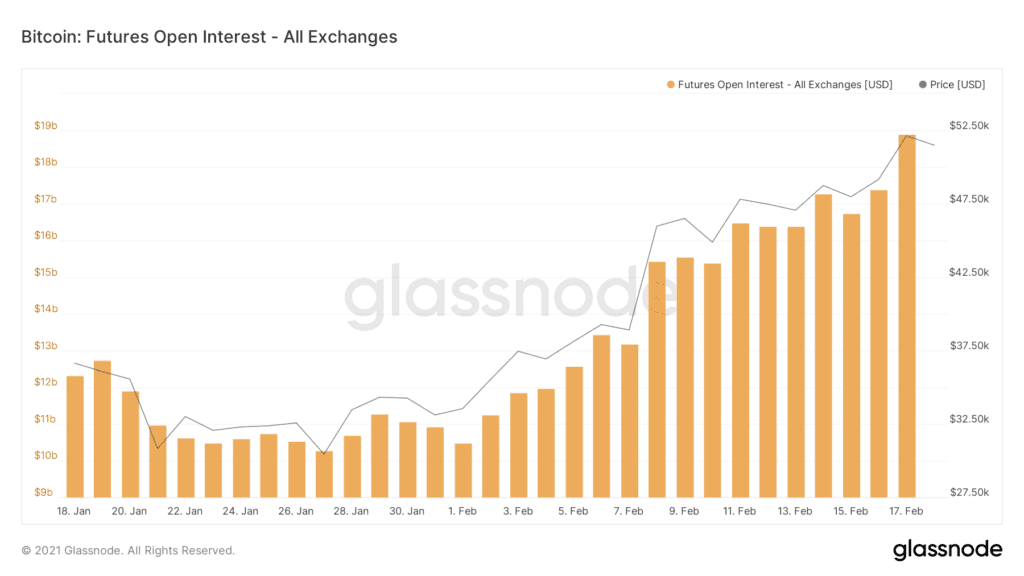

Bitcoin Futures Open Interest Signals Increase in Retail and Institutional Activity

Institutional money will continue entering the futures market as retail investors create more arbitrage opportunities. Earlier this week the price of bitcoin continued climbing to a new all-time high, breaking $52,000 as futures open interest across futures exchanges hit $18.9 billion […]

VIA SHUTTERSTOCK

Institutional money will continue entering the futures market as retail investors create more arbitrage opportunities.

Earlier this week the price of bitcoin continued climbing to a new all-time high, breaking $52,000 as futures open interest across futures exchanges hit $18.9 billion according to data from Glassnode.

The growing open interest shows long leverage is growing on retail exchanges, but the fact that retail leverage is high could set up for a “dangerous” short-term down move, commodities vet Chris Hehmeyer said.

Meanwhile, long open interest on institutional exchanges is going down while short interest [in futures] is gaining, which Hehmeyer said could be because of participants playing the price differential in investment vehicles like Grayscale.

Still, volume is trending up as institutional traders continue hedging using futures, according to Genesis.

“As prices increase, demand for leverage increases, thus widening the futures [curve],” a representative for Genesis said in emailed comment on behalf of the trading desk. “This invites short basis traders to take the opposing view and add to the volume [by selling futures].”

Volatility has been falling as more institutions short futures, but the retail leverage remains the big unknown as funding rates appear stretched.