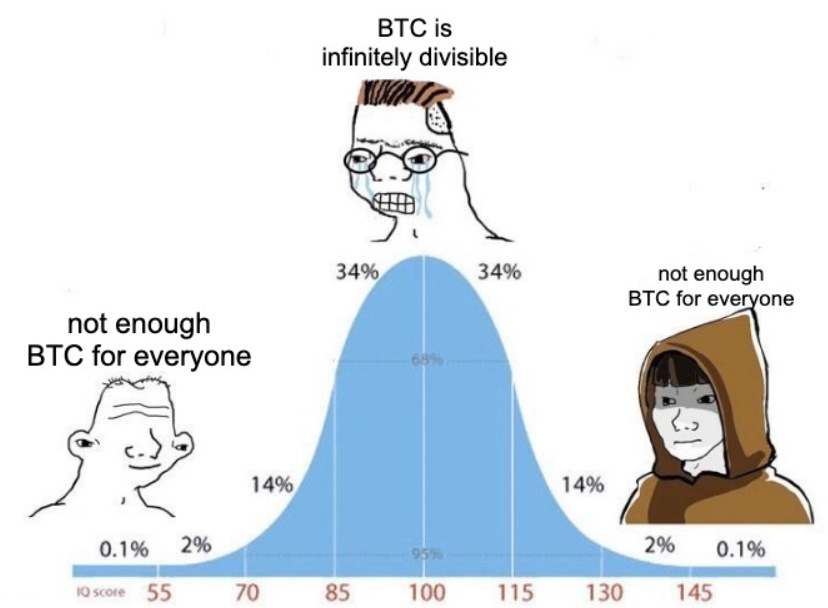

Both ends of the curve agree — there’s not enough bitcoin for everyone

Bitcoin’s recent peak is a victory lap for curvers left and right

Dream01/Shutterstock and Adobe modified by Blockworks

This is a segment from the Supply Shock newsletter. To read full editions, subscribe.

Bitcoin at $120,000 is a win for everyone on the left and right sides of the infamous bell curve meme.

Mid-curving is almost never the optimal strategy. Except for, perhaps, very specific points in a cycle — particularly in deep bear markets, when vibes and narratives are less powerful.

Right now, the extreme ends of the bell curve are both screaming one thing: There’s not enough bitcoin for everyone.

For example, the left-curve take on bitcoin scarcity goes something like this:

Bitcoin is currently only programmed to release 21 million BTC. Most of it has already been mined.

In fact, mining proceeds are now a tiny drop in the bucket compared to the trading activity across Binance and Coinbase, equivalent to less than 1% of their combined daily volume.

Now subtract the coins that are believed to have been lost — up to an estimated 4 million coins, or almost 20% of the entire intended supply.

We’re left with 15.9 million BTC in circulation right now. At the same time, there are more than 58 million USD millionaires around the world. That puts the millionaire-to-bitcoin ratio at 3.6-to-1.

If you think the smart money (millionaires) will increasingly want to buy bitcoin over time — at size — then there’s only one way the price can go. Up. It’s simple supply and demand.

Mid-curvers would point out that bitcoin is divisible by eight decimal places. So while whole bitcoin is scarce, individual satoshis are obviously anything but.

For neatness’ sake, we’ll say the current circulating supply of sats, minus the ones supposedly lost forever, is 1,590,000,000,000,000. That’s one quadrillion, five hundred ninety trillion sats — 190,000x larger than the total human population.

So, an even distribution of the current sat supply to every person on Earth would equate to 190,000 sats.

A common rebuttal to this logic has historically been, fittingly, about pizza. Imagine you have a delicious cheese pizza, and you need to feed a village with it. Except it’s nowhere near big enough.

Does cutting it into infinitely smaller slices help? Of course not, you’re left with the same amount of pizza. 1 pizza = 1 pizza; 1 BTC = 1 BTC.

Clearly, the pizza rebuttal has a flaw: Imagine that each one of those tiny slices can grow into a giant pizza, like adding water to one of those toys that rapidly expand when wet. Suddenly, the whole village can be easily fed, and perhaps even the neighbouring villages, too.

Along the same lines, consensus is forming that bitcoin is destined to reach $1 million per coin. Bloomberg Terminal just began denominating BTC in millions (current price: $0.122 million).

Now let’s take it to the extreme.

If hyperbitcoinization really happens and bitcoin becomes worth, say, $500 million apiece, then each satoshi would be equal to about $5. At that point, perhaps we would be marveling at the price of individual sats instead of whole bitcoins.

And besides, it’s technically possible to add even more decimal points to bitcoin, somewhere down the line, where whole coins are impossibly expensive. Lightning even tracks so-called “millisatoshis,” miniscule units that are 1/1000 of a sat.

But remember, this is no time for mid-curving. If you fancy yourself on the right-hand side of the curve, then the sentiment is exactly the same as the left: there’s not enough BTC for everyone, as proven by its recent repeated all-time highs.

It’s simple supply and demand.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.