Dollar dominance can’t be manufactured

Stablecoins are no substitute for what makes the dollar dominant

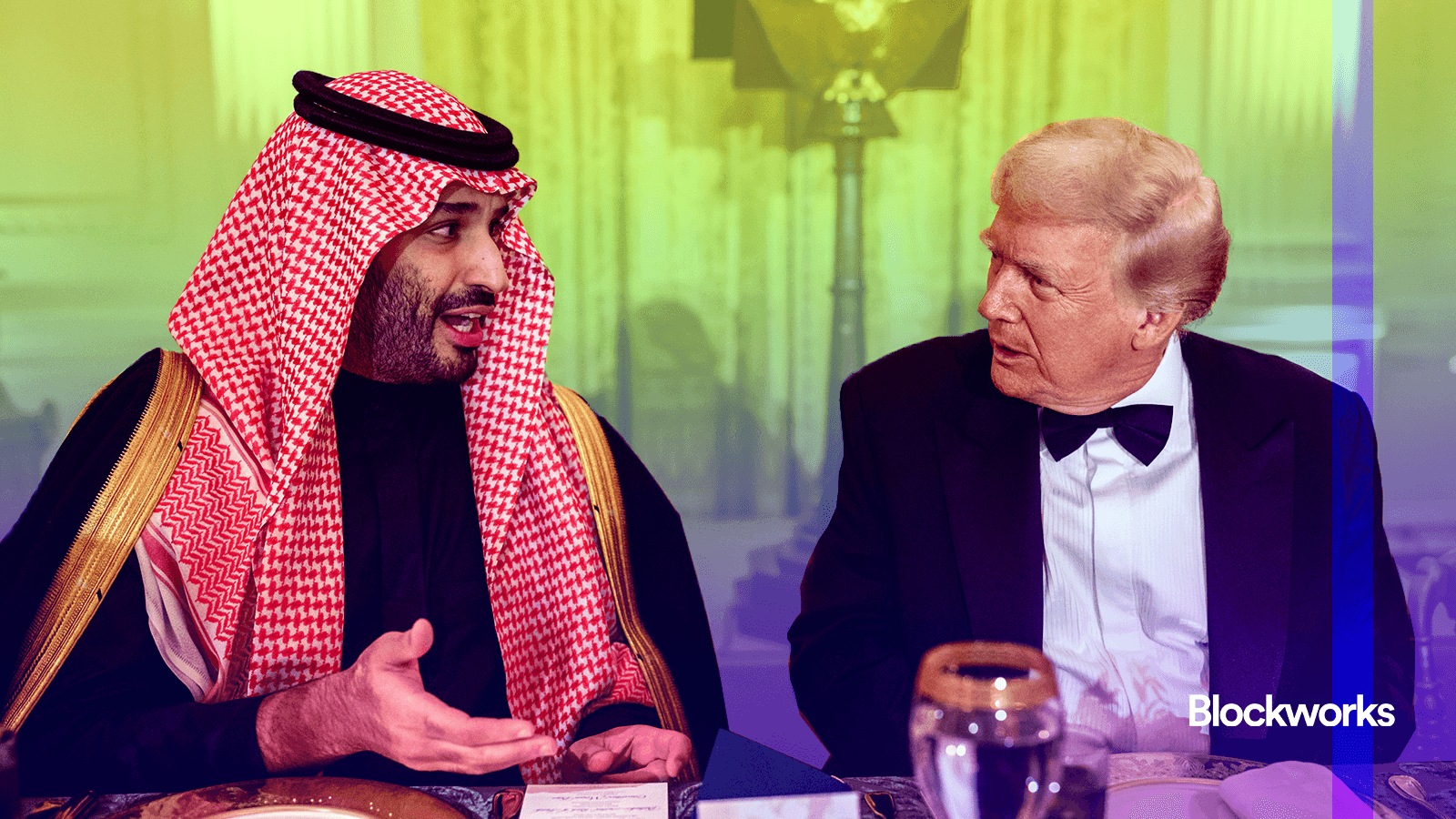

President Donald Trump and Crown Prince Mohammed bin Salman Al Saud of Saudi Arabia | Daniel Torok/The White HouseP20251118DT-3772″ (US government work")

This is a segment from The Breakdown newsletter. To read full editions, subscribe.

