Gemini To Expand Institutional Reach via Partnership With Betterment

Crypto exchange and custody firm to serve as the digital investment adviser’s custodian for new portfolio offering

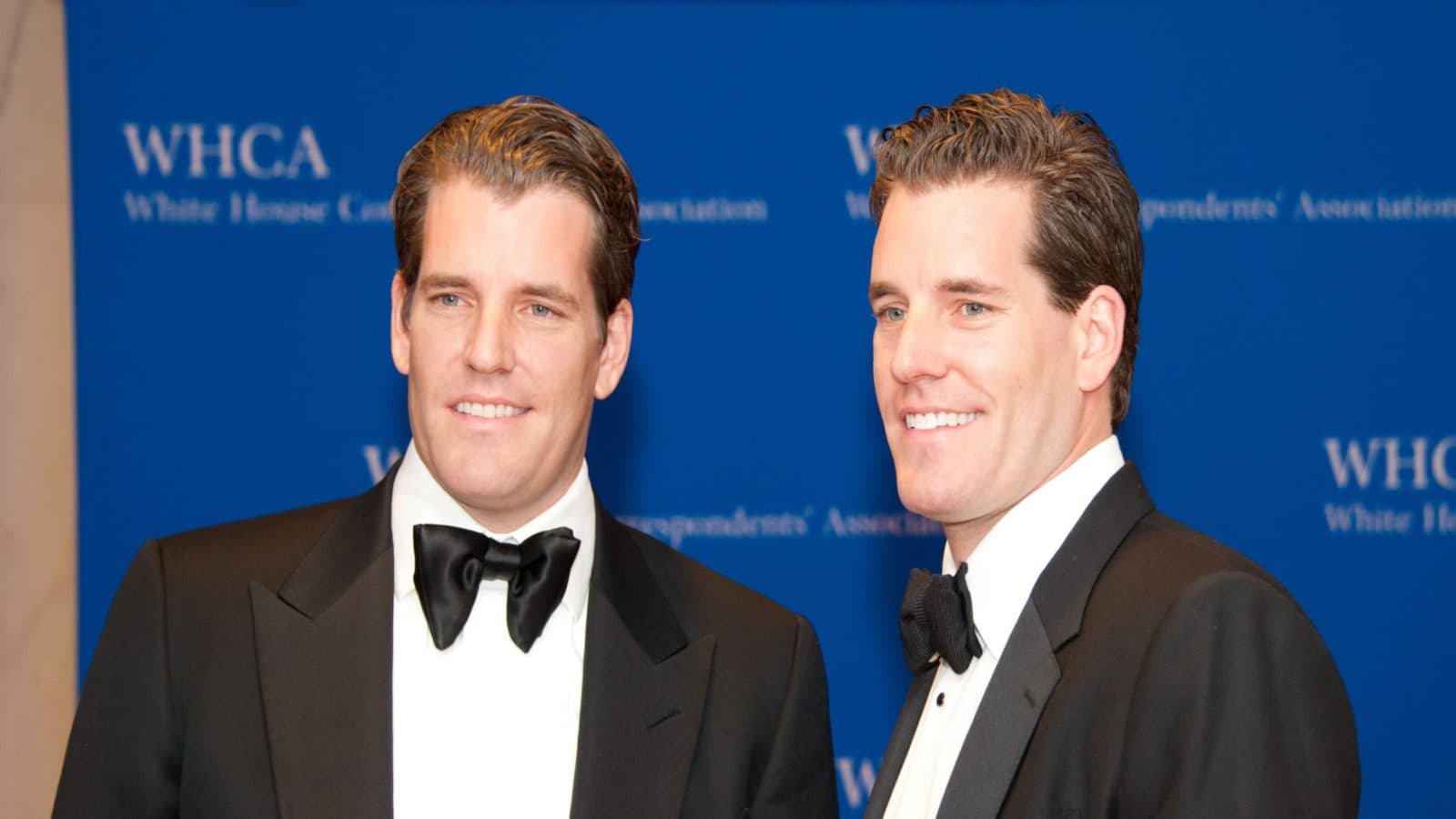

Cameron and Tyler Winklevoss, co-founders of Gemini | Source: Shutterstock

- Betterment’s 730,000 customers to have access next month to crypto portfolios constructed from digital assets listed on the Gemini Exchange

- Banks, fintechs and wealth managers among the institutions showing more interest in crypto, Gemini chief strategy officer says

Top robo-advisers are deepening their still-nascent cryptocurrency dealings.

The latest indicator: digital assets exchange and custodian Gemini has struck a deal with quantitative financial adviser Betterment in an effort to capture a slice of the growing number of crypto-minded institutions that are, in turn, going after retail traders apace.

With more than 730,000 customers, Betterment is set to offer crypto portfolios to clients starting next month constructed from digital assets listed on Gemini. Gemini serves as Betterment’s crypto custodian.

Partners of Betterment for Advisors, a product that allows investment pros to automate portfolio management, would as a result for the first time be able to invest in crypto for clients.

“We’re seeing increased interest in crypto from a broad range of institutions and intermediaries from large global banks, to fintechs, to wealth managers,” Marshall Beard, Gemini’s chief strategy officer, told Blockworks in an email. “We think these institutions will be critical to onboarding the next wave of people into Web3 and crypto.”

Despite the ongoing bear market, some industry participants say crypto interest from traditional finance players is higher than ever.

Fidelity in April moved to allow certain US workers to allocate a portion of their retirement savings to bitcoin through the company’s 401(k) options. BlackRock, the world’s largest asset manager with $8.5 trillion in assets under management, partnered with Coinbase last month and days later launched a bitcoin private trust.

The investment case for ether has changed for institutions after the Merge, proof-of-stake aficionados say, because staking yields that investors can now earn from the asset could bring in a flood of institutional capital looking for fixed-income-like returns.

The company acquired digital asset portfolio management platform BITRIA in January to allow more asset and wealth managers to meet clients’ demand for crypto. A week later, the company said it would buy crypto trading tech platform Omniex in a deal designed to simplify the experience for institutional investors looking to go deeper into the space.

Gemini-owned NFT art marketplace Nifty Gateway was selected to offer NFT storage for Starbucks’ Web3 loyalty program revealed earlier this month.

“We are always looking at accretive partnerships with both institutions and consumer brands that can help bring crypto to more people,” Beard said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.