MicroStrategy HODLs More Bitcoins Than Any Other Public Company

The company recently bought an additional 3,907 bitcoins, bringing its total bitcoin holdings to 108,992.

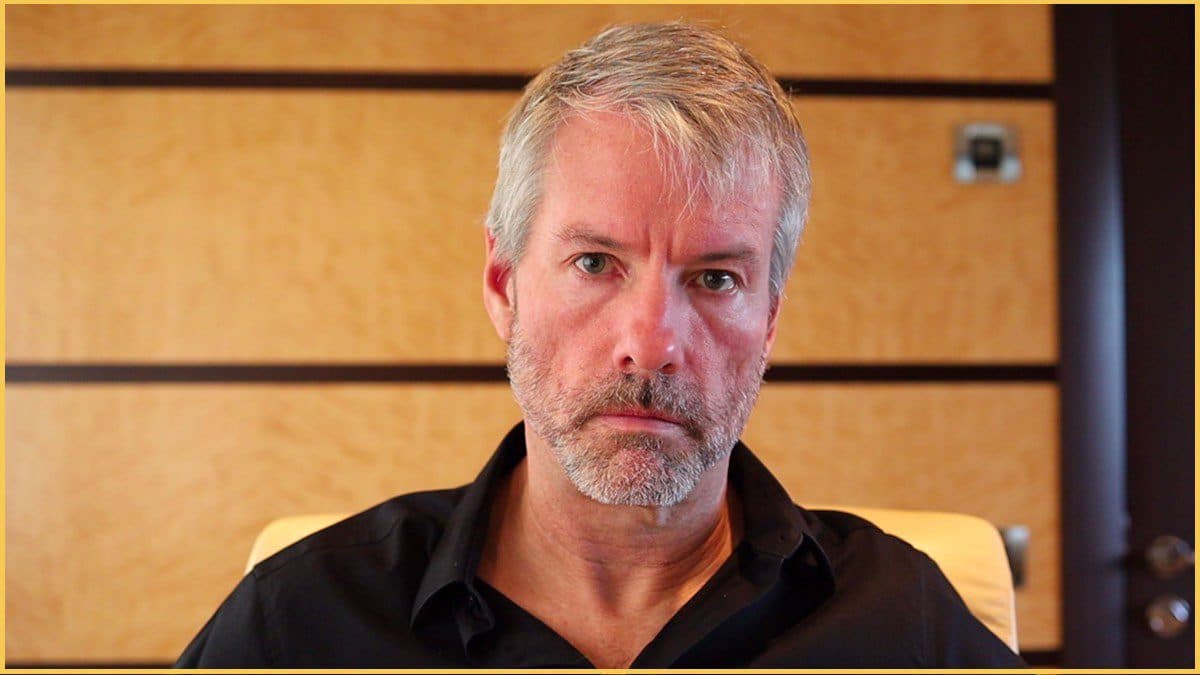

Michael Saylor, CEO, MicroStrategy

- Although MicroStrategy owns less than 1% of total bitcoins, it has the highest amount of bitcoin holdings for a public company, according to data by Buy Bitcoin Worldwide

- Saylor has said in the past that he and the company will remain focused on bitcoin and will not be investing in other cryptocurrencies, such as ethereum

MicroStrategy Inc. bought more bitcoin — approximately 3,907 more bitcoins, to be exact.

The company spent about $177 million in cash on its new bitcoins at an average price of $45,294 per bitcoin, according to a US Securities and Exchange Commission filing.

The latest purchase brings the company’s total holding to 108,992 bitcoins acquired for about $2.918 billion with an average price bought of about $26,769 per bitcoin. All prices are inclusive of fees and expenses, it said.

However, this news shouldn’t come as a surprise. Michael Saylor has said in the past that his company will continue to buy and hold, or “HODL,” bitcoin. Saylor said he sees bitcoin as a digital property that is “the most compelling technical opportunity of the decade,” Blockworks previously reported.

MicroStrategy was not available for immediate comment requested by Blockworks on Tuesday.

While many market players are supportive of the company’s decision, others are wary as to whether or not MicroStrategy is “buying up” the already limited bitcoin supply.

It is a good idea for companies to hold cryptocurrencies like bitcoin or stablecoins, but Saylor’s strategy is outstanding and should not be followed by others, said David Tawil, president of ProChain Capital. “He is an early adopter, a maximalist, and clear with his investors about his overall strategy,” Tawil said.

“It should become commonplace (for companies to own bitcoin), but I think that it is something that will come all at once,” Tawil said. “Among public, corporate boards and management, there is a unique risk-reward calculation for innovative risk-taking initiatives. Companies with a dominating shareholder or leader are likely to be first. From there, momentum will build, until the tide turns, and then corporations are asked by investors, ‘Why aren’t you doing this?’,” he added.

With that said, the company now owns less than 1% — or 0.58% to be exact — of the total 18.75 million bitcoins mined to date. It’s important to note that while over 18 million bitcoins have been mined, there are only 21 million bitcoins in existence.

Although MicroStrategy owns less than 1% of total bitcoins, it has the highest amount of bitcoin holdings for a public company, according to data by Buy Bitcoin Worldwide. Tesla is in second place as it holds “close” to 42,000 bitcoins, according to a tweet in late July by CEO Elon Musk.

“I believe as more companies become wise to bitcoin and inflation, we are going to see more follow,” said Steven McClurg, co-founder of Valkyrie Funds and Basquet Inc. “Bitcoin is the currency for the global digital economy, and if you transact in any way digitally or you are a tech company, you should own bitcoin,” McClurg said.

McClurg added that companies that hold too much US dollars on their balance sheets are in a “losing game” due to the rate of dollars being printed and inflation going up annually, the value of cash is destroyed every year.

At the end of July, Saylor said that MicroStrategy’s plan was to continue to acquire and hold bitcoin, while focusing on educating corporations, institutional investors, regulators and the general public on the benefits of digital property.

“There will never be more than 21 million bitcoin, and we feel like there’s a land grab right now to acquire as much as you can,” Saylor said during MicroStrategy’s earnings call in July.

Saylor has also said in the past that he and the company will remain focused on bitcoin and will not be investing in other cryptocurrencies, such as ethereum.

MicroStrategy (MSTR) shares fell on Tuesday from a high of $721 per share to as low as $691.23 per share during the day.

This story was updated on August 24 at 4:06pm ET.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.