Crypto Not Spooked By UK Regulatory Crackdown; CBOE SKEW Index at an All-Time High: Markets Wrap

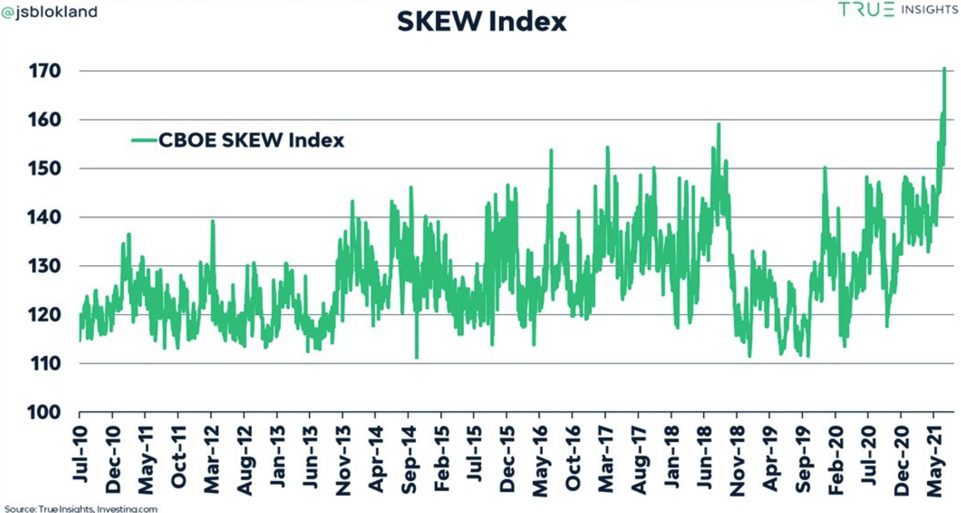

CBOE SKEW Index, rose to 170, benchmarking the highest it’s been in over 30 years. The index’s hike, which measures the perceived risk of the S&P 500 over a month-long period, could point to investors’ anticipation of market volatility.

Blockworks exclusive art by Axel Rangel

- CBOE SKEW Index, rose to 170, benchmarking the highest it’s been in over 30 years.

- Ether jumped 15% and Bitcoin hiked up around 7% on Monday.

Cryptos rise after a volatile month and in the midst of intensified global crackdowns on the digital asset class. Financial Conduct Authority, a regulatory body in the UK, said they would ban all exchanges on Binance Markets Limited in the country on Monday, leaving investors seemingly unfazed by the news. However, Binance said that the FCA ban only targeted a subsidiary and the exchange is still accessible within the country, appearing to have little immediate downsides for the asset class at-large.

Whether correlation or causation, ether jumped 17% and bitcoin hiked up around 7% following the news.

This is one of many clampdowns on the digital currency as China’s central bank just forced the country’s key financial institutions to block all of its transactions this month.

Crypto

- Bitcoin is trading around $34,343.56, hiking up 5.23% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,109.17, up 16.17% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.061, down -1.29% at 4:00 pm ET.

- VIX is up 1.28% to 15.82 at 4:00 pm ET.

Insight

Regarding the UK Binance Markets Limited ban, Elan Nahari, a contributor at Sovryn, the leading protocol for DeFi on Bitcoin, said in an emailed statement, “…It seems that this latest development will not have any direct effect on Binance users in the UK who will still be able to use products provided by Binance in other jurisdictions.” He added, “The limited number of companies that have received registration approval from the FCA suggests that the UK will find it difficult to attract companies on the forefront of financial innovation. ”

CBOE SKEW Index, rose to 170, benchmarking the highest it’s been in over 30 years. The index’s hike, which measures the perceived risk of the S&P 500 returns over a month-long period, could point to investors’ anticipation of volatility.

However, Wall Street indices have recently advanced, whipsawing following the Federal Reserve’s mildly-hawkish announcement of looming interest rate hikes and signals of tapering, to record highs for the S&P 500 and The Dow Jones Industrial Average just last week.

Equities

- The Dow is down -0.44% to 34,283.

- S&P 500 inched up 0.23% to 4,290.

- Nasdaq was little changed but up 0.98% to 14,500.

Graph tweeted by Jeroen Blokland

Graph tweeted by Jeroen Blokland

Insight

“At 170, investors are willing to pay a record-high premium to hedge the downside risk on the S&P 500 Index relative to buying market upside. But what does it mean? Historically, the return on the S&P 500 Index was outright negative three months after the SKEW index reached very high levels. This compares with a positive return during all 3-month periods. Together with the fact that the 200-day moving average, the equity put/call ratio, and the weekly flow are also pointing to exuberance, sentiment is flashing a bit red currently. Equity momentum, however, remains strong, especially relative to other asset classes,” said Jeroen Blokland, founder of True Insights in a tweet on Monday.

Fixed Income

- The US 10-year yields 1.47% as of 4:00 pm ET.

Commodities

- Crude oil had an intraday high of $74.45 per barrel but declined -1.70%.

- Gold is up 0.11% at $1779.70.

Currencies

- The US dollar strengthened 0.05%, according to the Bloomberg Dollar Spot Index.

In other news…

Billionaire Ricardo Salinas Pliego said that his bank, Banco Azteca, is on its way to become the first bank to accept crypto in Mexico, Blockworks reported on Monday. Following the news, Bitcoin hiked 7%.

Insight

“Bitcoin appears on track to becoming a globally accepted decentralized reserve and store-of-value asset that’s easy to transport and transact, has 24/7 price discovery and relative scarcity, and is nobody’s liability or project. Diminishing quantity juxtaposed with the propensity of currencies to debase over time and the substantial amount of money being pumped into the system is a solid foundation for Bitcoin’s price appreciation,” Bloomberg BI analyst, Mike McGlone, said in a published note on Monday.

We’re watching out for …

- US June Jobs Report will be released on Friday.

That’s it for today’s markets wrap. I’ll see you back here tomorrow.