Robinhood Sells Your Data, but Does That Matter?

Shooters shoot. Traders trade. And Robinhood sells your data. Word on the street says retail can now move the market. The argument goes like this: Retail traders are bored (quarantine) with money on their hands (stimulus) and more powerful and cheaper […]

Shooters shoot. Traders trade. And Robinhood sells your data.

Word on the street says retail can now move the market.

The argument goes like this: Retail traders are bored (quarantine) with money on their hands (stimulus) and more powerful and cheaper tools than ever before (Robinhood).

A research paper titled A Requiem for the Retail Investor found that “In 1950, retail investors owned over 90% of the stock of U.S. corporations. [As of 2009], retail investors own less than 30% and represent a very small percentage of U.S. trading volume.

In a more recent study run by New York University economist Edward Wolff, Wolff found that “More than 93 percent of the stock is owned by the top 20 percent of households. The bottom 80 percent of households own only about 7 percent.”

This doesn’t necessarily mean that retail is dead though. Spend one day on FinTwit and you’ll quickly see otherwise.

TD Ameritrade disclosed a record 608,000 new funded accounts for Q1, as well as more than 3x the number of users in March 2020 compared to March 2019. Brokerages like Schwab, Fidelity and E*Trade also reported record new users.

Without casinos and sports, gamblers are moving into the stock market. With returns of 7,000% in two weeks, equities like GameStop are providing plenty of reason.

So retail is alive and well, but back to the original question… does it drive the market?

This is where it gets tricky. You see, Robinhood sells the retail order flow to high-frequency traders [HFTs] and big hedge funds like Citadel.

These traders could then use HFT algorithms to front run the trades, which would massively accentuate the retail momentum.

In reality, it’s much more nuanced than this. There is an entire business around selling order book data, but it might not actually be a bad thing for consumers.

Quick Background on Robinhood

Robinhood was founded in April 2013 by Vladimir Tenev and Baiju Bhatt, who had previously built high-frequency trading platforms for financial institutions in New York City.

In December 2013, Robinhood raised a $3M seed round. Now, just seven years after launching, Robinhood has raised $1.2B and has over 10M users.

Roughly 80% of Robinhood’s customers are millennials and the average customer age is just 26, according to the Wall Street Journal. Robinhood’s marketing pitch is that you can trade for free.

So how does this thriving company actually make money?

Payment for Order Flow

Claiming that popular companies make money by selling consumers’ data has been all the rage for several years now.

Remember this phrase?

“If You’re Not Paying for the Product, You are the Product.”

Well, it turns out that still exists.

Twitter users were outraged this past week when they heard that Robinhood makes money by selling users’ trading data to high frequency trading firms.

If you’re a Robinhood user, your blood pressure may have gone up a few notches when you realized that more sophisticated investors than yourself are front running your trades.

Let’s slow down though and zoom out.

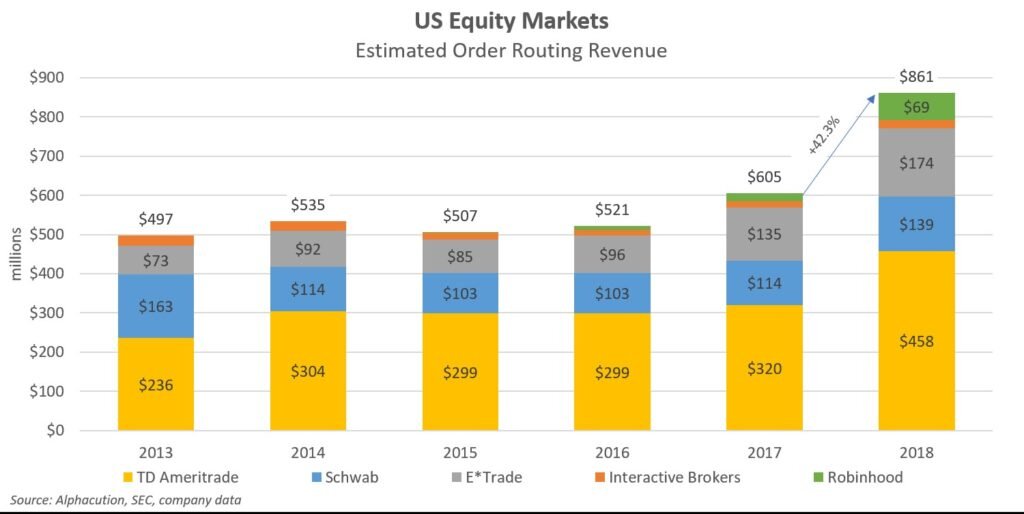

Robinhood does indeed make money, in part, by sending customer orders to high-frequency traders in exchange for cash. But so does everyone else!

This practice is called “payment for order flow”, or PFOF for short. It’s a common practice among brokerages such as TD Ameritrade, Schwab, and E*Trade.

Though Robinhood has faced the most criticism for its PFOF business, which was up 227% in 2018, in reality, nearly every brokerage has been selling their customers’ orders to market makers like Virtu, Two Sigma, and Citadel for years.

Based on historical numbers, Robinhood’s PFOF business probably brings in around $150 million to $250 million annually.

Why Do Market Makers Want Robinhood’s Data?

