Institutions Are ‘Piling In’ on Bitcoin Futures and Mining

New report from Arcane Research points to institutional interest and ‘super profits’ for miners fueling market dominance over altcoins.

Bitcoin ASIC miners

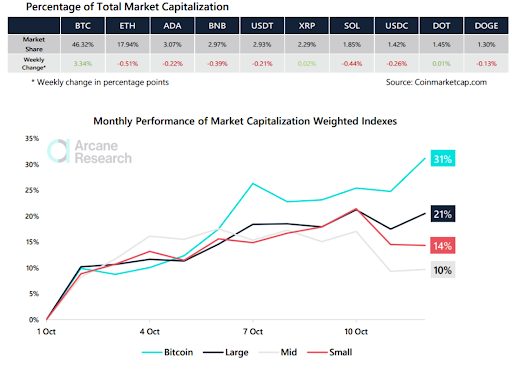

- Bitcoin is up 31% so far in October, blowing past market weighted cap indexes and most other altcoins by a wide margin and pushing bitcoin’s market dominance up to 46%

- Institutional interest in bitcoin continues via CME futures, while bitcoin mining continues to be a profitable investment

The fourth quarter of 2021 is shaping up to be ‘bitcoin season’ as new data from Arcane Research shows market interest — specifically institutional — continues to build around the world’s largest digital asset.

According to data sourced by Arcane Research, bitcoin is up 31% on month during the first two weeks of October blowing past other indexes. Arcane notes that most large-cap coins like Cardano and Binance’s BNB exchange token have been struggling, posting negative returns.

The research firm also noted that bitcoin makes up roughly 40% of the index, and the index’s performance would have been much worse without bitcoin.

“Historically, when bitcoin has started to outperform altcoins, retail traders have not been late dumping their altcoins for bitcoin, creating a feedback loop that drives the bitcoin price even higher,” Arcane wrote in a note. “The altcoin season might be over for this time.”

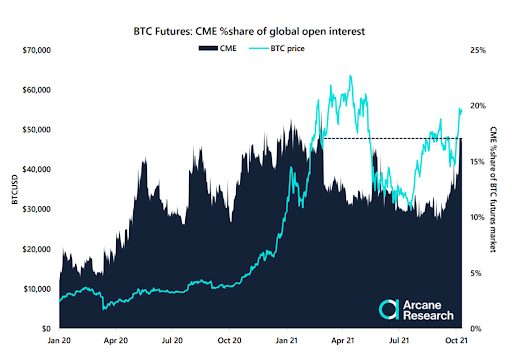

And with this market dominance comes renewed interest by institutional investors in bitcoin. As Blockworks has previously reported, open interest on the institutional-focused CME exchange for bitcoin futures is at a record high.

Arcane notes that open interest on CME has outpaced that of the bitcoin futures market.

“Institutional traders are flocking into the CME futures, betting on the approval of a bitcoin ETF backed by CME futures,” Arcane wrote. “We view this as a healthy signal from the futures market, as rapid growth in [retail driven] Bybit’s OI has previously tended to be a signal of an overextended market, whereas the opposite has been true with growing OI from the CME futures.”

Bitcoin miners hard at work

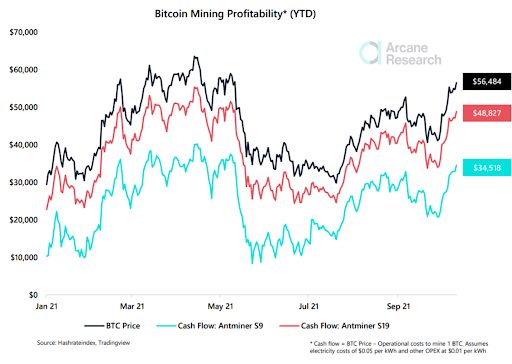

The bitcoin mining industry has had a record quarter thanks to a sense of market certainty with the migration of hashing power from China to the US and the established scale of industry players on the continent.

Compass Point, an equity research firm, has consistently ranked Marathon Digital and Riot Blockchain, two of the larger mining companies in the US, as buys due to their sustained profitability thanks to their scale.

In Arcane’s report, the firm estimates that the Antminer S9, used by both Marathon and Riot, is cash flow positive at $34,518 and the S19 is cash flow positive at $48,827.

“Bitcoin mining has been highly profitable during the whole year. The bitcoin price has increased by 92%, while the hashrate is at the same level as it was last year,” Arcane wrote.

Blockworks has previously reported that declining transaction fees on the digital coin’s network aren’t hindering miners’ expansion into North America.

“Although fees declining isn’t great for miners, I don’t see this as a long-term issue. We are still so early in the digital asset adoption curve that I think this will iron itself out over time,” Brian Dixon, chief operating officer of research firm Off the Chain Capital, told Blockworks in a previous interview. “Most well-known mining operations are very profitable and can sustain themselves during this period of volatility.”

Kevin Zhang, vice president of business development at Foundry, a Digital Currency Group subsidiary focused on financing and credit for miners, said that fee compression wouldn’t be an issue unless the price of bitcoin doesn’t appreciate — but since then the price of bitcoin has risen from around $47,000 to just over $55,000 with momentum building for a sustained rally in the fourth quarter.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.