LMAX Group CEO David Mercer: “Between one and three investment banks will trade crypto by the end of the year.”

Investment banks offer a trusted solution, and combined with access to deep liquidity and robust execution on institutional exchanges like LMAX Digital, they may be the key to ushering in the new wave of market participants in digital assets.

- Despite bitcoin’s increasing popularity within the institutional world, inefficient market structure and limited access to credit is restricting growth.

- Goldman Sachs and Morgan Stanley sit at the center of financial markets, and one day soon, they may do the same for digital assets.

“If an asset manager wants to buy $1 billion worth of bitcoin, who are they going to trust?”

According to David Mercer, CEO of LMAX Group, which operates the leading institutional exchange, LMAX Digital, the answer is investment banks. Giants like Goldman Sachs and Morgan Stanley sit at the center of financial markets, and one day soon, they may do the same for digital assets.

The critical role of investment banks has to do with credit availability. Despite bitcoin’s increasing popularity within the institutional world, inefficient market structure and limited access to credit is restricting growth.

Mostly though, institutions don’t want to reinvent the wheel when it comes to their own infrastructure. “Let me paraphrase a customer I spoke to last week,” said Mercer. “They trade 80 currency pairs with me, and they want to trade bitcoin. They said look, don’t talk to me about custody, don’t talk to me about keys, don’t tell me about gas, I just want to trade it the way I trade everything else.”

Investment banks offer a trusted solution, and combined with access to deep liquidity and robust execution on institutional exchanges like LMAX Digital, they may be the key to ushering in the new wave of market participants.

Why are investment banks starting to suddenly pay attention to digital assets?

Within the last month, a slew of investment banks have voiced their support of bitcoin. Citi recently released a 106-page report on the digital currency, calling the current moment in time a “tipping point” thanks to institutional adoption.

Back in January, banking giant JPMorgan Chase issued a $146,000 price target for bitcoin, and Guggenheim’s CIO Scott Minerd said that bitcoin “could climb as high as $600,000.” Just last month, it was reported that a $150-billion Morgan Stanley fund is considering bitcoin as an investment.

Why are banks getting involved now? According to Mercer, the answer is client demand. “[Crypto] is not so much a money maker for [the banks], they make enough in fixed income, in equities, and all their other products. I think it really is a case of client demand.”

Mercer’s explanation tallies with a recent interview with Matthew McDermott, Goldman Sachs’ head of Digital Assets, on the strong institutional demand they are seeing for digital assets.

“The team has fielded well over 300 conversations,” said McDermott. “And when I talk about the broad spectrum [of demand], I’m referring to hedge funds, to asset managers, to macro funds, to banks, to corporate treasurers, insurance and pension funds.”

Goldman Sachs is reportedly launching a cryptocurrency trading service in mid-March. Mercer expects that after banks take the initial step of facilitating trading, they will expand to a greater array of services.

“Once they’re in it, then they can look at market-making, liquidity providing, writing algorithms, and having a proprietary desk or a principal trading desk. I expect all of that will follow.”

The critical role investment banks play

Investment banks facilitate commerce. In financial markets, the key role that they play is one of trust.

The central presence of investment banks means that counter parties do not need to trust each other, they only need to trust Goldman Sachs or Morgan Stanley. Over time, robust infrastructure and regulatory frameworks have been built to assure the safety of market participants.

Although digital assets technically eliminate the need for trusted third parties, many large asset managers simply aren’t there yet. “Some of the biggest asset managers oversee over $5 trillion in AUM,” said Mercer. “They have a trillion or two sitting with lots of different banks, and they’d rather trust the credit of the banks than trust the blockchain.”

That is the reality for many institutions today. Digital assets make up a small part of a larger portfolio, whether that is for a trillion-dollar asset manager or a corporate treasurer. Most organizations will be unwilling to suffer the friction of building an entirely new infrastructure to manage just a small piece of the pie.

Banks, on the other hand, already have relationships with virtually every institutional client on earth. By initially reducing the friction associated with transacting in crypto, and eventually providing deeper liquidity and access to credit, they will help the ecosystem grow and thrive.

“It’s just trust and reputation,” said Mercer. “But then with that, you’re going to oil the wheels of the whole market because if ‘Bank A’ and ‘Bank B’ are plugged into LMAX Digital, they create activity in the exchange, more liquidity providers are competing for that flow, so you end up with a much more active tighter book, and that creates activity for other traders. All of the sudden, you’re going to see this snowball.”

Banks rely on institutional exchanges like LMAX Digital to interact with digital assets

Investment banks on their own aren’t enough to usher along institutional adoption.

Digital asset markets are wickedly complex and technologically difficult to navigate. Banks have the trust of their clients, but to trade, they need access to a regulated institutional exchange like LMAX Digital, offering deep liquidity and reliable, robust institutional grade trading infrastructure.

Think of LMAX Digital as the glue that holds digital asset markets together. Their low latency, high-throughput technology and deep pools of liquidity enable investment banks to give their clients the service that they have come to expect from traditional financial markets.

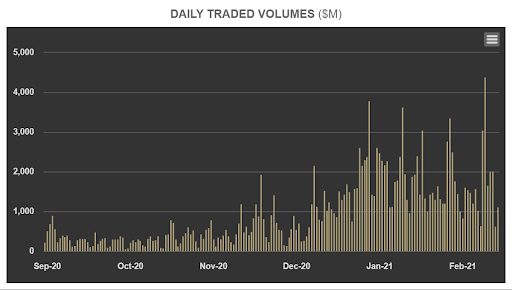

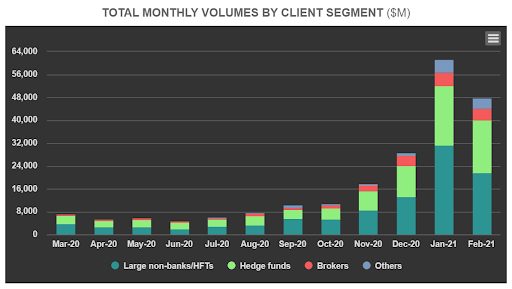

The LMAX Digital central limit order book enables efficient market structure, transparency between counterparties, and facilitates consistent execution for all market participants. Data shared by LMAX Digital with Blockworks corroborates this story and gives more granular insight into how this wave of institutional adoption is playing out.

Source: LMAX Digital

Source: LMAX Digital

Total volume for the month of February ended just shy of $50 billion, with a record-setting $4.4 billion traded in a single day.

Source: LMAX Digital

Source: LMAX Digital

Large non-banks remain the largest customer segment for LMAX Digital, although Hedge Funds are nearly as large and the fastest growing segment.

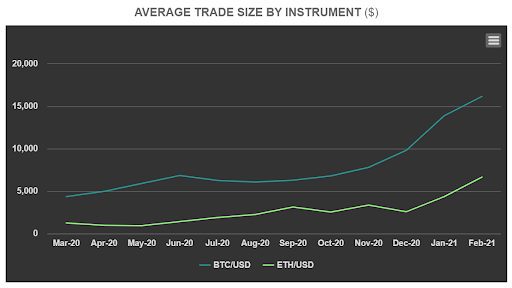

Source: LMAX Digital

Source: LMAX Digital

Finally, the average trade size has skyrocketed in recent months, more than tripling to over $15,000 in February when compared to March of 2020.

It looks as though institutions are indeed already playing a central role in the crypto market, and they will increasingly rely on LMAX Digital going forward.