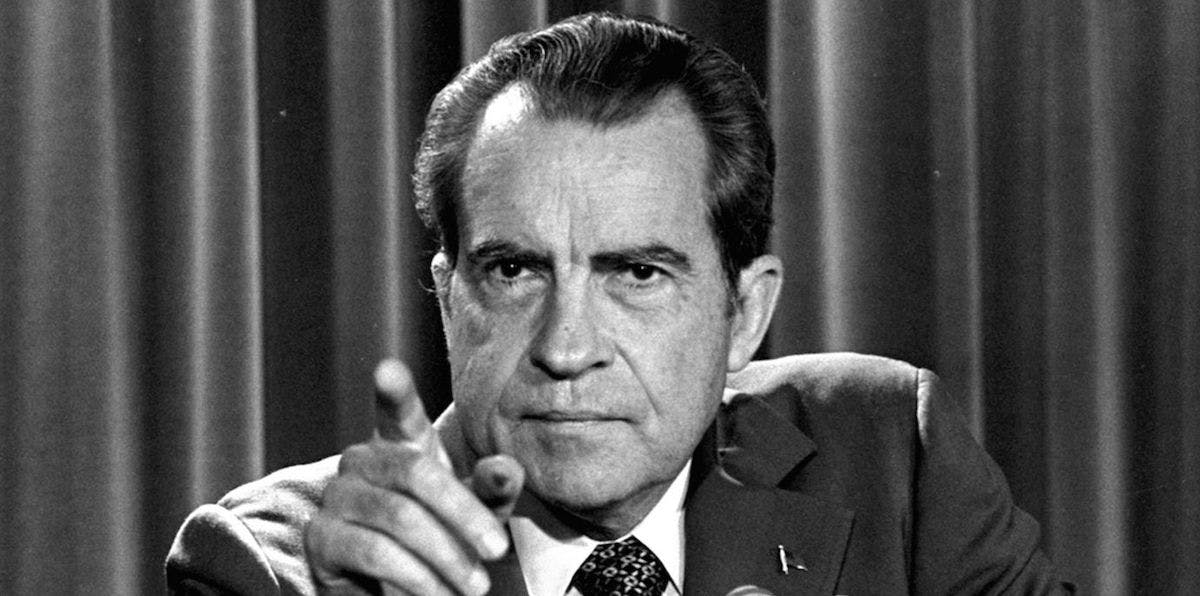

RIchard Nixon; Source: Boston Globe

- President Nixon assured Americans at the time that this was only a momentary change designed to “stop the speculators” who were supposedly out to destroy the dollar.

- The US has now had a purely fiat monetary system for 50 years.

In the late 1960s and early 1970s, some nation-states started getting concerned that the US was spending more money than it actually had.

The Vietnam war and several domestic spending programs were expensive endeavors. Did America really have that much gold, or was she printing extra dollars?

If it turned out to be true that the dollar was being printed far beyond its physical gold reserves, then the dollars being held by other countries would be devalued.

In response, countries like France, Japan, Korea, Great Britain and others started exchanging their US dollars for gold and demanding physical delivery of the metal. The only way to stop America from losing all of its gold, and therefore also reserve currency status, was to stop letting people convert their dollars into gold.

As a result, on August 15, 1971, President Richard Nixon de-pegged the US dollar from the price of gold, causing the Bretton Woods System to collapse.

President Nixon assured Americans at the time that this was only a momentary change designed to “stop the speculators” who were supposedly out to destroy the dollar. Of course, other countries were acting with their own best interests in mind and likely didn’t have a personal vendetta against the dollar.

The US has now had a purely fiat monetary system for 50 years. There is no objective anchor for any currency. National currencies now represent nothing more than debts owed to central banks.

The Triffin Dilemma fulfilled

As far back as 1959, one economist foresaw the failure of the Bretton Woods System.

Yale professor Robert Triffin stated that the US would have to expand its trade deficits in perpetuity in order to maintain the dollar’s reserve currency status. Ever-increasing trade deficits and a gold standard don’t go together, as a country can’t print more gold like it can print more currency.

The idea is that when a country issues an international reserve currency, that nation puts itself into a paradox of sorts from which there can be no escape. The government must attempt an impossible balancing act between the national interest to keep domestic unemployment low and economic growth steady while also helping other countries prosper.

But demand for the reserve currency and government debt denominated in that currency will drive up the currency’s value, making domestic exports weaker due to foreign currencies being less valuable. This makes other nations happy but hurts the one printing the reserve currency. To remedy this, the country can devalue its currency, but doing so threatens its reserve currency status as other countries will find it less desirable. Either way, the country can’t win in the long-term.

This is a distilled description of what’s referred to as The Triffin Dilemma. The reality of this problem revealed itself in a big way in 1971. We are still coping with the aftermath 50 years later.

So many modern societal problems can be traced back to the fiat-based monetary system, something we will explore further soon.

50 years later …

Half a century has passed since that fateful summer day in 1971. The system remains as broken as ever. Economic inequality has reached historic levels and many fiat currencies around the world have begun collapsing.

For the time being, the dollar is still seen as the safe haven currency. Citizens and investors who see their own national currencies entering hyperinflation rush to dollars. But for how much longer?

Just as nations began demanding delivery of their gold in the early 1970s, nations have now begun to move away from the fiat dollar as the standard for global trade. What will happen next?

Now is the time for a new Bretton Woods.

This article is part 3 in a 5-part series about Bretton Woods. Blockworks will be hosting a new Bretton Woods summit in the same location, 50 years later. Find out more about the conference and apply to attend today.