$1.9T Digital Asset Market Cap Closing in on Apple’s Value

Industry stakeholders believe that this bull cycle is the product of institutional finance continuing to signal their support for the asset class through new products like structured funds and ETFs, as well as legacy payment companies broadening support.

Source: Shutterstock

- Soaring past the market cap of Amazon, Microsoft and Saudi Aramco, digital assets are “here to stay”

- Industry stakeholders believe that this bull cycle is the product of institutional finance support

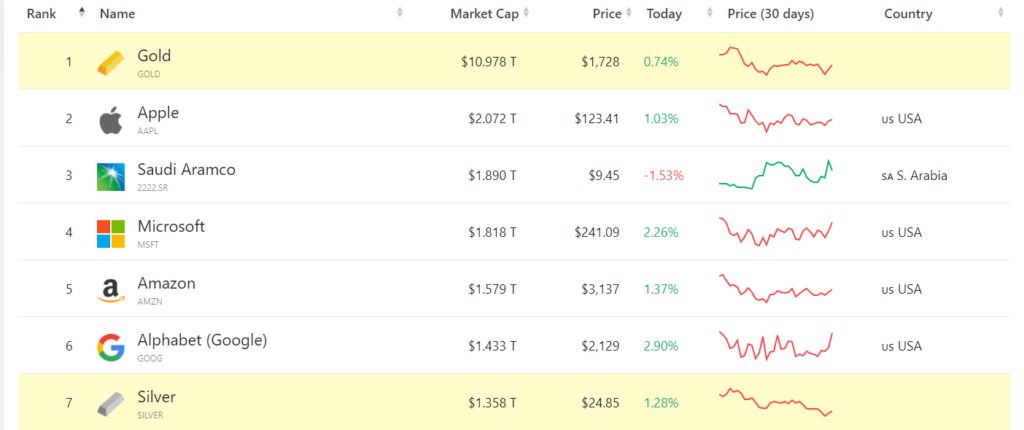

Buoyed by another bull market cycle, the market cap of digital assets has hit $1.93 trillion according to CoinGecko, shooting past the market cap of tech giants Microsoft and Amazon as well as Saudi Aramco, the world’s largest oil producer.

Source: CompaniesMarketCap.com

Source: CompaniesMarketCap.com

In mid-February, digital assets hit a symbolic milestone by surpassing the market cap of Alphabet, Google’s parent. The boom was spurred by the price of bitcoin breaching $46,000 upon news that electric vehicle maker Tesla had added $1.5 billion in bitcoin to its corporate treasury. Since then, more companies have added bitcoin to their balance sheet.

Industry stakeholders believe that this bull cycle is the product of institutional finance continuing to signal their support for the asset class through new products like structured funds and ETFs, as well as legacy payment companies broadening support.

Bill Noble, Chief Technical Analyst at Token Metrics, also points to the rise of the altcoin market as a booster for the broader digital asset market.

“This latest market cap milestone for digital assets is a result of altcoins starting to catch fire. Previously, the rally in crypto was geared towards smaller coins,” he said. “Now, altcoins with larger market caps like the ones on Coinbase have joined the rally. The expansion of the altcoin market cap is having a ripple effect, and creating a push in bitcoin and Ethereum.”

Bitcoin is up by approximately 12% over the past week, and Ethereum has posted gains of 23%.

“Digital assets are still at the very beginning of the emergence of the asset class, and there is a long way to go from here. Digital assets are here to stay, and we no longer think that is even a question,” said Gene Grant, CEO of VRBex, a Texas-based digital assets financial firm. “Senior management from companies we spoke with two years ago who said, ‘Why Bitcoin?’ are now admitting they made a mistake by not moving forward with our recommendations. They are now looking at how to get into the space.”

Some Wall Street veterans have taken ‘Why Bitcoin?’ to heart, and have voted to support institutional adoption with their feet by joining digital asset companies. For example, former SEC Commissioner Jay Clayton became an advisor at One River earlier this week, and Coinbase has hired a former Morgan Stanley heavyweight lawyer to run its enterprise compliance department.

“We have evolved beyond the stage where institutions were adamant that they would never touch these assets, to the point where they are actively hiring talent that focuses specifically on helping acquire them,” said Syed Hussain, CEO of Liquidity Digital, a firm specializing in the issuance of digital securities.

“If a single company like Saudi Aramco, which primarily deals with an asset that a lot of folks are looking to move away from, can command a nearly $2 trillion market cap, then what about an entire sector that is dealing with assets that global institutions are actively looking to move into, and of which the full potential hasn’t even begun to be realized yet,” he added.

Token Metrics’ Noble said that one of the things he’s watching for continued growth of the market is US interest rates.

“A rise, or continued rise, in US interest rates could hurt all speculative assets like stocks and crypto. However, one thing that has been amazing to see is crypto’s ability to hover near its highs despite the rally in the dollar and rise on bond yields,” he said.

The price of bitcoin is approximately $58,700 as the US Thursday trading day continues.