Digital Asset Funds See Lowest Weekly Inflows Since January

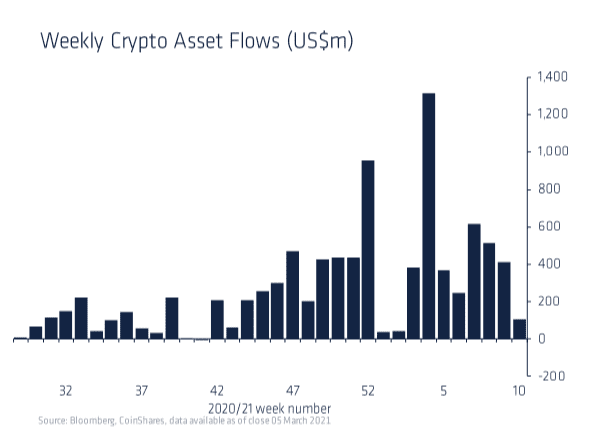

Amid last week’s ongoing price volatility, digital asset investment products saw inflows totaling $108 million, down from $395 million the week prior, according to data compiled by asset manager CoinShares. Despite the relatively slow week, net inflows into digital asset funds […]

Source: Shutterstock

- Despite the low inflow week, this quarter’s digital asset fund flows now match the total for Q4 2020

- Bitcoin remained the most popular digital asset, making up 90% of inflows

Amid last week’s ongoing price volatility, digital asset investment products saw inflows totaling $108 million, down from $395 million the week prior, according to data compiled by asset manager CoinShares.

Source: CoinShares

Source: CoinShares

Despite the relatively slow week, net inflows into digital asset funds this quarter now match the total for Q4 2020, signaling that investor interest remains strong.

Bitcoin remained the leading asset, making up 90% of inflows. Alternative coin ethereum, which has gained momentum in recent months, trailed with $3.7 million inflows, down from $91.2 million the week prior.

Bitcoin has stalled in recent weeks, at one point falling as much as 16% to around $45,000, after hitting a record of more than $58,000 last month. The largest digital asset remains up about 76% year-to-date despite the selloff.

Bitcoin daily trading volumes are up in 2021 to an average of $11.8 billion, compared to $2.2 billion in 2020. Investment products now make up 7% of bitcoin’s daily trading volume, up from 4% in 2020.