The investor’s guide to the DESK perps trading airdrop

DESK isn’t just another trading platform — it’s redefining what’s possible in on-chain trading

Desk modified by Blockworks

The Web3 industry has witnessed an unprecedented surge in token creation, with over 600,000 new tokens launched in January 2025 alone.

While this explosion of new assets has raised concerns — ranging from liquidity fragmentation to the disruption of a true alt season — some industry veterans see a different narrative unfolding.

Rather than signaling market decline, this flood of new tokens may be acting as a catalyst for a stronger, more selective liquidity cycle. Throughout 2024, the sheer volume of launches made it increasingly difficult for low-quality projects to maintain traction. As traders cycled through countless speculative plays, capital became increasingly scarce toward the end of the year, leaving little room for fresh runners to gain momentum.

Now, in 2025, we’re seeing a shift. Traders and investors are leaving the endless pump.fun casino to allocate capital toward projects with real fundamentals, product-market fit, and long-term sustainability.

One niche within Web3 stands to benefit from this shift more than most: perpetual trading.

As one of the most profitable and sustainable models in DeFi, perp trading is uniquely positioned to thrive in a landscape where liquidity consolidates around high-quality projects. Among the projects capitalizing on this trend, DESK (formerly HMX) is one that every trader should be watching — for more reasons than its leading -1 BPS Maker and 1.75 BPS Taker fees.

With a strategic focus on two of the most dominant narratives in crypto — Base and AI agents — DESK is aligning itself with key growth drivers. As their airdrop campaign continues, traders have a prime opportunity to engage with a platform built for longevity in an increasingly competitive market.

Let’s dive into why investors should get involved and how to get started.

DESK Airdrop: The Next Big Opportunity for Perp Traders

Even in sideways markets, the top four perpetual DEXs generate over $25,000 in daily fees and more than $10,000 in holder revenue — excluding HYPE, which also operates as an L1.

This steady cash flow has positioned perp DEXs as one of the most sustainable and profitable sectors in DeFi. Their ability to capture trading volume and redistribute fees makes them a cornerstone of long-term ecosystem growth.

The HYPE airdrop proved just how lucrative early participation in perp trading ecosystems can be. By allocating 31% of its token supply to its genesis event, HYPE turned early adopters into millionaires, with some traders securing seven- to eight-figure rewards. This approach set a new industry benchmark for airdrop structuring, proving that meaningful early-stage incentives drive adoption and long-term success.

Now, DESK is taking it a step further.

With 38.7% of its total supply committed to early adopters, DESK is raising the bar for community distribution. Paired with the lowest trading fees in the industry during its launch campaign, DESK is positioning itself as the next major player in the perp DEX space.

Campaign Details

The DESK airdrop operates on a points-based system designed to reward traders for their activity on the platform.

Points program start date

February 18, 2025

Points distribution

1,000,000 DESK Points distributed weekly, every Friday

Weekly Activity Cutoff

Tuesdays at 10:00 UTC

How to Earn DESK Points

Traders accumulate DESK Points based on:

- Order type

- Market conditions

- Trading volume

- Open interest

Ways to Increase DESK Points

7-Day Volume-Based Multipliers

Earn up to 2x points based on weekly trading volume. Multipliers update weekly.

Community Collaboration Boosts

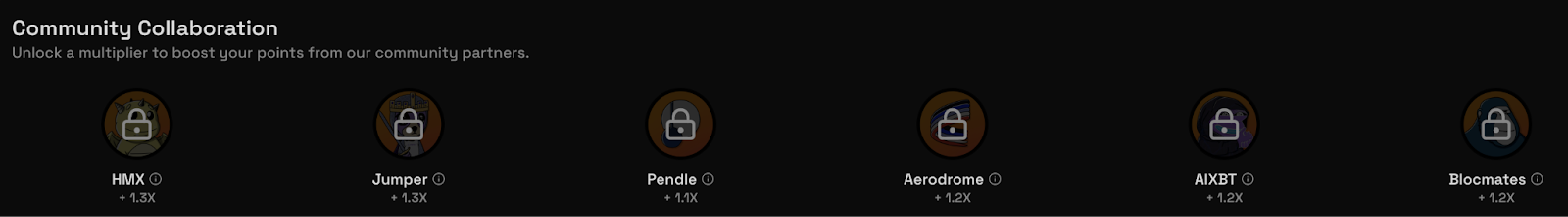

Traders from HMX, Jumper, Pendle, Aerodrome, aixbt, and blocmates receive up to a 1.3x boost on their DESK Points.

Trade on DESK here: https://desk.exchange

Track your DESK Points & progress here: https://desk.exchange/point

Referral Program

DESK makes it easy for traders to maximize their rewards — even without placing a single trade.

