Jerome Powell

Powell is ending “run-off” to keep reserves “ample” — a far cry from colonial America, where fiscal responsibility was public spectacle

Crypto hedge fund rotates more holdings into smaller cap tokens after Fed Chair Jerome Powell implies possible rate cut

Despite two governor dissents for the first time in 30 years, Powell remained sternly hawkish

As the Trump administration continues to test Fed independence, markets are beginning to react

Fed Chair Jerome Powell told Senators Wednesday that the timeline on lowering interest rates is up in the air

With an updated Summary of Economic Projections, the Fed sees growth slowing and inflation increasing

With Chair Powell’s term set to end in May 2026, there are a few different paths he could take

However, they noted there’s now an increased risk that unemployment and inflation will rise in the coming months.

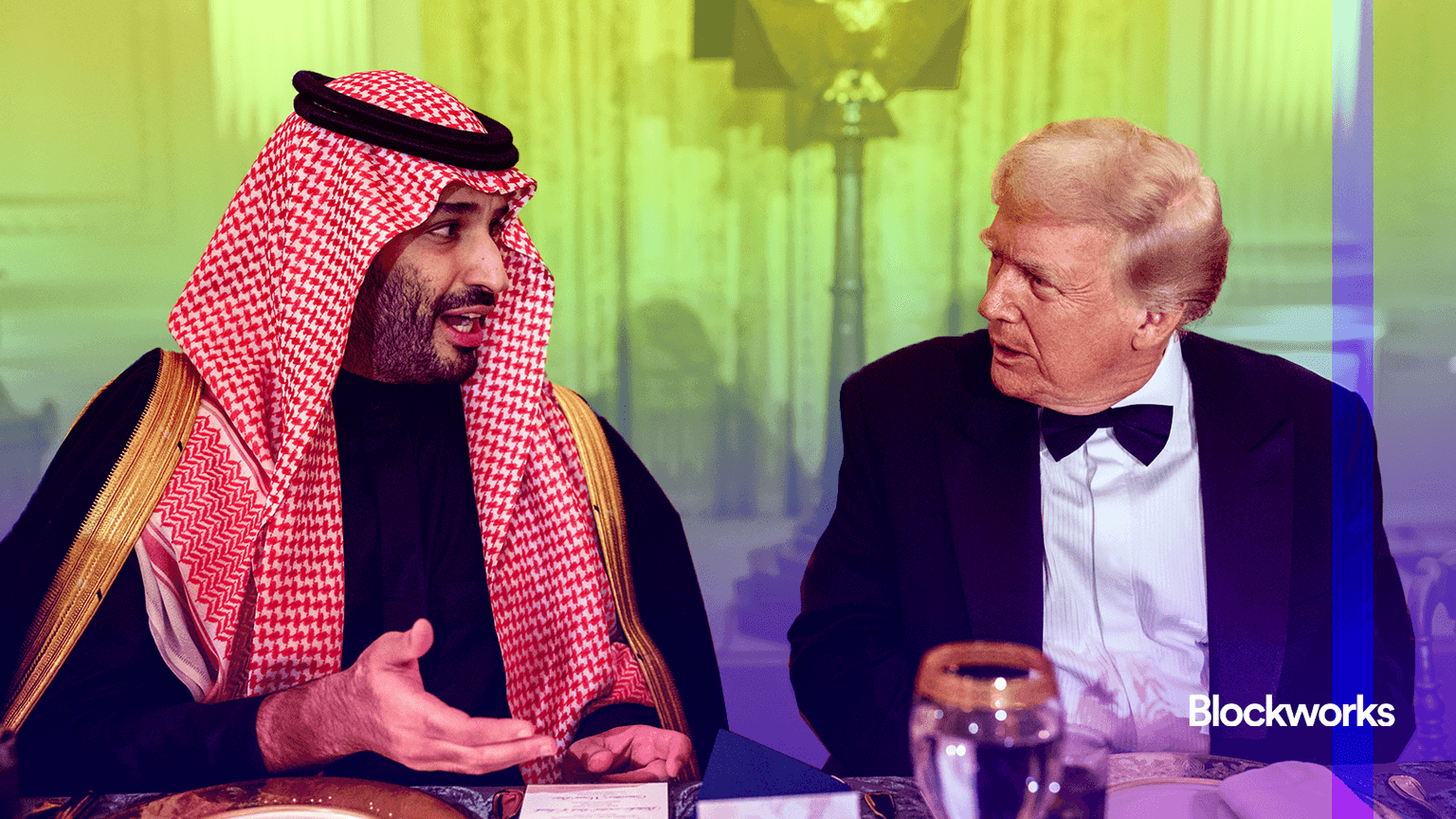

President Trump’s comments that he will not look to fire Fed Chair Jerome Powell sent stocks higher in after-hours trading Tuesday

Markets seem to sense the Fed has another tough decade ahead of it — one spent fighting for a certain cause

Trump is the only sitting president in modern history who has publicly threatened to fire the Fed chair

Fed Governor Waller said tariff inflation could be “temporary,” and Chair Powell said the bank will take a “wait-and-see” approach

Senators yesterday grilled Powell on everything from the dismantling of the CFPB to Trump’s tariff policies

While the figure may show consumer resilience, some argue the boost in spending is just a reflection of higher prices

There are a few possible outcomes now that Trump will be moving back to Washington in January