Robinhood’s leap shows the prediction-market arms race is underway

Robinhood is pushing deeper into high-margin market design, joining competitors like Kalshi and DraftKings

Creativa Images/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

We start with a risk-off tape across tech, crypto and miners, then zoom in on Robinhood’s prediction market roadmap.

Indices

Markets closed with a clear risk-off tone yesterday. Gold was the lone bright spot, finishing up 0.8%, while the S&P 500 ended flat and the Nasdaq and BTC fell -1.38% and -1.89%, respectively.

The underlying drivers remain unchanged, with continued rotation out of the AI trade weighing on tech-heavy indices. This time, sentiment was rattled by reports that a key Oracle investor pulled out of a data center project. Although Oracle later disputed the claim, the headline was enough to push already cautious investors further into defensive positioning.

That weakness spilled into crypto, with every sector finishing in the red. One surprising holdout was the meme index, which declined just -1.2% despite typically being one of the most sentiment-sensitive sectors. The index found support from M (MemeCore), which was the only constituent to close green and gained 1.96% on the day.

The hardest-hit sectors were Crypto Miners and AI, both down close to -9%. Miners continue to feel pressure from fears that the AI trade is rolling over, with IREN now down -31% over the past month. In the AI index, TAO was the weakest performer, falling -9% despite its recent halving.

Some hopium for the readers: Despite the negative market sentiment, BTC ETFs have flipped positive once again and notched $346.1 million worth of inflows yesterday. Let’s hope this trend can continue for at least a few consecutive days to end the year off on a slightly positive note.

Market Update

It feels like every other week brings a major development in prediction markets. This week it was Robinhood, which unveiled new prediction-market features at its keynote event. The growing focus makes sense. Prediction markets have become Robinhood’s fastest growing product by revenue, with 11 billion contracts traded by more than 1 million users.

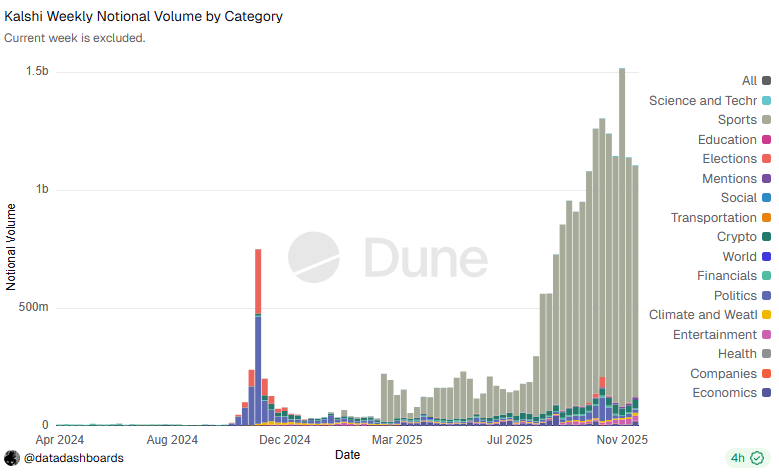

Sports continue to be the clear driver. They now account for about 35% of volumes on Polymarket and close to 90% on Kalshi. If we annualize sports volumes from the past four weeks across both platforms, that comes out to roughly $74.5 billion. For context, FanDuel saw about $50.7 billion wagered in 2024 and DraftKings around $49.4 billion. Prediction markets are no longer a niche product — they are directly competing with established Web2 incumbents.

The final missing piece has been parlays. Parlays make up roughly 30% of sports-betting volumes and nearly 60% of industry revenues. They bundle multiple wagers into a single bet, offering much higher payouts but with far lower odds of winning. This is precisely why they are so lucrative for platforms.

Robinhood is now moving aggressively into this territory. It announced that users will soon be able to trade combinations of outcomes, totals and spreads for individual NFL games. Looking ahead to early 2026, users will be able to create custom combinations of up to 10 outcomes for NFL games. Robinhood will also allow trading on individual player performance. This is a meaningful leap from the basic win/lose markets currently offered and opens the door to far more speculation and volume. Robinhood plans to extend these features beyond football and eventually beyond sports altogether.

The remaining question is how Robinhood chooses to build. Will these products be developed in partnership with Kalshi or brought fully in-house? This question became more relevant after Robinhood’s recent plans to build proprietary prediction market infrastructure through a joint venture with Susquehanna International Group. Coinbase also entered the picture this week by announcing a partnership with Kalshi to roll out prediction markets to its users. The arms race is clearly underway.

Sports markets have found clear product-market fit this year. With distribution at scale and increasingly sophisticated products, Robinhood’s latest moves could give it a meaningful edge. If there were a market today for the prediction market leader by volume in 2026, my bet would be on Robinhood.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.