- Invite friends to DESK and earn 10% of their DESK Points every week.

- Registers your account for future DESK referral fees, creating a long-term passive income opportunity.

The basics of DESK

What is DESK?

DESK is a next-generation perpetual trading infrastructure designed to empower both human traders and AI agents with cutting-edge tools and seamless automation.

Traders get an unmatched edge with DESK’s ultra-low fees — the cheapest on earth — featuring a Maker fee of -1 BPS and a Taker fee of 1.75 BPS.

And as a top 3 perp DEX on Arbitrum by trading volume and a consistent top 5 performer across all chains in revenue generation, DESK has cemented itself as a major player in on-chain derivatives trading. Yet, despite strong fundamentals, its market cap remains undervalued at just $4.66 million.

With its recent expansion to Base, DESK is on a mission to power the evolution of trading by delivering high-performance, data-driven infrastructure for professional traders and AI-driven strategies.

The New Wave of Trading Infrastructure

DESK merges the proven product-market fit of perpetual DEXs with the intelligence of AI, creating a high-performance, on-chain trading ecosystem optimized for automation and strategy execution. By integrating with Eliza OS and soon expanding to Base’s Agent Kits and other AI frameworks, DESK brings its users to the forefront of AI-powered trading innovations. Upcoming Co-Pilot features will further enhance automated trading strategies.

As demand for AI-driven trading continues to surge, DESK provides the necessary infrastructure for both individual traders and algorithmic agents to optimize strategies, execute high-frequency trades, and automate risk management — all while maintaining self-custody. By bridging these two rapidly growing sectors, DESK is positioning itself as a fundamental pillar of future on-chain value creation.

Core Features and Product Innovations

DESK’s infrastructure rivals centralized exchanges (CEXs) while maintaining DeFi’s transparency and security.

Orderbook Infrastructure

Delivers CEX-grade trading with:

- Near-instant confirmations

- Deep liquidity

- Ultra-low fees

- 10,000 transactions per second (TPS) — ideal for high-frequency trading

Unified Cross Margin

Maximizes capital efficiency, allowing traders to speculate on alts without selling majors or yield-bearing positions.

Flexible Settlement System

Provides more control over trade execution:

- Deferred Loss Settlement – Reduces unnecessary liquidations in bullish markets.

- Withdrawal of Unrealized PnL – Lets traders withdraw unrealized profits (uPnL) without closing positions.

- Sophisticated Liquidation Flow – Prevents major market disruptions.

Yield Generation for Lenders

Users can deposit settlement tokens to earn passive income, with funds covering borrowing fees for traders.

Data Aggregator Infrastructure

Aggregates real-time pricing from top oracles while providing:

- Social sentiment signals

- Whale activity tracking

- Trend indicators for predictive analysis

DESK SDK

A seamless software development kit for rapid HFT integration and unmatched product expansion.

Security and Reliability

Since launching as HMX, DESK has maintained a flawless security record, with zero major incidents leading to fund losses. Over time, DESK has facilitated over $60 billion in total trading volume and generated $21.5 million in trading fees, proving its resilience and ability to capture sustained demand.

With its rebrand to DESK, the team is doubling down on security and reliability, working with Cantina — a top-tier auditor trusted by Coinbase, Uniswap, and Optimism. DESK also maintains 24/7 security monitoring to protect platform integrity and ensure long-term reliability.

As perpetual trading infrastructure evolves, DESK is emerging as a key force in the space, combining security, high-performance execution, and AI-driven automation to define the next era of on-chain trading.

On-chain trading’s future starts with DESK

DESK isn’t just another trading platform — it’s redefining what’s possible in on-chain trading. By merging the speed and efficiency of CEX-grade infrastructure with the flexibility of DeFi, DESK has positioned itself as a leader in intelligent, automated, and capital-efficient trading.

Its high-speed, low-latency execution rivals centralized platforms while maintaining full transparency and self-custody. Seamless AI integration allows traders and AI agents to optimize strategies with precision, while innovative perpetual trading mechanics enhance capital efficiency.

As AI-driven strategies become more dominant in on-chain finance, DESK is building the infrastructure to support this next wave of trading evolution. By aligning with key industry narratives like Base and AI agents, it is tapping into two of the most explosive growth areas in crypto today.

With 38.7% of the total token supply allocated to early adopters, DESK is offering one of the most generous distributions in the space.

Start trading and earning. Visit us at https://desk.exchange/.

This content is sponsored and does not serve as an endorsement by Blockworks. The veracity of this content has not been verified and should not serve as financial advice. We encourage readers to conduct their own research before making financial decisions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.