Palantir Buys $50.7 Million in Gold Bars to Hedge ‘Black Swan Event’

Palantir Technologies Inc. has purchased nearly $51 million in physical gold so far in August and may accept payment in gold in the future, according to a filing from the software company’s second quarter financial results.

Source: Shutterstock

- The gold purchase was made in the form of 100-ounce gold bars

- Palantir, co-founded by CEO Alec Karp and technology mogul Peter Thiel, creates softwares used by the government and corporations

In preparation for a “black swan event,” Palantir Technologies Inc. has purchased nearly $51 million in physical gold so far in August and may accept payment in gold in the future, according to a filing from the software company’s second quarter financial results.

Palantir, co-founded by CEO Alec Karp and technology mogul Peter Thiel, creates softwares used by the government and corporations.

Dan Tapiero, founder and CEO of 10T Holdings weighed in on the news of the purchase on Twitter.

The gold purchase was made in the form of 100-ounce gold bars, which “will initially be kept in a secure third-party facility located in the northeastern United States,” according to the filing.

Palantir Gotham, one of the company’s artificial intelligence platforms, is used by counter-terrorism analysts at offices in the United States Intelligence Community (USIC) and United States Department of Defense, according to Palantir. Gotham compiles and analyzes large amounts of information using AI algorithms to help organizations, including the US military, make data-driven decisions.

“I think it is interesting that a firm that reportedly has close ties to the US Defense and Intelligence establishments is buying gold, especially since it is reportedly being bought to hedge ‘black swan’ events,” said Luke Gromen, founder of Forest For the Trees LLC. “We’ll have to see if there is anything more to it than that.”

Palantir, which made its public market debut in September 2020, reported higher-than-expected revenue for the second quarter of 2021 after closing more than 62 deals, each worth $1 million or more.

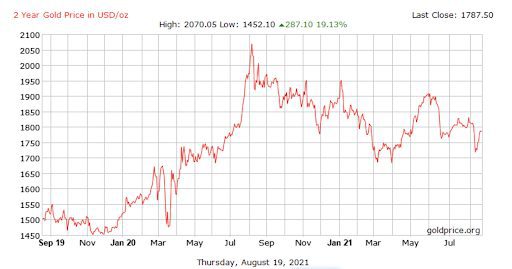

At time of publication, gold was trading down 0.4% at $1,787.50 per ounce.

Source: Goldprice.org

Source: Goldprice.orgWant more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.