Stocks Extend Gains Ahead of Fed, Earnings; Bitcoin Rallies: Markets Wrap

US stocks inched higher Monday, led by big tech, extending gains from last week’s highs as investors await the biggest week of earnings season.

Source: Shutterstock

- Bitcoin breaks $40,000 for the first time since sell-off began in April

- Tesla Inc. saw major gains, closing 2.42% higher Monday ahead of its earnings report

US stocks inched higher Monday, led by big tech, extending gains from last week’s highs as investors await the biggest week of earnings season.

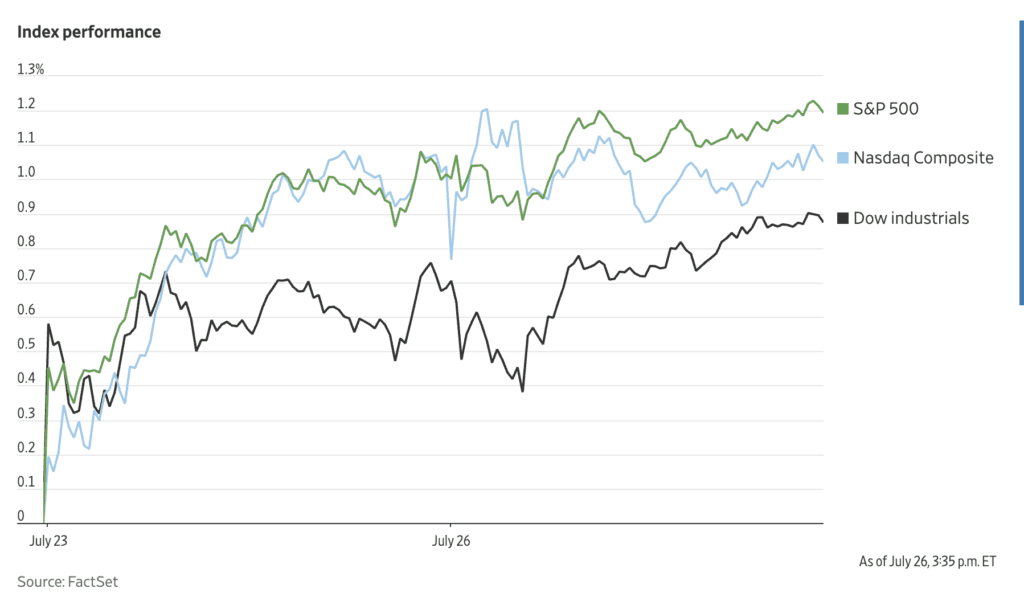

The S&P 500 hit an intraday high Monday afternoon while the Nasdaq lost just 0.07%. The two indexes, along with the Dow, each ended Friday’s session at record highs.

Tesla Inc. saw major gains, closing 2.42% higher Monday. The electric car company is set to release second quarter earnings after the close. Investors also bet on Apple Inc., Amazon.com Inc., Alphabet Inc. and Facebook Inc. ahead of earnings data released later this week.

Bitcoin surpassed $40,000 for the first time since May following unconfirmed rumors that Amazon may soon accept the cryptocurrency as payment and promising comments from Tesla CEO Elon Musk last week. Regulatory discussions will continue this week as the Senate committee on banking, housing and urban affairs begins its “Cryptocurrencies: what are they good for” hearing on Tuesday.

The Federal Reserve Open Markets Committee (FOMC) begins Tuesday. Investors will hear an update on taper-talk status and inflationary control efforts on Wednesday following the meeting’s conclusion.

Equities

- The Dow rose 0.68% to 5,061.

- S&P 500 advanced 1.01% to 4,411.

- Nasdaq was up 1.04% to 14,836.

Rising Delta variant cases pose a threat to the current economic recovery as Covid-19 vaccine rates begin to slow, experts warn. A decision from the Fed about tapering and interest rates will also impact investor decisions in the coming days and months.

Some cryptocurrency-associated stocks rose along with digital assets. MicroStrategy surged 24.46% and Coinbase rallied 9.13% Monday. Square and PayPal remained relatively flat.

Crypto

- Bitcoin is trading around $38,743, up 12.6% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,330, up 7.88% in 24 hours at 4:00 pm ET.

- VIX gained 3.08% to 17.73 at 4:00 pm ET.

DeFi

- Uniswap is trading at $20.13, up 13.41% in 24 hours as of 4:00 pm ET.

- Chainlink is trading at $19.77, up 3.31% in 24 hours as of 4:00 pm ET.

Insight

“With 24 percent of the S&P 500 having reported Q2 thus far, revenues are beating by 4 percentage points and earnings by 19 points. Earnings leverage is why stocks remain strong,” Nicholas Colas, co-founder of DataTrek Research, wrote in a note Monday.

“We cannot recall a time when US equity markets have run so far ahead of Wall Street analysts’ earnings estimates. The reason for this optimism is earnings leverage, with markets anticipating $225/share in S&P earnings power vs. the Street’s $214/share. Q2 results show we can get there, which is the chief reason US large caps remain resilient.”

Commodities

- Brent crude is up 0.74% at $74.66 a barrel.

- Gold fell 0.28% to $1,797.

Fixed Income

- US 10-year treasury yields 1.27% as of 4:00 pm ET.

Currencies

- The Bloomberg Dollar Spot Index lost 0.3%.

In other news…

FTX and Binance are limiting the leverage available to most traders days after Uniswap said it was delisting a number of tokens from its user interface it deemed problematic.

That’s it for today’s markets wrap. We will see you back here tomorrow.