“The dollar is always going to be the reserve currency. Anyway, for a long time.”

— Jerome Powell

When the price of oil suddenly quadrupled in 1973, Saudi Arabia was wholly unprepared for the billions of dollars that started flooding in.

Strictly speaking, the money never actually made it “into” the Kingdom: Global buyers of Saudi oil sent their payments to accounts at Citibank and JPMorgan in New York — where the money sat idle because Saudi finance officials barely knew how to move it, let alone invest it.

With billions piling up in non-interest bearing accounts, the Saudi Arabian Monetary Agency (SAMA) reluctantly asked an American banker, David Mulford, to manage it for them.

Mulford and a small team moved to the underdeveloped port town of Jeddah where they scrambled to secure accommodation in houses newly-built in a part of the desert with no roads (to get there, you simply drove over the sand).

The houses lacked telephones, televisions, mail delivery and even trash removal (the bankers left their trash in the sand for Bedouins’ goats to feed on).

The office they commuted to six days a week was even worse.

They were assigned a single room in a “decrepit” building, furnished with only chairs and desks — no computers or telephones.

“Across the hall from our room a simple toilet was set in a long, deep room with an open drain behind it,” Mulford wrote in his autobiography. “This was used by our section of the building and flushed once a day at three in the afternoon.”

Investment deals were negotiated, agreed and processed via the building’s single telex machine (a kind of hybrid typewriter/telegraph) that was constantly in use — a single deal required dozens of telex messages and weeks to complete.

And yet, as Mulford recalls, “we had to invest money at the rate of approximately $500 million per day just to prevent ourselves from falling behind.”

Mulford’s account of his nine years at SAMA debunks the persistent conspiracy theory that the Saudis invested their oil money in US Treasurys as a quid pro quo for a security guarantee.

Instead, the Saudis invested in US Treasurys because they had to: No other market in the world could absorb the $20 billion a month the Saudis had to invest.

And none was so safe and easy to invest in — important factors when investing by telex.

SAMA actually tasked Mulford with moving 30% of their investment funds out of the US market. But he struggled to do it.

“In most markets outside the US in those days, a currency trade of $5-10 million was enough to move markets,” he explains, “so there were practical limitations on the amount of currency diversification that we could achieve.”

This, I think, challenges the idea that dollar dominance can be engineered through either coercion or clever policy: The Saudis chose Treasurys because of what America was, not what it promised or demanded.

Even in the 1970s economy — plagued with both recession and inflation and a president that resigned in disgrace — US financial markets retained the depth (quantities of high-quality assets), liquidity (easy tradability of those assets) and safety (rule of law) that made it the best option for the world’s largest investor.

Today, the US has all the best companies, too: Non-US investors own roughly $19 trillion of US equities (more than double what they own in Treasurys).

It also has a central bank that’s retained its inflation-fighting credentials despite political pressure to finance ever-bigger fiscal deficits.

The current head of that central bank, Jerome Powell, fundamentally attributes the dollar dominance to “democratic institutions” and “the rule of law.”

That institutional foundation is central to its appeal.

“I think the dollar will remain the reserve currency as long as those things are in place,” he added.

There’s no guarantee they forever will be, of course — and many economists doubt they will be for much longer.

Ken Rogoff, for example, warns that the dollar is “fraying at the edges” as foreign investors worry about a “breakdown of our institutions,” unpredictable policy making (that may disadvantage foreign capital), and threats to central bank independence.

All of which is adding up to “a loss of confidence in investing in the United States.”

If so, efforts to manufacture demand for the dollar — through, say, promoting stablecoins — are unlikely to help much.

Stablecoins are in demand precisely because the dollar is in demand — a dynamic that’s unlikely to ever work in reverse.

If the US chooses to surrender the dollar’s structural advantages, no amount of manufactured demand will save it.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.