Used Cars, PCE Data Hint that Inflation May be Transitory

The used car market can reveal broader inflationary patterns. Prices for used cars and trucks rose nearly 30% between May 2020 and May 2021.

Source: Shutterstock

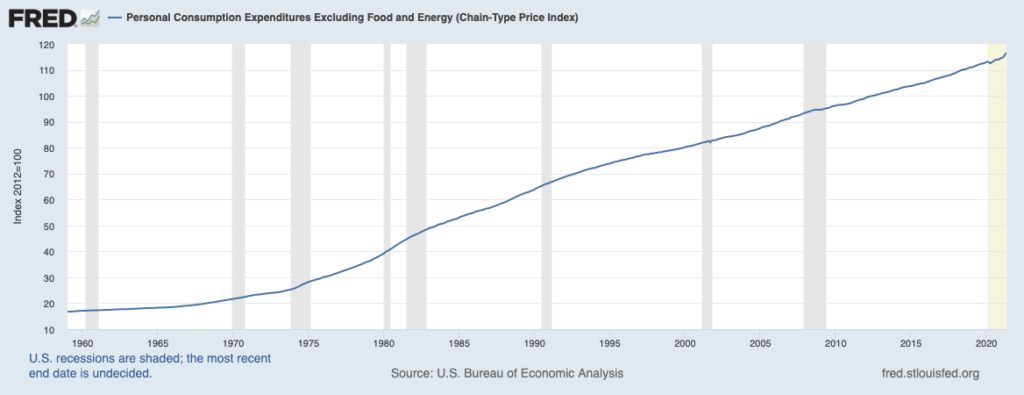

- The latest core PCE reading showed the biggest increase since 1992, but was in line with estimates

- Used car prices, which rose nearly 30% between May 2020 and May 2021, may be topping out

The latest personal consumption expenditures (PCE) data released Friday shows that the Federal Reserve is unlikely to make any major policy changes in the near future.

In the biggest increase since 1992, core PCE rose 3.4% year-over-year, exceeding the 2% flexible target set by the Fed, but in line with economists’ estimates. The core index rose 0.5% from last month in May, lower than the expected 0.6%, according to data from the Commerce Department.

Equity futures rose at the open and government bond yields stayed flat on the news. As Fed officials have continued to downplay inflation concerns, this reading is unlikely to shift current policy significantly.

Used car pricing reveals inflationary patterns

Eyes are also on used cars, a market that can reveal broader inflationary patterns. Prices for used cars and trucks rose nearly 30% between May 2020 and May 2021.

Surging prices in the second-hand vehicle market have helped US inflation soar to the highest levels in more than a decade. Used car prices rose 10% in April and an additional 7.3% in May. In May, used cars made up one-third of the overall rise in consumer prices.

“The latest Manheim Used Vehicle Value Index shows used car/truck inflation is in the process of topping out,” said Nicholas Colas, co-founder of DataTrek Research. “That’s important to broad measures of US inflation; May’s core CPI inflation reading of 3.8% was just 2.7% without used vehicle inflation.”

In June, Manheim’s wholesale index of used-vehicle value was 36% higher than a year earlier. This was down from an annual rate above 50% in April. If used car prices are peaking, it may be a sign that the current spike in inflation will also run its course shortly.

“Used car inflation should be less of an issue in the second half of 2021, lowering the chance of big upside surprises in upcoming CPI reports,” said Colas.

Bank stress test results

Bank shares were also on the rise Friday following the Fed’s statement that the biggest US lenders would be able to easily withstand a severe recession. The 23 financial institutions that participated in the stress test, including Bank of America, Citigroup and Goldman Sachs, “would experience substantial losses under the severely adverse scenario but would remain well above their minimum risk-based requirements and could continue lending to businesses and households,” according to the Fed’s Dodd-Frank Act Stress Test released Thursday.

The pandemic impact

As the Fed continues to watch inflation and employment numbers, the pandemic continues. Even as unemployment numbers remain high, there is a record number of job openings in the US. Officials are urging Americans to continue to exercise caution and get vaccinated as the new Delta variant poses a threat.

“Six hundred thousand-plus Americans have died, and with this Delta variant you know there’s going to be others as well. You know it’s going to happen. We’ve got to get young people vaccinated,” Biden said during a trip to North Carolina Thursday.