Institutional Interest in ETH Doubles Down

“Institutional money managers have moved in to start hedging net long portfolios against outsized volatility events,” Two Prime wrote in a recent report.

Source: Shutterstock

- The price of ether has risen 907% in the past year as institutional interest hits overdrive

- Two Prime’s research models an eventual decoupling of bitcoin and ether

Ether (ETH), the eponymous token of the Ethereum blockchain, is “steeply undervalued” compared to bitcoin, and investors have taken note driving up the size of the open interest market for ether, research house Two Prime wrote in a recent report.

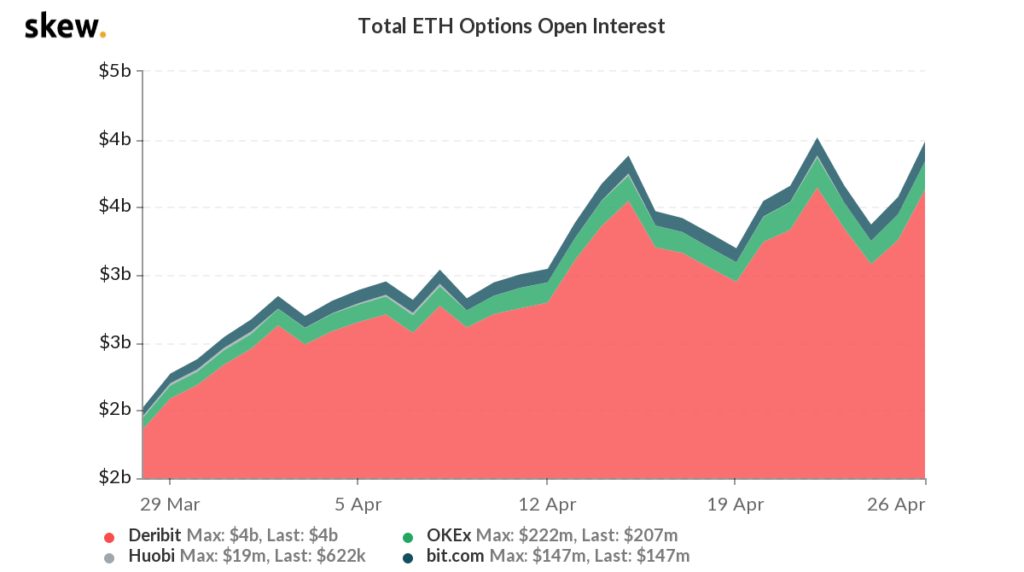

“Institutional money managers have moved in to start hedging net long portfolios against outsized volatility events,” Two Prime wrote. The report noted that the size of the open interest market grew from $365 million in April 2020 to $7.5 billion as of April 2021.

“Ultimately the volatility of these products will be consumed by traditional finance arbitrageurs, derivative traders and automated trading programs,” Two Prime added.

Source: Skew via Two Prime

Source: Skew via Two Prime

“Option markets rely heavily on active institutional investors with a sophisticated approach to risk management,” they wrote. “Options volume and option open interest has subsequently increased to reflect higher institutional adoption of Ethereum.”

The report also noted the rapid exchange outflow of ether beginning in late 2020 due to “large-scale institutional purchases that temporarily overwhelmed coin mining production and strained the ability of trading exchanges to meet demand.”

According to Two Prime, part of this outflow has come from staking demand, the value of staked ether is now over $9 billion. As Blockworks has previously reported the interest in bond-like digital assets that staking provides has fueled demand amongst institutions.

All of this is eventually going to break the correlation between bitcoin and ether, reported Two Prime.

“While ether’s price historically correlates 90% to bitcoin, we expect to see increasing independence in price behavior as the Ethereum ecosystem grows in capability, credibility and volume,” the research house wrote citing the sharp spike in demand for NFTs and DeFi. “In the near term, we expect continued price appreciation as funding continues to support creative growth in decentralized applications and institutional investors purchase additional ether.”

The price of ether is currently $2,700, according to CoinGecko, and is up approximately 15.6% on-week. Bitcoin, in contrast, is down 2% on-week.