Rothschild Investment Corp. Has Acquired Another $700,000 in Grayscale’s Bitcoin Fund

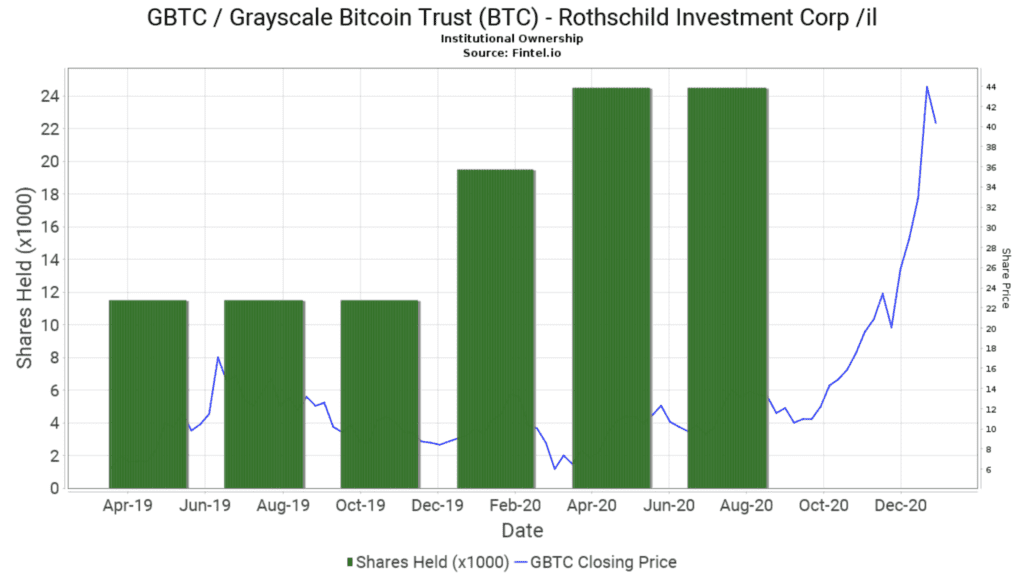

Rothschild Investment Corporation now owns 30,354 shares of Grayscale Bitcoin Trust (GBTC) valued at $975,000 according to a quarterly holdings report it filed with the Securities and Exchange Commission Monday morning. Chicago-based Rothschild first began buying GBTC shares in 2017 and […]

Joey B. Lax-Salinas / JoeyBLS Photography

Rothschild Investment Corporation now owns 30,354 shares of Grayscale Bitcoin Trust (GBTC) valued at $975,000 according to a quarterly holdings report it filed with the Securities and Exchange Commission Monday morning.

Chicago-based Rothschild first began buying GBTC shares in 2017 and previously reported owning 24,500 shares as of July 24, with total holdings valued at $269,000 as of Sept. 30.

Via Joey B. Lax-Salinas

Via Joey B. Lax-Salinas

Rothschild manages $1.4 billion and provides investment advisory services for 1,405 clients.

Interest in bitcoin from institutional investors has grown significantly over the last year; billionaire investors Paul Tudor Jones, Stanley Druckenmiller and Bill Miller have come out as bitcoin bulls; S&P Dow Jones Indices revealed plans to launch cryptocurrency indexing services in 2021 for more than 550 of the top traded coins; insurance giant MassMutual bought $100 million of bitcoin.

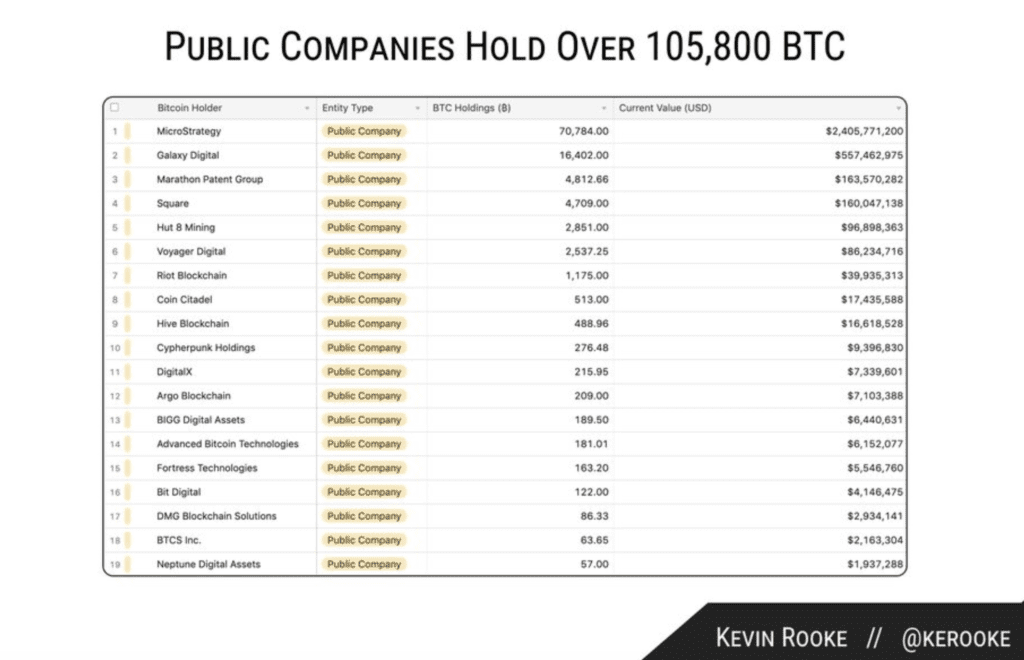

Last year, public companies held fewer than 20,000 BTC on their balance sheets, according to according to digital asset analyst Kevin Rooke. That’s grown to 105,837 BTC this year, valued at over $3.6 billion, held by 19 public companies.

The Grayscale Bitcoin Trust invests solely and passively in bitcoin. It’s currently priced at $34.45 per share with a 261.49 percent return over the last 12 months.