Equities Climb, Cryptos Flatten Amid Blowout Corporate Earnings: Markets Wrap

Twitter, which reported higher-than-expected earnings, benchmarked their biggest revenue growth in over five years.

Source: Shutterstock

- Big winners in the index include Moderna Inc. and Facebook, whose shares hiked 7.26% and 5.53%, respectively.

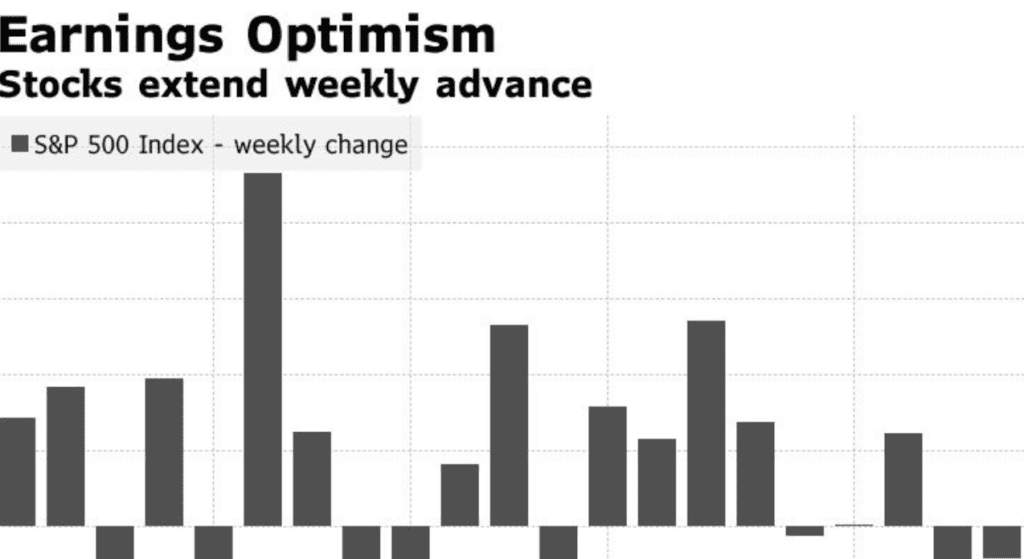

- As almost 90% of S&P 500 companies have beat estimates, US stocks continued their weekly gains.

Fears surrounding rising Covid-19 cases and concerns of inflationary pressures stunting economic growth took a back seat to a blowout earnings season on Friday.

As almost 90% of S&P 500 companies have beat earnings estimates, US stocks continued their weekly gains.

Big winners in the index include Moderna Inc. and Facebook, whose shares hiked 7.26% and 5.53%, respectively. Online craft-marketplace Etsy Inc., made gains, as concerned investors anticipate looming pandemic restrictions.

Twitter, which reported higher-than-expected earnings, benchmarked their biggest revenue growth in over five years.

The social media firm’s revenue grew 74% year over year. Analysts predicted the company would generate $1.09 billion in revenue but topped expectations at $1.19 billion. Snapchat’s shares jumped 23% since posting higher figures as well.

The tech-heavy Nasdaq Composite and the S&P 500 were both up above 1% intraday. All major indices closed ahead.

Equities

- The Dow rose 0.68% to to 35,061.

- S&P 500 advanced 1.01% to 4,411.

- Nasdaq was up 1.04% to 14,836.

Cryptos slowed momentum on Friday, after continued gains during the week.

After an onslaught of bullish news including Elon Musk’s market-moving remarks at a bitcoin conference and signals of institution adoption from BNY Mellon and JPMorgan, Bitcoin jumped 10%. On Thursday, Twitter CEO Jack Dorsey said bitcoin will be a “big part” of the company’s future, Blockworks reported. The largest digital currency increased again after the social media firm’s earnings call.

It was a big week for BlockFi. The company was given a series of regulatory warnings from three different US states this week. Starting with New Jersey, the garden state’s attorney general gave BlockFi one week before stopping new interest rate accounts with a cease-and-desist order. Texas and Alabama followed suit.

In decentralized finance (DeFi), the governance token of Axie Infinity Platform has doubled this week, Coindesk reported on Friday. The company, whose revenue has gone up 17,000% since April, is a blockchain-based video game that gives users the ability to raise and trade creatures, using non-fungible tokens. Essentially, it’s like a Pokémon-style investment opportunity. AXS is now trading at an all-time high of $30, skyrocketing 5,700% since last year.

Bitcoin has maintained support around $33,000, after falling below $30,000 Tuesday morning. Ethereum has continued to stay above $2,000. Both cryptos were trading slightly slower at press time.

Crypto

- Bitcoin is trading around $32,261.77, down -0.19% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,019.46, hiking 0.24% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.062, shedding -0.11% at 4:00 pm ET.

- VIX fell -4.47% to 16.90 at 4:00 pm ET.

DeFi

- Uniswap is trading at $17.33 with a total value locked of $3,877,749,338, down -1.1% in 24 hours at 4:00 pm ET.

- Chainlink is trading at $15.48, shedding -3.3% with trading volume at $564,088,315 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 31.1% at 4:00 pm ET.

Insight

“We have seen a rebound from a psychological level with the highest volumes in the entire month of July. Volatility is autocorrelated so we will see more action in the coming days be it up or down,” said TabTrader’s Kirill Suslov in a note.

A Covid-19 resurgence has caused broad sell-offs in oil, resulting in continued volatile trading sessions for the commodity. WTI plunged on Monday but has inched back up throughout the week.

Commodities

- Brent crude shot up to $74.05 a barrel, advancing 0.35%.

- Gold was down -0.19% to $1,802.

Fixed Income

- U.S. 10-year treasury yields 1.283% as of 4:00 pm ET

Currencies

- The US dollar strengthened 0.09%, according to the Bloomberg Dollar Spot Index.

In other news…

Commodity Futures Trading Commission Commissioner Dan Berkovitz said blockchain technology will benefit US regulatory groups in the future, adding that it has “great potential” during a virtual panel on Thursday.

That’s it for today’s markets wrap. I’ll see you back here on Monday.