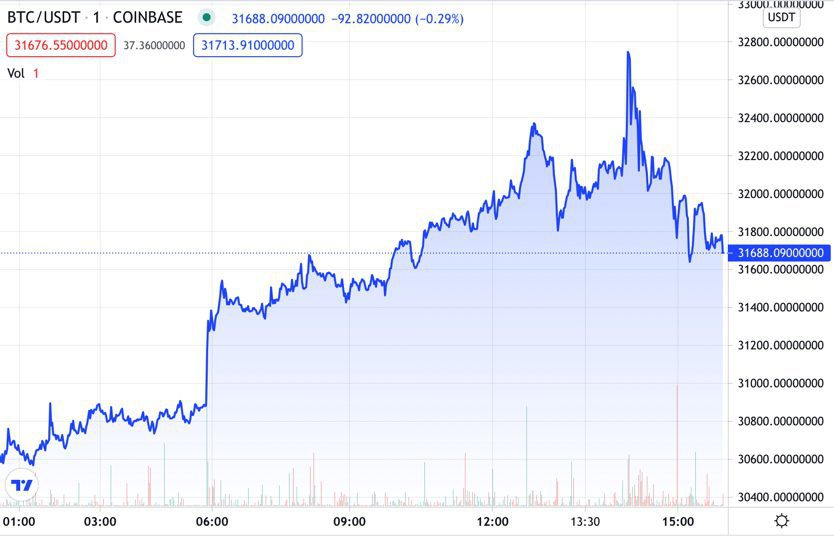

Bitcoin Surges After Shallow Dip Below $30K: Markets Wrap

Signals of further institutional adoption could have triggered crypto’s early morning rally, when bitcoin jumped over 10%.

Blockworks exclusive art by Axel Rangel

- BNY Mellon has joined State Street and four other banks in offering custody support to a new crypto trading platform, Pure Digital.

- Virtually Human Studio raised $20 million in Series A funding, led by TCG Capital Management.

Bitcoin rebounded on Wednesday, climbing upwards of $32,000, after falling below $30,000 the day before.

Institutional adoption could have triggered crypto’s early morning rally, when bitcoin jumped over 10%. Ethereum broke past $2,000 for the first time in a week.

BNY Mellon, which has $45 trillion AUC, joined State Street and four other banks in offering custody support to a new crypto trading platform, Pure Digital.

Later in the day, Tesla’s Elon Musk said that he owned ethereum, bitcoin and dogecoin. He added that he “would like to see bitcoin succeed.” Musk also said that Telsa would likely resume accepting bitcoin as payment in the future. During his bullish remarks at “The B-Word” conference, ethereum hiked 13% while dogecoin surged almost 20%. The panel also featured Ark Invest’s Cathie Wood and Twitter CEO Jack Dorsey.

Bitcoin now faces resistance around $34,000.

Crypto

- Bitcoin is trading around $31,730.57, up 6.24% in 24 hours at 4:00 pm ET.

- Ether is trading around $1,945.31, advancing 8.38% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.061, advancing 1.4% at 4:00 pm ET.

- VIX fell -8.57% to 18.03 at 4:00 pm ET.

Insight

“We see that volumes of trading have increased at the lower price levels, presumably because people are buying the dip. At least whales definitely are,” TabTrader CEO, Kirill Suslov, said in a note. “However, such an important round number price level may be both difficult to pierce through and if pierced successfully, the negative pressure can prevail.”

Graph: TradingView

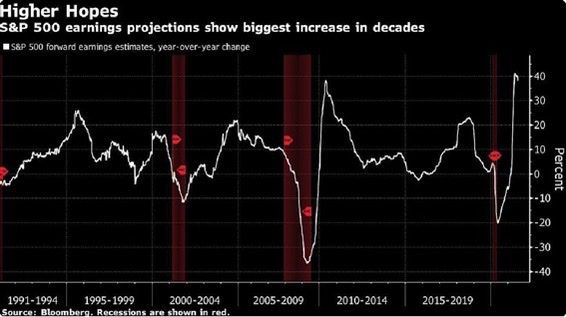

Graph: TradingViewUS stocks made gains for a second trading session in a row after rebounding from Monday’s big hit to equities.

Equities

- The Dow made gains to 34,794, up 0.84%.

- S&P 500 advanced 0.80% to 4,357.

- Nasdaq was up 0.90% to 14,629.

Fixed Income

- US 10-year treasury yields 1.292% as of 4:00 pm ET.

Commodities

- Brent crude shot up to $72.74 a barrel, advancing 4.17%.

- Gold was little changed, down -0.40% to $1,803.80.

Currencies

- The US dollar fell -0.21%, according to the Bloomberg Dollar Spot Index.

In other news…

Virtually Human Studio raised $20 million in Series A funding, led by TCG Capital Management.

We’re watching out for…

- US existing home sales will be on Thursday.

- European Central Bank rate decision will be on Thursday.

- The Tokyo Summer Olympics begin on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.