A 13-year-old From India Raised $300K for His Latest DeFi Project

Gajesh Naik, from Goa, has launched a DeFi project on the Avalanche smart contracts blockchain.

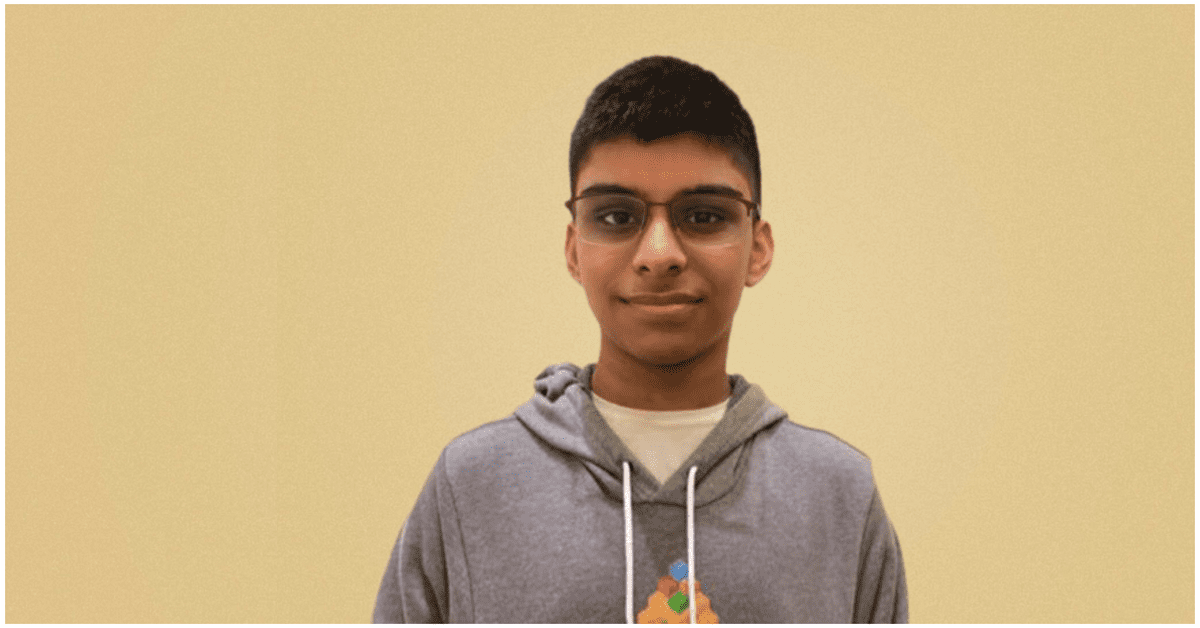

13-year-old Gajesh Naik

- Naik said that he believes smart contracts will open doors for many other pre-teens like him and there will be no restrictions for creativity to blossom no matter what the age

- He made headlines earlier this year after it was shared that his first DeFi project, Gaj Finance, managed around $1 million in cryptocurrency

Meet the 13-year-old crypto-focused Gajesh Naik. He’s a DeFi founder from Goa, India, and recently raised $300,000 in pre-seed funding for his most recent DeFi protocol project, called Taksh.

Taksh is a DeFi protocol launched in 2021 on the Ethereum-compatible smart contracts platform Avalanche. It aims to provide users a reward system to help them maximize their yields and savings through compounding rewards and yield farming, Naik said.

“My goal with funding is to get investors who can advise me on how I should grow the project and also kick-start hiring and other marketing activities,” Naik told Blockworks.

The round was backed by Frontier founder Ravindra Kumar and several undisclosed investors. The capital raised will go toward further developing the project and audits, Naik told Blockworks in an interview.

“I can’t use centralized exchanges and because of my age I am unable to sign contracts, therefore smart contracts have enabled me to raise funding, despite my age.”

Blockchain smart contracts allow investors to provide capital, automate and execute agreements without intermediaries.

Naik said that he believes smart contracts will open doors for many other pre-teens like him and there will be no restrictions for creativity to blossom no matter what the age. “In the past, I have faced my share of trolling and disbelief. However, a large community has been very supportive and kind,” he added.

“I want to keep on building”

Naik made headlines earlier this year after it was shared that his first DeFi project, Gaj Finance, managed around $1 million in cryptocurrency.

The now 13-year-old developer started coding at seven, but recently became interested in crypto when he attended a blockchain workshop a year ago, he said.

He started off learning Solidity, the object-oriented coding language for Ethereum-based smart contracts, and dove into the deep waters of Web3 afterward. “To gain more experience and exposure, I did some freelancing before launching my first project Gaj Finance, formerly PolyGaj, in April 2021,” Naik said. “During that time I also relaunched my YouTube channel where I helped people to learn about crypto, blockchain, and coding,” he added.

Following this pre-seed round, Naik plans on raising a seed round and launching a public sale through an initial dex offering.

“I want to keep on building. I want to learn as much as I can. My dream is to build innovative DeFi and NFT products,” the 13-year-old said.

Going forward, aside from building, Naik wants to have fun, but he also wants to learn from the leaders in the crypto space and work with them.