Stocks and Cryptos Uptick as Investors Digest Fed Chair’s Comments: Markets Wrap

Bitcoin and ether traded higher after chairman Powell said that having a Fed-issued digital currency would be more feasible than several cryptocurrencies in a congressional hearing.

BLOCKWORKS EXCLUSIVE ART BY AXEL RANGEL

- Chair Powell said that the Fed will release a new CBDC report in early September

- Venture Capital Firm, Andreessen Horowitz, led a $9 million Series A funding round for crypto wallet, Phantom

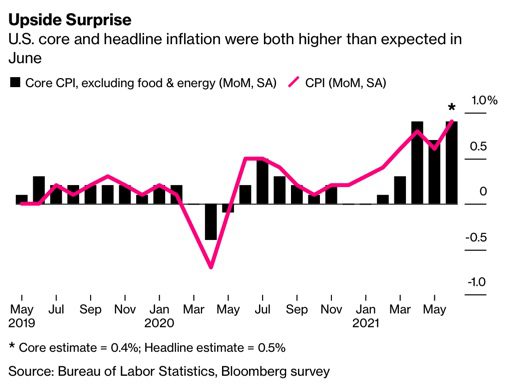

Equities made small gains following remarks from Federal Reserve Chairman Jerome Powell that officials are still a “ways off” from altering monetary policy. Powell stuck to his guns, even after Tuesday’s unusually high consumer price index data, which revealed a 5.4% hike in June, year over year, its highest jump since 2008.

He remained optimistic about economic growth, adding that inflationary pressures stem from the reopening of the economy and should simmer down in the near future.

The S&P 500 touched benchmark highs intraday, but came down some after Powell said the U.S. has yet to achieve “substantial further progress” to scale back bond purchases. Technology stocks led to early wins with Microsoft Corp. and Apple Inc in the index.

Dow Jones Industrial Average and the S&P 500 made gains while the Nasdaq Composite parred small losses by market close.

Equities

- The Dow was up to 34,933, gaining 0.13%

- S&P 500 was little changed, up 0.12% to 4,374

- Nasdaq fell -0.22% to 14,644

Insight

Blockworks Economic Strategist Allison Reichel weighed in prior to Federal Reserve Chair Jerome Powell’s remarks today.

“In line with the last Fed minutes, tapering is expected as soon as Q4 2021, but much of Fed action will depend on what happens this fall, and whether or not labor rebounds and wages can keep up with price growth,” Reichel predicted Tuesday. “Due to ‘substantial further progress’ not being met and inflation still remaining in reasonable range of 2% long term goals with average inflation targeting, it’s likely that Powell will keep an eye on the pace of labor growth and recovery and will be at the ready to use the Fed’s tools if necessary.”

Bitcoin and ether were up after Powell said that having a Fed-issued digital currency would be more feasible than several cryptocurrencies on Wednesday afternoon. During a congressional hearing, Powell argued that stablecoins would need more regulations and added that the House of Representatives Financial Services Committee would issue a report on cryptocurrencies, CBDCs and stablecoins in September.

In more bearish news for the decentralized asset class, BlackRock CEO Larry Fink said that there is “very little” demand for crypto recently, according to an interview with CNBC,

Bitcoin is at a critical point, trading around from $32,000 to $35,000 in the past month, respectively. However, as consumer prices skyrocket, the digital currency will be tested to see if it is a true hedge against inflation, according to Bloomberg. Bitcoin was up roughly 1%.

On Wednesday, Blockchain investment firm QR Capital announced that it will list an ether ETF on Brazil’s stock exchange, Blockworks reported. Ether was up 2% following the news.

Crypto

- Bitcoin is trading around $32,784.33, up 0.83% in 24 hours at 4:00 pm ET

- Ether is trading around $1,987.68, advancing 2.06% in 24 hours at 4:00 pm ET

- ETH:BTC is at 0.001, down -2.28% at 4:00 pm ET

- VIX shed -4.85% to 16.29 at 4:00 pm ET

Insight

“I believe there’s absolutely no validity to the opinion that other cryptocurrencies are irrelevant,” said David Tawil, president of ProChain Capital on Powell’s remarks. “There are so many types of cryptocurrencies that are based on so many different protocols for so many different use cases, so to say that a CBDC coming out of the United States is essentially going to stop all that is ridiculous.”

Commodities

- Brent crude is down to $74.44 a barrel, falling -2.68%

- Gold is up 1.02% to $1,828.50

Fixed Income

- U.S. 30-year treasury yields 1.976% as of 4:00 pm ET

Currencies

- The US dollar fell -0.41%, according to the Bloomberg Dollar Spot Index

In other news…

Andreessen Horowitz led a $9 million Series A round for multi-chain crypto wallet, Phantom, Blockworks reported on Wednesday. Additionally, the venture capital firm, also known as a16z, launched a $2.2 billion cryptofund just last month.

Insight

“We’re entering the next phase of decentralized computing, and Phantom is an important part of that story,” added Garry Tan, a participant in the funding round and an early investor in Coinbase. “Great user experience for interfacing with digital assets and decentralized applications is the missing link.”

We’re watching out for …

- Bank of Korea’s monetary decision will be on Thursday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.