Hyperliquid’s USDH battle and the DATCO bid

Our take on durability, valuation, and fundamental catalysts

NatalyFox/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

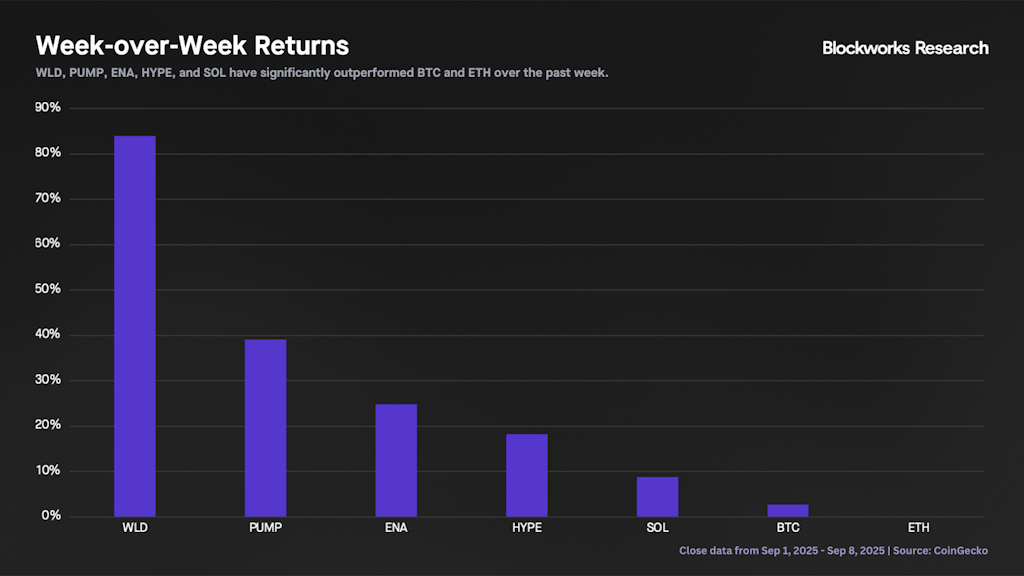

Crypto markets have had a positive start to the week, with clear outperformers but for very different reasons. The chart below shows the week-over-week performance of various assets as of Sept. 8. We observe that WLD (+84%), PUMP (+39%), ENA (+25%), HYPE (+18%), and SOL (+9%) have shown remarkable relative strength against BTC (+3%) and ETH (flat).

Let’s start discussing HYPE and PUMP, whose outperformance has been primarily fundamentals- or value-driven. Regarding Hyperliquid, major stablecoin issuers including Paxos, Frax, Sky and Agora are outbidding each other ahead of a Sept. 14 validator governance vote that will determine who gets to have Hyperliquid’s native “USDH” ticker, with proposals offering aggressive revenue-sharing agreements (up to 100%).

The USDH debate has centered around institution- vs. native-team issuance and ecosystem alignment. For instance, Native Markets, led by Max Fiege, proposed that 50% of the reserve yield be immutably contributed to the Assistance Fund, while the other 50% be dedicated to USDH growth through partnerships with builder-code interfaces, HIP-3 markets and HyperEVM apps. Paxos, on the other hand, proposed allocating 95% of interest from reserves backing USDH to buy back HYPE and redistributing it to applications and validators proportional to their USDH balances across their platforms.

While Native Markets would be GENIUS-compliant via Bridge, Paxos has highlighted its already proven global regulatory coverage and reach (not only GENIUS, but also MiCA and MAS-compliant), with existing payment corridor integrations across the Middle East, Latam, Africa and Asia. While it’s still unclear who will come out on top, it’s evident that Hyperliquid wins regardless. Migrating $5 billion in USDC deposits to USDH could represent an additional $200 million in revenue for Hyperliquid annually, representing ~20% of its ~$1 billion revenue run rate. At the same time, the battle to win the USDH ticker showcases the conviction and value these issuers see in Hyperliquid’s exchange and the HyperEVM ecosystem, with HYPE hitting an all-time high of $52.67 today.

