Incentive Ecosystem Foundation is Raising $100M to Support Solana-based Serum

The funding is emphasizing investments from firms that can help the decentralized exchange expand into the traditional finance space, a Serum contributor JHL told Blockworks

Blockworks Exclusive Art by Axel Rangel

- “We’ve raised about $70 million to $80 million, and it’s still ongoing,” pseudonymous contributor JHL said

- Long term, JHL said the Serum community would love to see the protocol become the central liquidity hub for all financial assets

The Incentive Ecosystem Foundation (IEF), a community-led organization focused on supporting the Serum network, has raised over $70 million and is in the process of closing the round at $100 million, a Serum contributor who goes under the alias JHL told Blockworks.

“We’ve raised about $70 million to $80 million, and it’s still ongoing,” JHL said. “We’re wrapping up conversations with VC firms and the total amount to be raised will be $100 million,” he said.

Serum is a decentralized exchange (DEX) platform and liquidity provider for DeFi protocols on Solana’s blockchain. It is the eighth-largest decentralized exchange and has a 24-hour trading volume of about $273,383,720, according to data on CoinGecko.

There are over 70 projects participating in its ecosystem, from AMM and yield farming project Raydium to economy driven multiplayer online role-playing games like OpenEra.

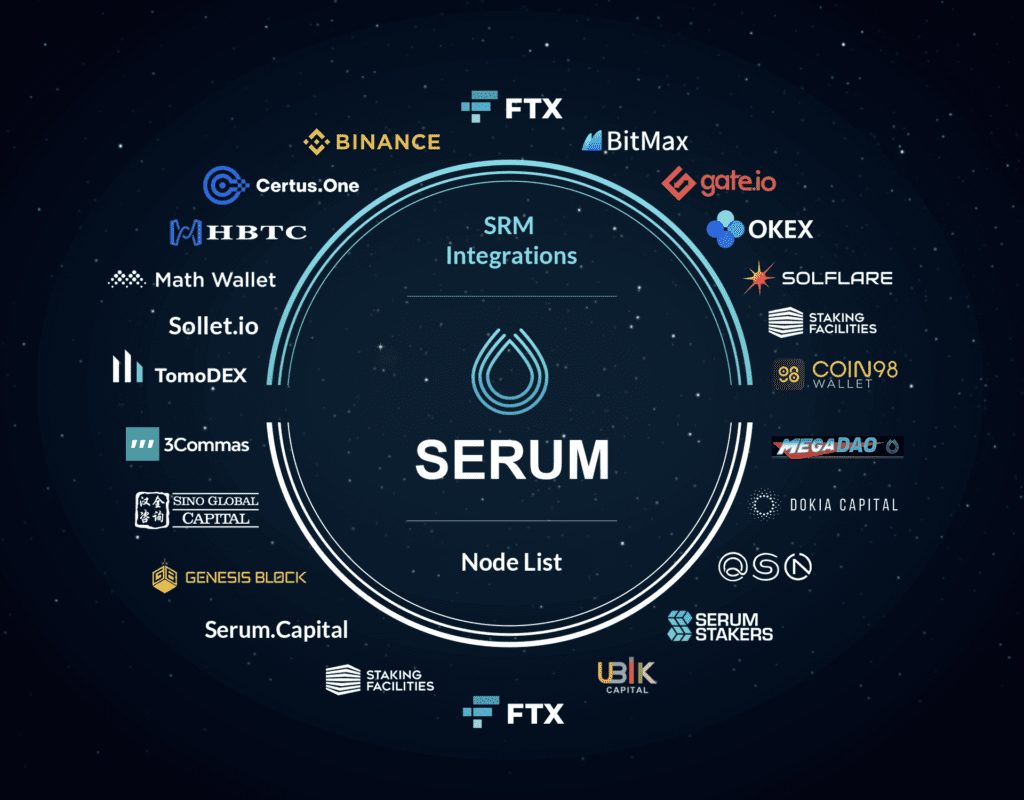

The Serum integration node list; Source: Serum

The Serum integration node list; Source: Serum

The funding will go toward supporting several areas of growth on Serum’s network such as DeFi, NFTs, gaming, metaverse and DAO tooling.

There are about 18 investors funding the capital raise, currently, including Commonwealth Asset Management, Tiger Global, Tagus, and executives from GoldenTree Asset Management.

“I think there’s a lot of interest from these firms because of Serum’s architecture,” JHL said. “It’s similar to the experience of trading on platforms like Binance or FTX,” he noted.

Around 85% of the allocation that investors receive will go into current and future tokens in the ecosystem including Serum, Solana and other ecosystem tokens like Raydium, JHL said. About 30% will be allocated to Serum, with 15% to Solana tokens.

IEF previously closed a funding round 18 months ago, when the organization was created, but the amount raised was not public, JHL said. “At the time, we raised primarily from crypto-native venture capital firms and now the emphasis is more on firms that can help us expand into the TradFi space,” he noted.

Long term, JHL said the Serum community would love to see the protocol become the central liquidity hub for all financial assets to be traded, from token equities to synthetic assets as well as fiat currencies.

“Really what we’re trying to do is bring all this on-chain and have Serum become this global hub for liquidity for trading these kinds of assets,” JHL said.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.