Economy

Bad math makes headlines: real progress, a history of candlelight, and “the worst poverty analysis…ever seen”

US indexes were muted Monday as investors wait to hear from Chair Powell and President Trump

Markets strongly suspect that committee members will make the first interest rate cut of 2025

After a jittery few months, recent economic data is hinting at a resilient economy that is beginning to re-accelerate

The ADP’s print and the Department of Labor’s report show different pictures, and use different metrics

The private sector lost 33,000 jobs in June; analysts had projected payrolls to add 100,000 positions

With the June FOMC meeting coming up, the Fed remains unlikely to cut interest rates. Is this the right move?

Job openings rallied and continuing claims stalled ahead of May’s employment report

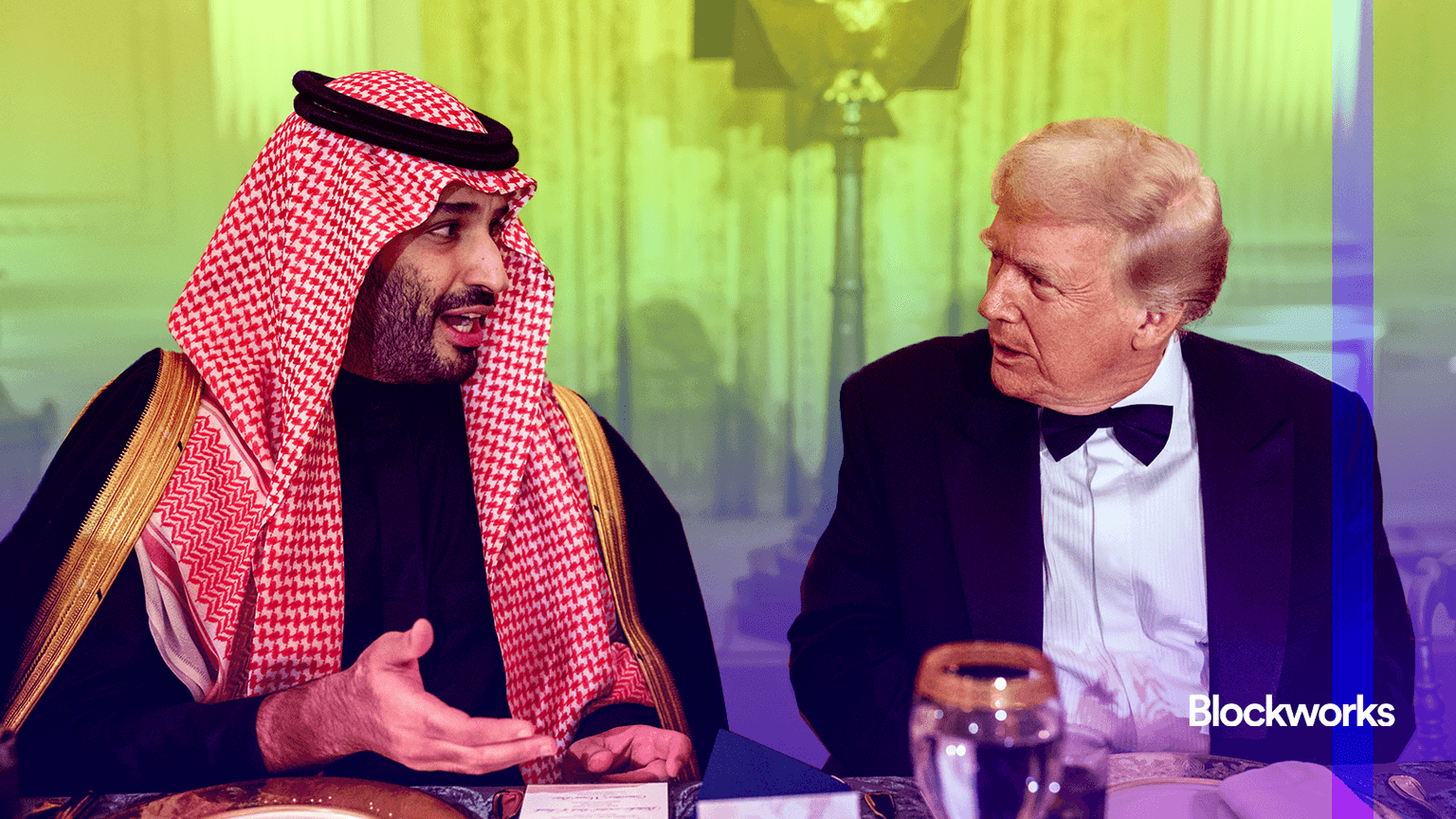

The newly passed House bill amplifies that strategic pivot for the Trump administration, from attempting austerity to running the economy hot

Higher inflation historically lags behind tariff implementation, so don’t celebrate just yet

Craig Fuller, CEO and founder of FreightWaves, breaks down how tariffs are and will impact shipping and inventories

Big Tech pulled US indexes back into the green Thursday, as investors waited for two more Mag 7 first-quarter reports after the bell

Charts and takeaways from Tuesday’s jobs report and Wednesday’s GDP print, as the economy digests the tariff war

Tariff swings impact stock market and company outlooks, with Apple and NVidia likely to be affected by China tariffs

Inflation reached a five-month low in March, but 10% blanket levy may impact prices