Bitcoin Trends Higher as Stocks Rebound: Markets Wrap

“We view the cryptocurrency market as a high growth market that is large, profitable, and filled with opportunities,” Ex-NYSE president Thomas Farley said.

Source: Shutterstock

- Crypto startup, Bullish announced plans to go public with the help of former NYSE president Thomas Farley’s SPAC

- Square, led by Jack Dorsey, said the digital payment services company has plans to make a hardware wallet for bitcoin

Bitcoin rises and ethereum seesaws amid a slew of bullish announcements this week, signaling further crypto adoption in the mainstream.

Twitter CEO Jack Dorsey confirmed that Square, a digital payments service company, will move forward with making a hardware wallet for bitcoin, Blockworks reported on Friday. Following Dorsey’s remarks, bitcoin rose to $33,000. The digital currency surged roughly 2% the following hour.

It was a big week for crypto-related IPO news, too. Crypto startup, Bullish, announced plans to go public with the help of former NYSE president Thomas Farley’s SPAC on Friday, Blockworks reported. Circle, a crypto financial services firm, said they would be merging with SPAC Concord Acquisition in a $4.5 billion deal,

Crypto

- Bitcoin is trading around $33,458.70, up 2.00% in 24 hours at 4:00 pm ET

- Ether is trading around $2,134.02, shedding -0.16% in 24 hours at 4:00 pm ET

- ETH:BTC is at 0.063, down -0.91% at 4:00 pm ET

- VIX fell -14.84% to 16.07 at 4:00 pm ET

Insight

“We view the cryptocurrency market as a high growth market that is large, profitable, and filled with opportunities,” Farley told Blockworks. “In terms of the merits of the investment overall, the cryptocurrency market is just in the first or second inning.”

Source: TradingView

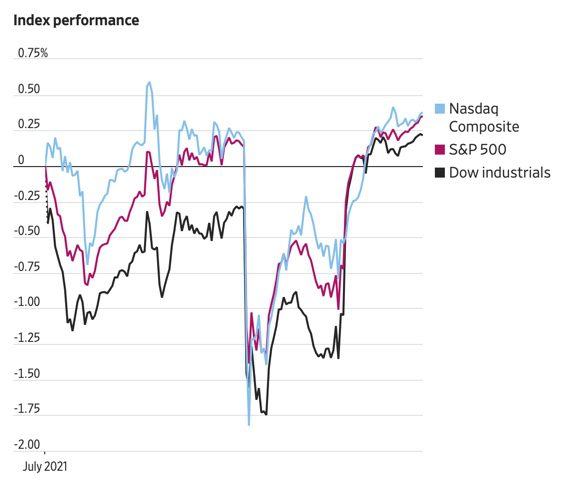

Source: TradingViewMajor equities continue to climb to record highs after choppy trading earlier in the week. The S&P 500 rebounded from its biggest drop in over two weeks, pushing up 1% Friday as investors continue to assess economic growth. The tech-heavy Nasdaq Composite and Dow Jones Industrial Average followed suit, inching up 0.8% and 1.3%, respectively. The Dow jumped roughly 450 points intraday.

However, following less-than-ideal initial jobless claims data and concerns of expedited Fed tapering, all Wall Street gauges were down the day before. Bank stocks recovered on Friday after taking big hits following the Wells Fargo news.

Equities

- The Dow shot up to 34,869, making gains of 1.3%

- S&P 500 advanced 1.13% to 4,369

- Nasdaq was up 0.98% to 14,701

Insight

“We’ve seen the first phase, and the S&P’s string of recent new highs says we’re still in it,” Co-founder of DataTrek Research, Nicholas Colas said in a note on what to expect in H2. “But, at some point we hit phase two and markets then wrestle with what the ‘right’ valuation is for that new environment. While these awkward mid-cycle periods are rarely bull market killers, they can make for very low returns… and valuations are high enough currently that peaking earnings could be a larger risk than before.”

Source: FactSet

Source: FactSetFixed Income

- The US 10-year yields 1.358% as of 4:00 pm ET

Commodities

- WTI crude is up to $74.61 a barrel, advancing 2.29%

- Gold is up 0.49% to $1,809

Currencies

- The US dollar fell -0.33%, according to the Bloomberg Dollar Spot Index

In other news…

In Turkey, the rate of people who completed transactions with crypto is up 11 times YoY, according to data from Paribu, cryptocurrency trading platform.

That’s it for today’s markets wrap. I’ll see you back here on Monday.