Pantera Capital Leads $15M Fundraise in Dex Protocol 0x

Decentralized exchange protocol 0x has raised $15 million in funding led by Pantera Capital. Coinbase Ventures and Blockchain.com Ventures also participated in the Series A round. Clay Robbins, head of growth at 0x, told Blockworks the funding would enable the company […]

- The 0x protocol has enabled over $15 billion in trading volume, providing critical backend infrastructure for many DeFi applications

- DEXs surpassed $63 billion in volume during the month of January, shattering prior records

Decentralized exchange protocol 0x has raised $15 million in funding led by Pantera Capital.

Coinbase Ventures and Blockchain.com Ventures also participated in the Series A round. Clay Robbins, head of growth at 0x, told Blockworks the funding would enable the company to scale its decentralized exchange to a global market.

“Investors are beginning to understand the impact open source financial primitives [the software building blocks of DeFi] can have on the financial market,” he said. “This round led traditional institutional capital is a validation of the change these primitives present for partnership with firms coming over from traditional financial markets.”

The raise comes as VC firms broadly are paying more attention to DeFi companies. Although many DeFi companies don’t have the same capital requirements as other fintech startups, and some structural challenges exist in funding them, the top 34 DeFi companies have raised over $500 million from 100 funds according to published numbers.

According to research from Outlier Ventures, investor interest is shifting away from traditional blockchain projects to DeFi as enterprise adoption of blockchain fails to materialize. In a September report, the company wrote that in the third quarter of 2020 crypto projects raised $759 million from investors with DeFi and fintech taking two-thirds of this pot.

Robbins said the transient nature of capital in the DeFi industry is of a huge benefit to the end-user given the competitive nature of protocols.

0x Protocol effectively operates as a blockchain-based version of Liquidnet, a dark pool aggregator of liquidity that matches buyers and sellers via its engine.

0x makes money from fees on its proprietary trading desk, Periscope Trading, as well as market-making activities through its protocol and interest generated from its ZeroX treasury.

The 0x Protocol has two main products: an API, or application programming interface, which allows developers to integrate cross-platform asset swaps and price hunting; and a consumer platform called Matcha, which aggregates the most competitive prices for retail investors and has seen $2.7 billion in volume during the last six months.

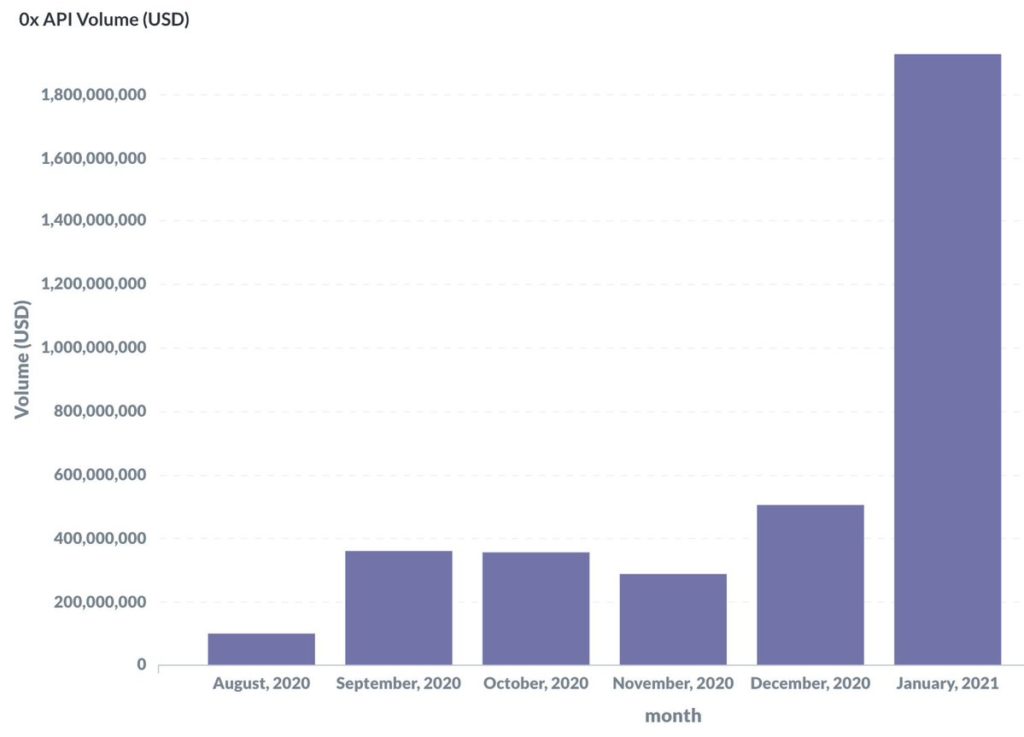

0x Protocol API Volume

0x Protocol API Volume

The API has been integrated into the backend of DeFi applications like MetaMask and ShapeShift, pushing approximately $3.5 billion in volume since its inception.

0x’s token soared more than 100 percent in the last 24 hours before the company announced the fundraise to $1.71.