Uranium, booze and blockchain

Whether real estate, diamonds or energy, crypto has an abundance of opportunities ahead of it through RWA tokenization

BONDART PHOTOGRAPHY/Shutterstock modified by Blockworks

There are some pretty weird things being brought on-chain nowadays.

Real-world-asset (RWA) tokenization is one of the hottest topics in crypto as industry participants eye the impending bull run. With how rapidly the RWA market is growing, now is the opportune time for crypto enthusiasts to begin exploring the topic.

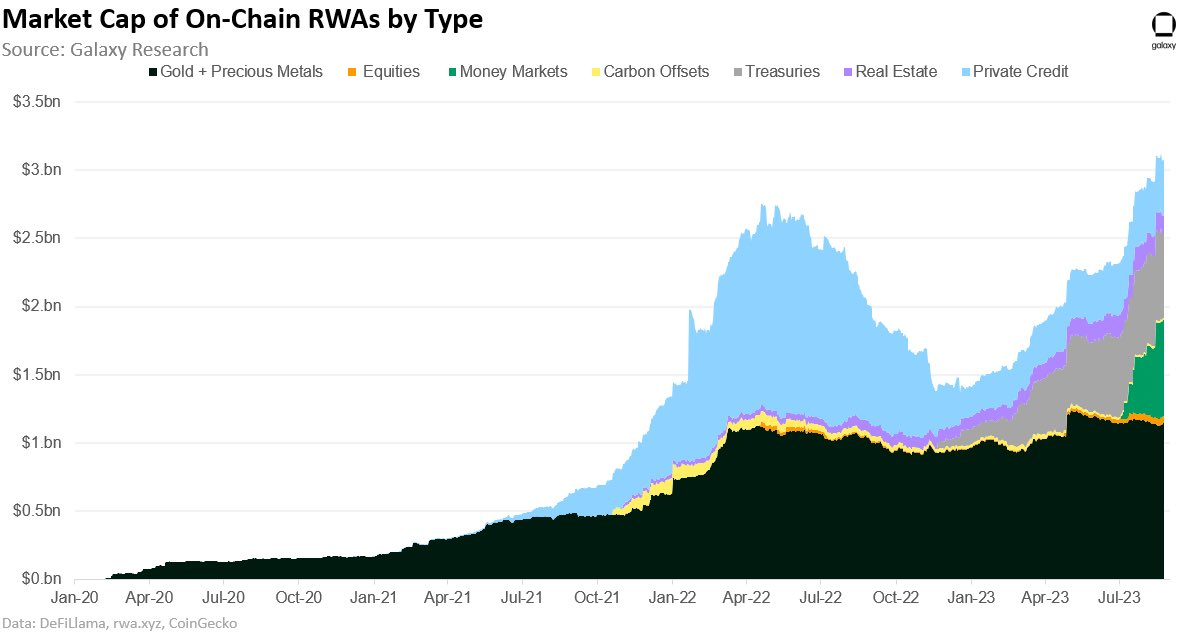

The value of RWAs on-chain crossed $3 billion in August | Source: Galaxy Research

The value of RWAs on-chain crossed $3 billion in August | Source: Galaxy Research

RWA tokenization brings crypto into the real world, drastically expanding crypto utility across various use cases, the most prominent of which are financial assets, including precious metals and real estate.

Outliers are currently being tokenized as well. This article explores some of the strangest.

From NFTs to glasses clinking

Fine wine and spirits producers seek three key insights to connect with customers better: buyer identity, current owner, and consumption history. That’s according to Jamie Ritchie, former worldwide chair of wines and spirits at Sotheby’s, who left the auction house to join BlockBar in the Web3 industry.

Through BlockBar’s blockchain marketplace, fine alcohol producers can now sell directly to clients, eliminating middlemen.

Here’s how it works.

Every bottle is tokenized with an NFT issued to the purchaser. The bottle is stored in a fully insured, temperature-controlled environment until clients decide they want it. When they do, they trade in the NFT and BlockBar transports the bottle.

“The distribution model of wines and spirits, particularly at the higher end, isn’t working well. The bottles aren’t getting to the right people – the people who appreciate them – before they go through too many different steps. It’s better to reduce those steps. Let’s say you’re consuming 10 [bottles a year], and I’m consuming none, but I’m the one buying from the producer – where does the producer want to focus their efforts? If we can give them that information, which blockchain enables, they’re going to be happy.”

— Jamie Ritchie, COO of BlockBar

Tokenization plays a crucial role in ensuring authenticity as well.

