Cryptos Stabilize as 10-Year Treasury Note Rises: Markets Wrap

Cryptocurrency markets look past PBoC’s recent announcement on Friday, trading steady with small losses.

shutterstock

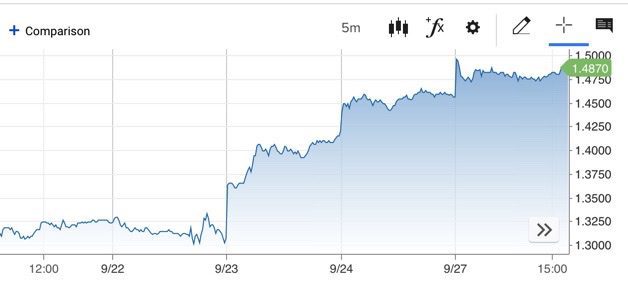

- The 10-year breached 1.5%, its highest level in three months

- Total crypto market cap remains right below $2 trillion, according to Messari

Treasury yields rose on Monday as investors mull over signs of rising inflation. The 10-year breached 1.5%, its highest level in three months. In comparison, the note notched 1.3% in late-August. The hike in Treasury yields has added to worries over equity valuations, particularly in tech sectors, which has most recently propelled the market’s rally.

Overall, major Wall Street gauges were mixed on Monday. The tech-heavy Nasdaq Composite took the biggest hit, shedding 0.5% by market close while the Dow Jones Industrial Average was up 0.5%.

Fixed Income

- US 10-year treasury yields 1.487% as of 4:00 pm ET.

Equities

- The Dow rose 0.23% to 34,876.

- S&P 500 was down -0.28% to 4,442.

- Nasdaq declined -0.51% to 14,971.

10-year Treasury yield over the past five days. Source: CNBC

10-year Treasury yield over the past five days. Source: CNBC

Cryptocurrency markets look past PBoC’s recent announcement on Friday, trading steady with small losses.

After news that China doubled down on its stance toward crypto transactions and Evergrande’s continued financial woes, bitcoin and ethereum both slid over 6% on Friday. Following the weekend, bitcoin climbed back up above $43,000.

Insight

“Bitcoin, ethereum, and the broader crypto markets are bouncing between key levels of support going into the final week of Q3. Despite near-term shakiness, our bullish thesis remains firmly intact that a strong Q4 could be looming on the backs on further institutional and retail inflows,” Cody Ryan, Co-founder of Clearblock Insights, said. “Bitcoin volume held by long-term holders (individual addresses who’ve held for > 5 months) reached an all-time high earlier today of 80% of the total available supply. This shows us long-term convicted holders are accumulating — the same cohort that would historically be selling aggressively into bear markets.”

Crypto

- Bitcoin is trading around $43,140.61, declining -1.19% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,003.5, down -2.79% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.069, declining -1.4% at 4:00 pm ET.

DeFi

- Terra ($LUNA) is trading at $38.71, up 10.2% and trading volume at $1,595,299,172 in 24 hours.

- Uniswap ($UNI) is trading at $22.83, declining -6.2% with a total value locked at $4,258,297,833 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 33.9% at 4:00 pm ET.

Commodities

- Brent crude was up to $79.42 per barrel, rising 1.7%.

- Gold fell -0.04% to $1,751.

Currencies

- The US dollar strengthened 0.08%, according to the Bloomberg Dollar Spot Index.

In other news…

Cardano’s commercial arm, EMURGO, announced the launch of a $100 million investment vehicle which aims to inject funds into projects focusing on decentralized finance, non-fungible tokens and blockchain education, Blockworks reported on Monday.

We are looking out for

- House Financial Services Committee hearing on the Treasury’s pandemic response on Thursday

- University of Michigan consumer sentiment data will be released on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.