Market makers make money on the spread between the bid and the ask. They provide liquidity to the market, which means they take the other side of trades.

When a sophisticated institutional investor, such as a large hedge fund, come to a market maker, this can be risky for the market maker.

If the hedge fund is selling a large volume of securities, there’s probably a good reason for it. If the market maker takes the other side of the trade and buys the securities that the hedge fund is selling, there’s a decent chance that the market will keep moving in the hedge fund’s favor. This exposes the market maker to downside risk.

With retail traders though, it’s virtually impossible for this to happen. Retail traders, by virtue of them being retail, don’t trade in large sizes nor do they coordinate with other retail traders. They’re generally less sophisticated than institutional traders so for a market maker, it’s rare that you’ll lose money on making a market for retail traders.

Basically, it’s more profitable and risk free to make markets for retail as compared to institutional.

In fact, Virtu—one of largest market makers—executed nearly 25 percent of retail shares for S&P 500 securities with orders between 100 and 1,999 shares in January, putting its market share behind only Citadel (S&P Global).

So, trading firms are taking retail orders from Robinhood. But they’re not doing anything illegal. They’re simply doing what they’re supposed to do: providing liquidity and making markets.

In fact, the market making firms like Citadel and Virtu are one of the reasons why Robinhood users can place trades for free.

Less than 50% of Robinhood’s Revenue Comes from PFOF

According to a Bloomberg report last year, Robinhood brought in around 40 percent of its revenue in 2018 from selling its customers’ orders to market makers.

So what makes up the 60 percent?

A combination of a subscription service called Robinhood Gold (because when in Silicon Valley, we must have recurring revenues…), net interest from cash deposits, and income from lending stocks purchased on margin.

We don’t need to discuss Robinhood Gold much because it’s simple to understand. For $5/month, you get access to “Morningstar research reports, NASDAQ Level II Market Data, bigger instant deposits, and margin investing.”

Income from lending stocks purchased on margin probably makes up a decent chunk of Robinhood’s revenue, but it’s really the net interest from cash deposits that brings home the bacon for Robinhood

This is a good time to remind you that we don’t have access to any Robinhood data that you don’t have. These are predictions based on public data. Robinhood is notoriously private about their numbers.

Net Interest Margin

Patrick McKenzie has the best description of the net interest margin business:

Suppose I were to give you $100, in return for your promise to give it back when I wanted it and pay me 0.27% annualized interest in the meanwhile.

Suppose you invested this in a virtually riskless bond, perhaps a mortgage-backed security with government backing, offering 2.53% annualized interest. You’d earn $2.26 in net interest in a year.

Suppose I were to give you $200 billion dollars.

Now I’m the American middle class and you’re Charles Schwab.

You would earn something like $5.8 billion dollars in net interest income.

This would entirely pay for your sideline business in running a brokerage. Stocks, bonds, mutual funds, branch offices, call centers, blah blah blah, it all exists to justify the only pricing page that matters, and all the verbiage on the pricing page is about how much you pay the customer.

This is an exaggeration, but not much of one.

57% of Schwab’s revenues are from net interest. The firm could literally give away every other service; discount the mutual fund fees to zero, do away with commissions, etc etc, and they would still be profitable.

Schwab isn’t even the leader among discount brokerages in dependence on net interest.

That would be E*TRADE, at about 67% of revenues. Interactive Brokers makes 49% and TD Ameritrade 51% in the segment.

Did you get that?

No? Okay, let’s let Patrick carry on.

Some people get mad about the financial industry for taking advantage of customers.

I find it hard to get mad about a deal between willing counterparties, but if you think that Wall Street is soaking the US middle class, you should be monomanically focused on the interest spread between cash balances in brokerage accounts and high-interest bank accounts or money market funds.

That is the cost that does not call itself a cost.

Brokerage customers keep ~10% of their assets in cash.

The 200 basis point spread between cash in brokerage accounts and money market funds or insured bank accounts, all of which are functionally riskless, is equivalent to a 20 bps asset management fee across the portfolio.

Vanguard’s flagship funds charge about 10 bps for wrapping the entire stock market, SPY (an ETF, which structurally has lower costs) does it for 4 bps, and people think the roboadvisors might be expensive doing similar for 25 bps on top of the underlying investments… and the discount brokerages charge effectively 20 bps over all your assets just for managing the tiny portion that is in cash, the easiest asset to manage.

But instead people get mad about payment for order flow, because nobody writes books about Interest Rate Spreads Are Just Too Darn High.

To summarize, brokerages like Schwab, TD Ameritrade, and E*Trade make 50-70% of their revenue from their net interest margin.

This is the spread between what the brokerage pays their customers on their cash versus what the brokerage can earn on its investments in 2-year U.S. Treasuries.

Net interest margin is how Robinhood makes money.

Conclusion

The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer.

Today, it’s never looked more like that is actually the case.

At its core, Robinhood is just a computer program that moves money around. It puts a sleek user interface over an API to the financial markets, allowing retail investors to buy $100 worth of Apple.

But as soon as Robinhood caved to Citadel and prohibited their users from selling stocks like GameStop or AMC, they became a part of the problem. You could even argue that they violated their fiduciary duty.