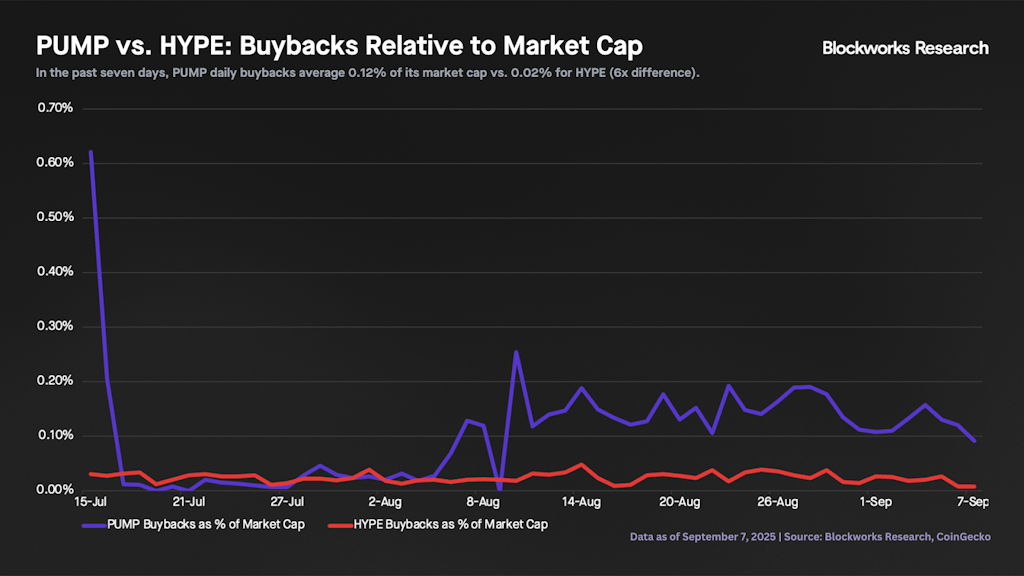

While Hyperliquid has been the center of attention, PUMP has actually been the best-performing asset of the two in the past week, up 39% (vs. 18% for HYPE). Pump has decisively reclaimed its launchpad market share, now above 85%, running at an annualized revenue rate of $540 million and using 100% of its revenues to buy back the token. Moreover, it remains surprisingly attractively priced, with a circulating P/S of three and FDV/Sales of nine.

The other side of HYPE and PUMP’s fundamentals-driven price increases are SOL, ENA, and WLD’s DATCO-driven flows. Yesterday, Forward Industries (NASDAQ: FORD), Galaxy-Multicoin’s SOL DATCO, announced $1.65 billion in cash and stablecoin commitments, confirming Kyle Samani as chairman. With this announcement, the big question regarding whether DATCO purchases would translate to buying SOL with cash on the secondary market vs. simply purchasing locked SOL at a discount has been answered. Combined with Solana ETFs under the ’33 Act likely being approved in October, SOL is poised for outperformance into year-end as the third crypto asset with a structural funnel to TradFi flows after BTC and ETH.

On its part, StablecoinX announced on Friday an additional $530 million capital raise to buy ENA on the open market. The planned deployment schedule for ENA purchases will be dynamic based on price: $5 million per day if ENA is above $0.70, and $10 million per day if ENA is below $0.70 or if it’s down more than 5% in a 24-hour period. Importantly, the Ethena Foundation has the right to veto any sales of ENA by StablecoinX at its sole discretion.

Finally, Eightco Holdings (NASDAQ: OCTO) announced on Monday a $250 million raise to implement the first Worldcoin-focused DATCO strategy, with Dan Ives appointed as chairman. Notably, Tom Lee’s Bitmine (BMNR) had purchased 13.7 million shares of OCTO at $1.46, which rose ~3,000% to $45 on Monday, meaning that the $20 million investment is now worth more than $600 million. On its part, WLD rose as much as 85% on Monday, hitting a high of $1.92.

The contrast between value- vs. momentum-driven price action is interesting to think about, especially in the context of investment horizons and sustainability of flows. The buying pressure from DATCOs has been telegraphed to the market, leading to frontrunning by traders and investors. The main uncertainty for these vehicles is whether they will trade at a premium to NAV, in which case they will be able to sell equity to buy more of the underlying token, à la BMNR. On the other hand, Hyperliquid and Pump’s flows are more reliant on these apps expanding their leading position in each of their respective verticals and increasing their revenue (and thus buybacks) growth rate. That is, of course, not to say assets like SOL and ENA are devoid of fundamentals, since they have clearly found product-market fit and are quality tokens. Still, the majority of their inflows in the past few weeks have come from DATCOs’ expectations as opposed to fundamental catalysts.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.