Bitcoin, Cardano Break Fresh Highs: Market Wrap

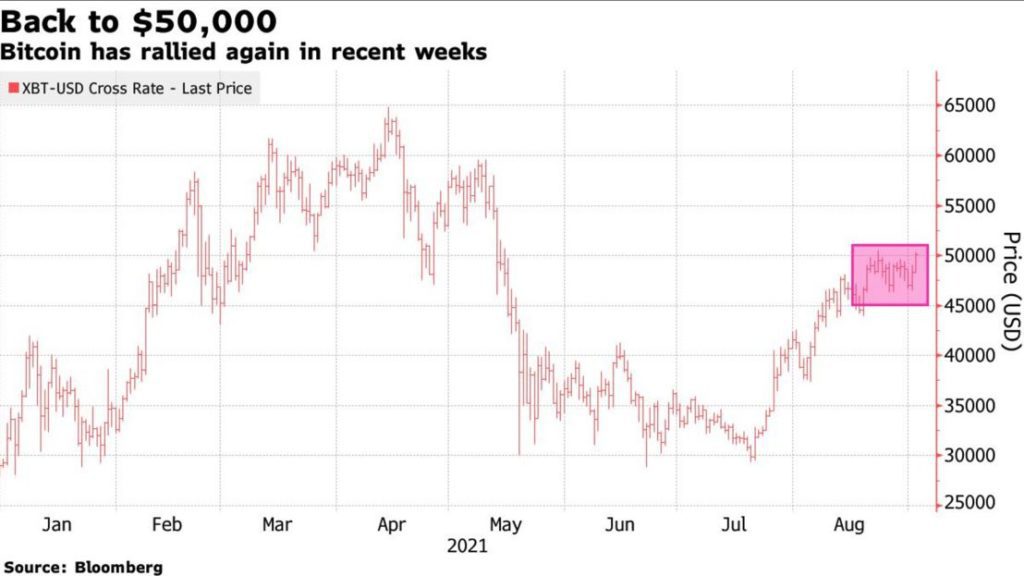

In a broad cryptocurrency rally, Bitcoin traded above $50,000 again on Thursday.

Credit: Shutterstock

- Cardano hit an ATH, following the blockchain platform’s testnet on Thursday, trading above $3

- The crypto market cap passed $2.3 trillion in market value Thursday morning

In a broad cryptocurrency rally, bitcoin traded above $50,000 on Thursday, with a day-high of $50,429.44 in the morning. Jumping 29.69% in a month, bitcoin has made multi-week gains after a string of news signaling widespread adoption. The crypto market cap rose over 5% in the last day, surpassing $2.3 trillion in market value in the morning.

According to a survey from Bakkt, 48% of US consumers reported investing in crypto during the first half of the year. For those who don’t invest, 32% of respondents were interested in buying crypto within the next six months.

Cardano has risen to record-breaking levels in recent weeks. Prior to the Alonzo hard fork, the token’s forthcoming upgrade, ADA has soared 116.4% in the past month, according to Messari. Cardano hit an ATH, following the blockchain platform’s testnet on Thursday, trading above $3. Investors may be bullish on the altcoin given the upcoming upgrade, which will in theory improve Cardano, allowing more people access to deploy smart contracts on its blockchain. Cardano is nearing a $100 billion in market value.

DeFi

- Uniswap (UNI) is trading at $30 with a total value locked of $5,208,522,453 declining -1.9% in 24 hours at 4:00 pm ET.

- Chainlink (LINK) is trading at $30.24, up 3.1% with trading volume at $1,542,878,353 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 30.4% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $49,578.19, up 2.68% in 24 hours at 4:00 pm ET.

- Ether is trading around $3,799.66, advancing 1.82% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.075, down -0.7% at 4:00 pm ET.

Insight

“If Bitcoin can maintain a level over $50,000 then it will be a significant step towards bitcoin prices reaching $85,000 or $100,000 in Q3 and Q4. Although, its previous ATH of $64,000 could also act as a resistance point,” Ulrik K.Lykke, Executive Director at ARK36, said. “The first reason to expect higher BTC prices is that the current price trend is driven mostly by spot purchases. When Bitcoin was last at $50,000 levels last time, much of the market activity was leverage trades which made for a much less resilient market structure.”

Equities

- The Dow advanced 0.37% to 35,433.

- S&P 500 is up 0.28% to 4,536.

- Nasdaq advanced 0.14% to 15,331.

- VIX rose 1.99% to 16.41 at 4:00 pm ET.

Commodities

- Brent crude was up to $72.76 per barrel, advancing 1.63%.

- Gold was down -0.2% to $1,812.3.

Currencies

- The US dollar fell -0.24%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.287% as of 4:00 pm ET.

In other news…

Franklin Templeton, a $1.5 trillion investment manager, is seeking to add a cryptocurrency research analyst and trader to its firm, Blockworks reported. However, the fund group has yet to confirm whether it plans to offer bitcoin-based investment vehicles to clients.

We are looking out for

- US jobs report is due on Friday

That’s it for today’s markets wrap. I’ll see you back here tomorrow.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.