Sotheby’s rare bottle auctions require stringent authenticity checks to combat forgers, but the risk of counterfeit or tampered bottles increases the more times bottles change hands. Bottles could also have been kept in suboptimal conditions.

With BlockBar, bottles move directly from the producer to storage, guaranteeing authenticity so long as they remain stored. While stored, owners can sell or gift bottles via the NFT. The NFT’s journey is recorded on the blockchain, offering producers valuable insights into bottle consumption.

Tokenization transforms nuclear and solar energy

Currently, about 440 nuclear reactors supply 10% of global electricity, with 60 more under construction.

While nuclear power is seen as the future of clean energy, uranium trading has traditionally been opaque due to safety concerns and trade restrictions.

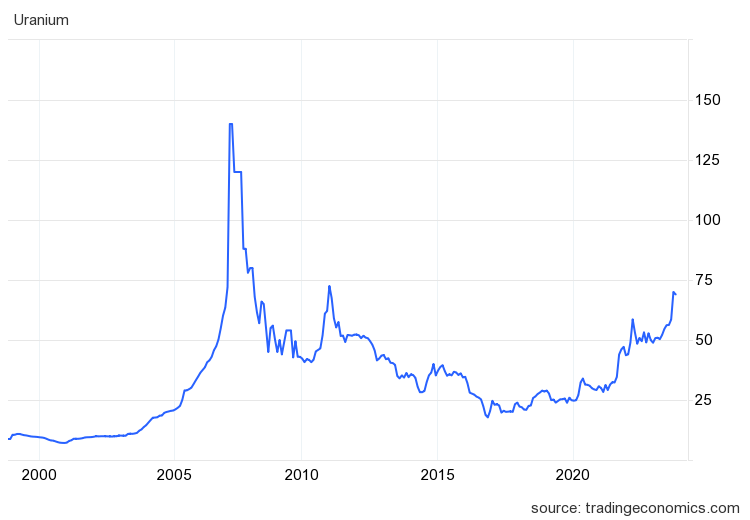

Historical price of uranium | Source: Trading Economics

Historical price of uranium | Source: Trading Economics

Typically, uranium attracts buyers like utility companies, governments, and trading houses, with retail investors being left out of the equation. $U, a uranium-backed fungible token from Uranium3o8, aims to change that.

“Other than buying uranium directly from a miner like Madison on a sales contract basis, the only other way ‘Joe Retail’ could play in uranium as a commodity was through either a participation agreement or through the purchase of futures.” Duane Parnham, CEO of Madison Metals

The initiative is being supported by Madison Metals Inc., a leading mining firm with several decades of experience.

Uranium isn’t the only renewable energy source being tokenized; through the efforts of companies like Aurora Labs, solar energy is also being brought into this new reality.

Instead of tokenizing the energy itself, Aurora’s technology is being used by PowerGold, an Enpower affiliate specializing in green energy investments, to tokenize their energy company. The move offers an investment opportunity (currently in the private sales stage) that was once exclusive to institutions and high-net-worth individuals. This innovative approach aligns people’s actions with their sustainability goals, democratizing access to green energy investments.

Leveraging, Aurora Cloud, PowerGold was able to tackle the regulatory challenges associated with its token sale and successfully achieved its objective of facilitating seamless ENP token transactions within a secure and compliant network. PowerGold is poised to revolutionize the renewable energy investment sector, with a strong emphasis on transparency, compliance, and, most importantly, accessibility—all made possible with the support of Aurora Cloud.

Tokenizing the energy company itself, as exemplified by Aurora and PowerGold, offers a new paradigm in the renewable energy industry. It enables individuals to invest in sustainable energy ventures, contributing to a more environmentally conscious future. This transformative approach, in combination with other efforts and innovations related to Solar tokenization, is set to reduce energy costs, enhance availability, and evolve supply chains to better manage energy surpluses, among other pivotal aspects of the energy landscape.

Breaking boundaries through tangible assets

Crypto’s expansion outside of the typical DeFi utilities that the industry has grown accustomed to marks the start of an impactful new era.

Whether real estate, diamonds, or crazy assets like booze, solar companies and energy, and uranium, crypto has an abundance of opportunities ahead of it through RWA tokenization. It’s a play that brings crypto from URL to IRL, with the power to rapidly accelerate adoption by touching the lives of millions globally.

This content is sponsored by Aurora Labs.

The RWA crypto movement is exactly what Aurora is bringing value to through Aurora Cloud, a fully integrated suite of blockchain products aimed to help businesses leverage the power of blockchain. Over 260 applications are already benefiting from the Aurora network, with use cases in supply chain management, gaming, customer loyalty programs, and much more.

Learn more about Aurora Cloud.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.