Yield Basis is making native BTC yield a reality

Yield Basis introduces an IL-free AMM design that already dominates BTC DEX liquidity

Hybrid_Graphics/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Yield Basis (YB) is a novel DeFi mechanism that uses leverage to eliminate impermanent loss (IL) from AMMs. The founder of Yield Basis is the same founder as Curve, and synergies exist between the two. The mechanics of how this mechanism works can be found here.

After years of witnessing failed attempts, YB strikes me as the first solution with legs, but you don’t need to take my word for it. YB already accounts for the three-largest BTC DEX pools in DeFi ($400 million+).

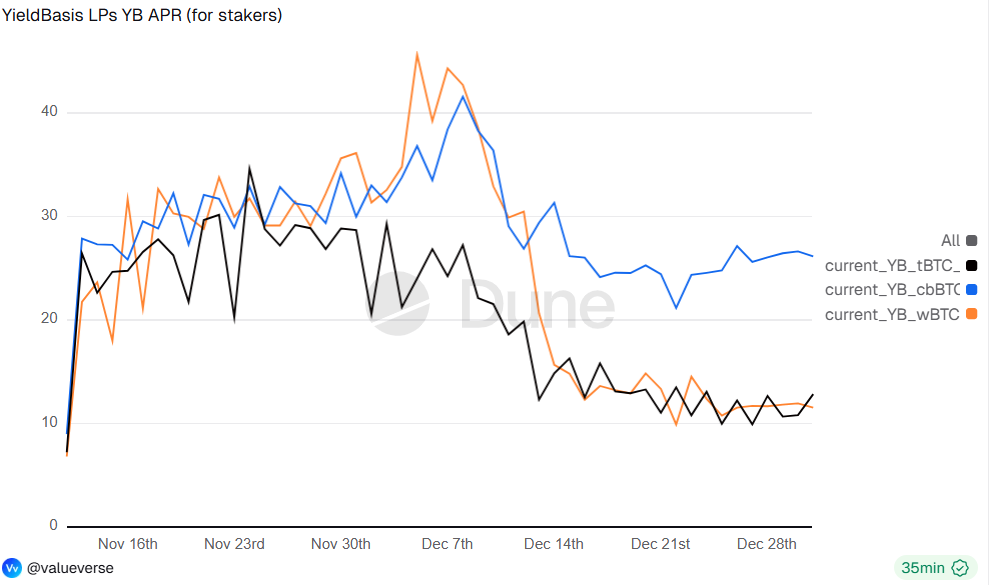

Moreover, this means that (wrapped) BTC token holders can now earn yield while supplying liquidity. Historically, the seven-day moving average for this (supply) yield has ranged between 4% and 40%.

And since many of us don’t LP into AMMs (unless we’re farming something), you might have forgotten that yields are earned in the pool tokens. So yes, that means native BTC yields.

Source: Valueverse

Source: Valueverse

As for the token itself, it’s not just a meme governance token — there’s actual value. The fee switch was turned on earlier this month. YieldBasis LPs have two options for generating yield from provided liquidity: (a) hold the ybBTC LP token and receive BTC-denominated trading fees, or (b) stake ybBTC, forgo BTC-denominated trading fees and participate in YB emissions.

Corporate Finance 201 agrees with me when I say, “Don’t buy back the token, give me the earnings from the protocol, and I can decide for myself if and when I want to buy the token.” What I mean is, dividends give optionality, especially when you can choose which type of yield to receive. For perspective, for the week ending Dec. 25, roughly $450,000 was distributed (and this figure is despite caps on the LP pools).

Source: Valueverse

Source: Valueverse

If you’ve read this and think there’s finally a way to earn native yield on BTC without IL and without the risks, effort and costs of hedging, then you’d be right — but there could be more. YB is positioned as more than just an IL-free AMM: It is a yield and liquidity infrastructure designed to make otherwise non-productive assets yield-bearing while establishing secondary markets. By targeting wrapped native assets and tokenized RWAs, YB can theoretically make any sufficiently liquid and volatile asset productive, allowing issuers to earn from liquidity rather than subsidize market making, while also enabling holders to access yield and downstream DeFi use cases such as collateralization.

This model extends beyond crypto majors like BTC and ETH to tokenized commodities and equities such as Gold, Silver, and NVDA, whose onchain adoption is currently constrained by IL, shallow liquidity, and the absence of yield or liquidation pathways. Yield Basis could unlock these markets by offering a unique, superior yield option with an attractive risk-reward profile, deep liquidity and strong network effects.

YB is not without risk. I encourage you to read the paper (or get AI to explain it) and understand the potential downsides, but also the potential unlocks that YB has to offer.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.