Bitcoin Miner Iris Energy Says Bad Debt Contained in ‘Rotten Arms’

Embattled Iris Energy appears confident that its $103 million debt has been contained within special purpose vehicles

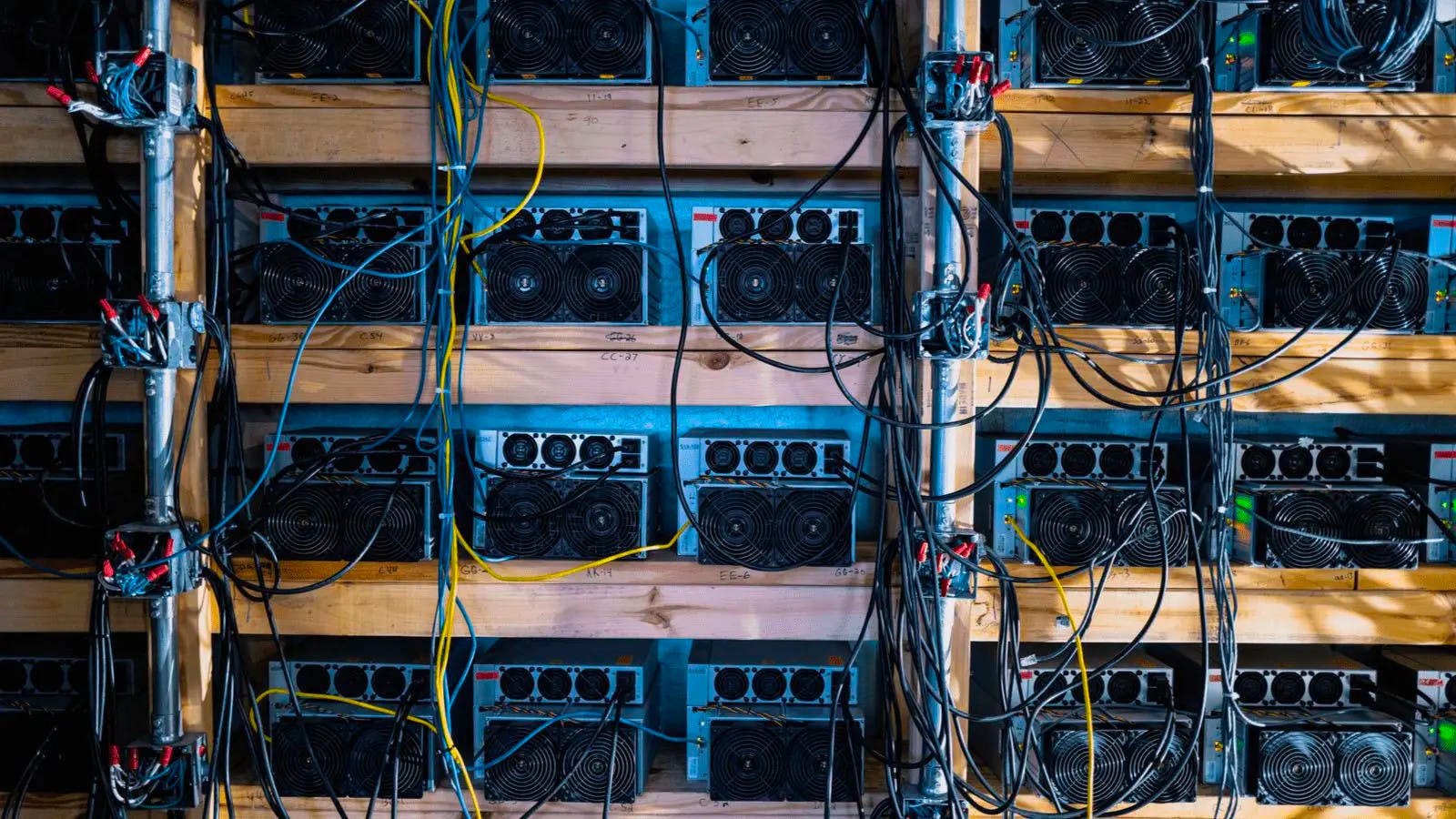

Source: Shutterstock

Bitcoin miner Iris Energy remains defiant despite facing debt default on $103 million in loans next week.

In a recent SEC filing, the Australia-based firm said that while it can generate $2 million in monthly gross profit by mining bitcoin, monthly principal and interest repayments on its debt stands at $7 million, representing a $5 million monthly shortfall.

Iris Energy stock trades on the Nasdaq and fell 15% following the disclosure, now down more than 80% year to date.

Macroeconomic factors, rising inflation and a sharp hike in electricity prices are severely impacting miners’ ability to turn a profit globally. Miners now find themselves in a very different market compared to a year ago, when many across the industry took out high-interest loans to fund rapid expansion.

Loans were commonly financed against bitcoin mining machines, as is the case with Iris Energy. But now that prices are down and bitcoin mining difficulty is high, multiple major operations have found themselves underwater, weighed by unmanageable debt obligations.

Core Scientific, one of the largest bitcoin mining operations in the world, revealed last month it was considering restructuring its capital or seeking relief through bankruptcy, collapsing its stock price by more than 80%.

Argo Blockchain, another major miner, has also been feeling the pinch after an unnamed investor withdrew a $27 million capital injection at the eleventh hour. The firm faces potential closure if it can’t find fresh funding.

Concerns are swirling that Iris Energy could suffer the same fate. But Bom Shin, vice president of corporate finance at Iris Energy, told Blockworks the company’s bad debt is structured within a number of special-purpose vehicles (SPVs).

Iris Energy’s SPVs maintain a market value of approximately $65 million to $70 million, about 35% less than its principal loans outstanding as of September’s end.

According to Shin, the debt is “very much contained” and shouldn’t immediately lead to bankruptcy. Shin said that while an “uneconomical market” was not generating enough cash flow, Iris was engaged in ongoing discussions with its lender to shore up the situation. The executive declined to comment on the identity of the lender.

Should an agreement with its financial lender stall, Iris said in its update that neither of its SPVs would be able to make scheduled principal payments on its debt ahead of next Monday.

The firm did say it is holding ongoing discussions with its mining equipment vendor Bitmain in a bid to unlock prepayments — the partial or full settlement of debt ahead of an official due date.

Iris Energy still hopes to expand and diversify revenue

Iris Energy immediately offloads its mined bitcoin at market rate, which means it has averaged its way down from BTC’s highs last year. This contrasts strategies employed by some competitors, which only sell their bitcoin when times get tough — or not at all.

Bitcoin’s price has shrunk 68% from highs seen 12 months ago when it was hovering just above $64,000. Bitcoin was trading at $20,350 as of Thursday morning.

While registered in Sydney, Australia, Iris said three of its operations are based in Canada, including a flagship data center operation in British Columbia. All operations are entirely powered by hydroelectricity at a set price of four cents per kilowatt-hour, providing 12-month visibility of fixed costs.

Further expansion plans are anticipated in Childress County, Texas, which would happen “very carefully,” signaling the firm’s intentions to move forward with its operations, Blockworks was told.

Iris floated plans to establish hosting services that would allow clients to mine crypto for a fee without needing to build or invest in the infrastructure themselves, which it considers a significant growth opportunity.

Remaining upbeat, Shin likened Iris’ current situation to that of a healthy body with a rotten arm.

“Chop off the arm and the body survives,” he said in relation to the firm’s SPVs.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.